Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

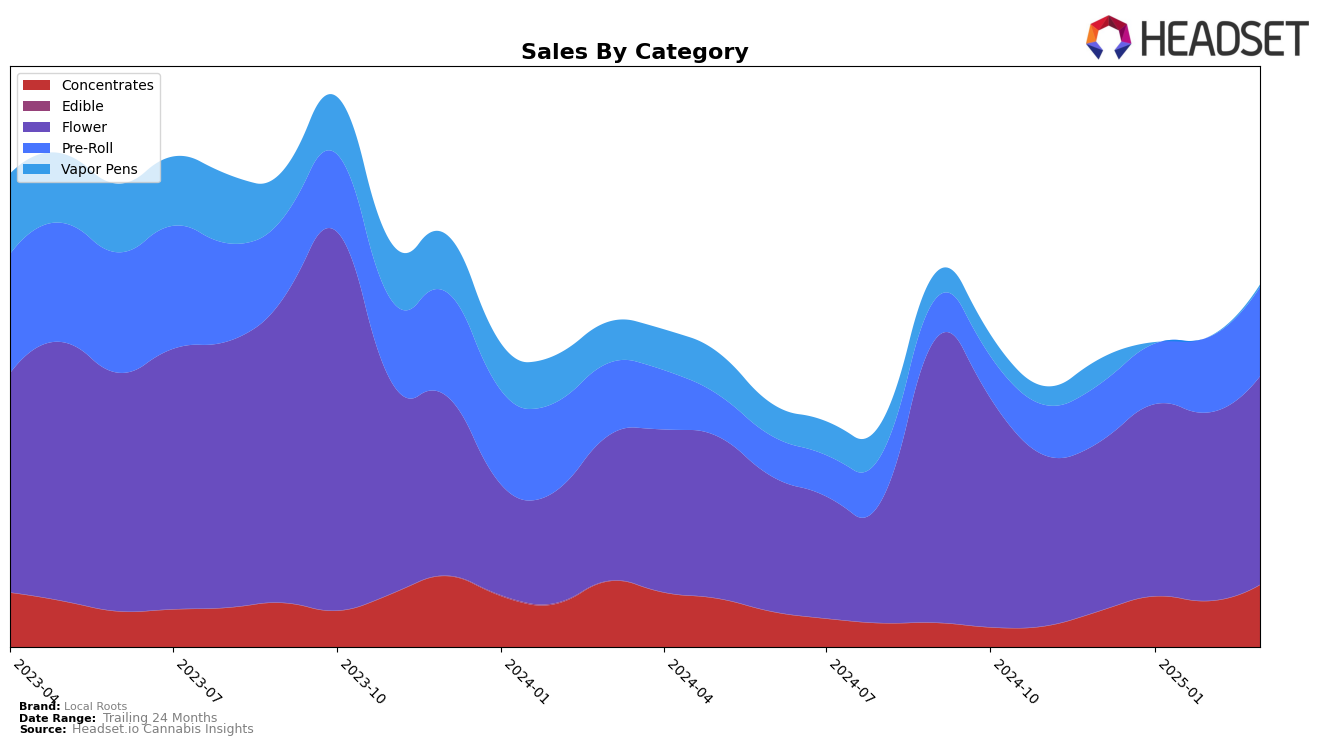

Local Roots has shown a notable upward trajectory in the Massachusetts concentrates category, improving its rank from 17th in December 2024 to 8th by March 2025. This consistent rise in ranking suggests a strengthening market presence, supported by a substantial increase in sales from $76,627 to $133,652 over the same period. Conversely, in the vapor pens category, Local Roots was ranked 66th in December 2024 and did not appear in the top 30 in the following months, indicating a potential area for growth or reevaluation.

In the flower category, Local Roots has made modest gains, moving from 35th in December 2024 to 26th by March 2025. While not as dramatic as the concentrates category, this steady improvement reflects a positive trend in their market penetration. The pre-roll category also saw Local Roots climb from 51st to 35th, showing a similar pattern of gradual growth. However, the absence of a top 30 ranking in the vapor pens category post-December highlights a significant challenge, suggesting that while the brand is making strides in some areas, there are opportunities for improvement in others.

Competitive Landscape

In the Massachusetts flower category, Local Roots has demonstrated a notable upward trajectory in its rankings and sales over the past few months. Starting from a rank of 35 in December 2024, Local Roots improved to 27 by January 2025, further climbing to 25 in February, before slightly dropping to 26 in March. This positive trend is reflected in their sales, which increased from December to March, indicating a growing consumer preference for their products. In contrast, Strane experienced a decline, falling from rank 12 in December to being out of the top 20 by March, with a consistent decrease in sales. Root & Bloom also saw fluctuating ranks, ending March at 27, just below Local Roots, after peaking at rank 20 in February. Meanwhile, Nature's Heritage and Bountiful Farms remained mostly outside the top 20, with Nature's Heritage making a slight comeback in March. These dynamics suggest that Local Roots is gaining a competitive edge in the Massachusetts flower market, positioning itself as a rising brand amidst fluctuating performances from its competitors.

Notable Products

In March 2025, the top-performing product for Local Roots was Golden Goat (3.5g) in the Flower category, maintaining its first-place ranking from the previous two months with sales of 2268 units. Golden Goat Pre-Roll (1g) held steady in second place in the Pre-Roll category, showing consistent performance following its rise from the second position in February. New to the rankings in March, Blueberry Hashplant (3.5g) entered the Flower category at third place. Blue Dream x Blowfish Pre-Roll (1g) and Eternal Sunshine Pre-Roll (1g) debuted in the Pre-Roll category at fourth and fifth places, respectively. This indicates a strong interest in both new and established products within the Local Roots lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.