Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

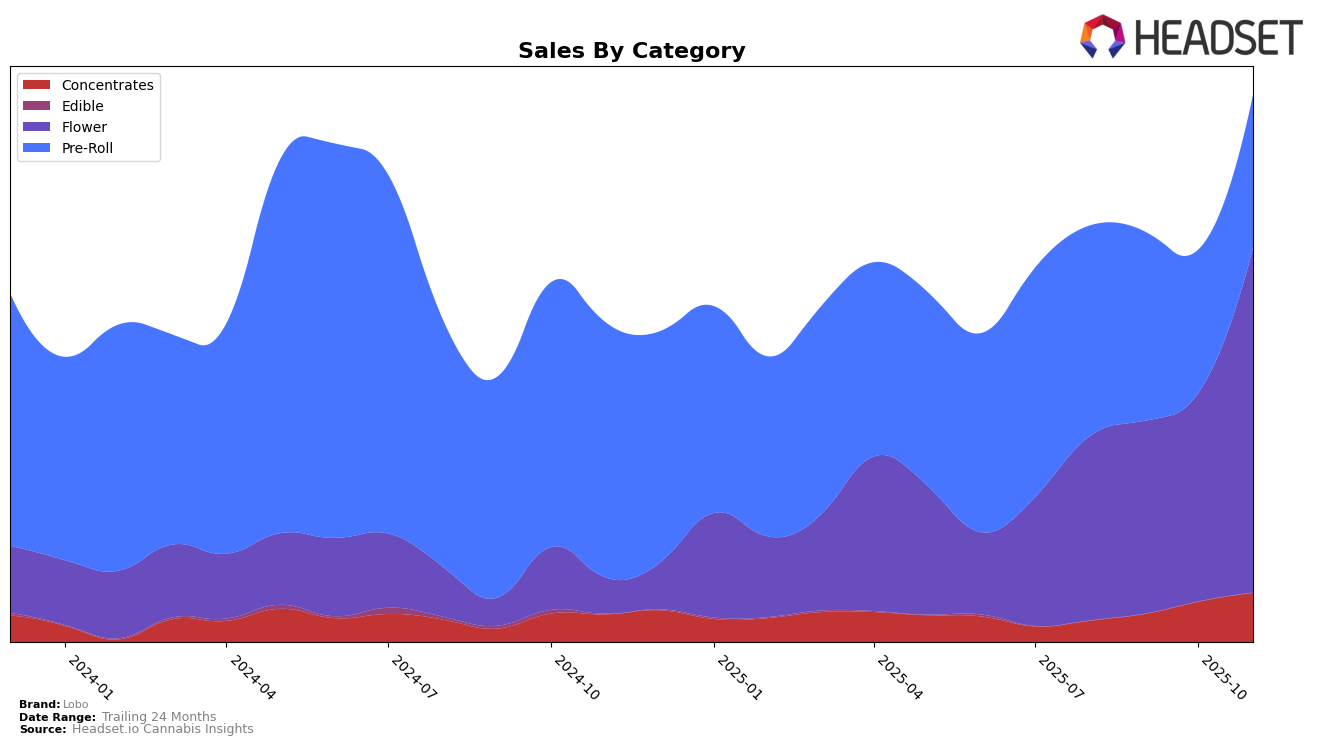

Lobo's performance across various states and categories shows a mixed picture, with notable trends in the Pre-Roll and Concentrates segments. In Illinois, Lobo's Pre-Roll category has struggled to gain significant traction, failing to break into the top 30 rankings consistently from August to November 2025. This indicates a challenging market environment or competitive landscape that Lobo is yet to overcome. Conversely, in New Jersey, Lobo has shown resilience in the Concentrates category, maintaining a steady presence in the top 30, with a slight improvement from 30th to 29th place between September and November. This suggests a growing acceptance or strategic foothold in the New Jersey concentrates market.

New York presents a more optimistic scenario for Lobo, particularly in the Concentrates and Flower categories. The brand's ranking in the Concentrates category improved from 29th in August to a commendable 21st by November, reflecting a positive trajectory and potential for further growth. Similarly, the Flower category saw Lobo climbing from 58th to 40th place over the same period, indicating increased consumer interest or effective market strategies. However, the Pre-Roll category in New York experienced a decline in rankings, from 41st in August to 50th in November, which could warrant a reassessment of market strategies or product offerings in this segment. Overall, Lobo's performance highlights both challenges and opportunities across different states and categories, with New York showing the most promising developments.

Competitive Landscape

In the competitive landscape of the New York flower category, Lobo has shown a promising upward trajectory in recent months. Starting from a rank of 58 in August 2025, Lobo has climbed steadily to reach the 40th position by November 2025. This improvement in rank is indicative of a positive trend in sales, as evidenced by the increase from $187,901 in August to $253,129 in November. In contrast, Flav experienced fluctuations, with its rank peaking at 38 in October before dropping to 44 in November, despite a sales increase in September. Meanwhile, 1937 maintained a stronger position, although its rank fell from 22 in October to 36 in November, suggesting a potential decline in momentum. Veterans Choice Creations (VCC) and Hashtag Honey have shown more stability, with slight variations in rank but consistent sales figures. Lobo's ascent in rank and sales amidst these dynamics highlights its growing appeal and competitive edge in the market.

Notable Products

In November 2025, Snow Caps 3.5g from the Flower category reclaimed its top position as the best-selling product for Lobo, with impressive sales of 2653 units. Gelonade Moonrocks 3.5g made a notable entrance, securing the second spot, indicating a strong demand for this new entry. Bold - Blue Dream Infused Pre-Roll 1g maintained a steady performance, holding onto the third rank, consistent with its position in September. The Blue Dream Diamond Infused Pre-Roll 5-Pack 2.5g experienced a slight decline, dropping to fourth place from its previous second position in October. Sour Diesel Hashish 1g closed the top five, showing a consistent presence in the concentrates category since its debut in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.