Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

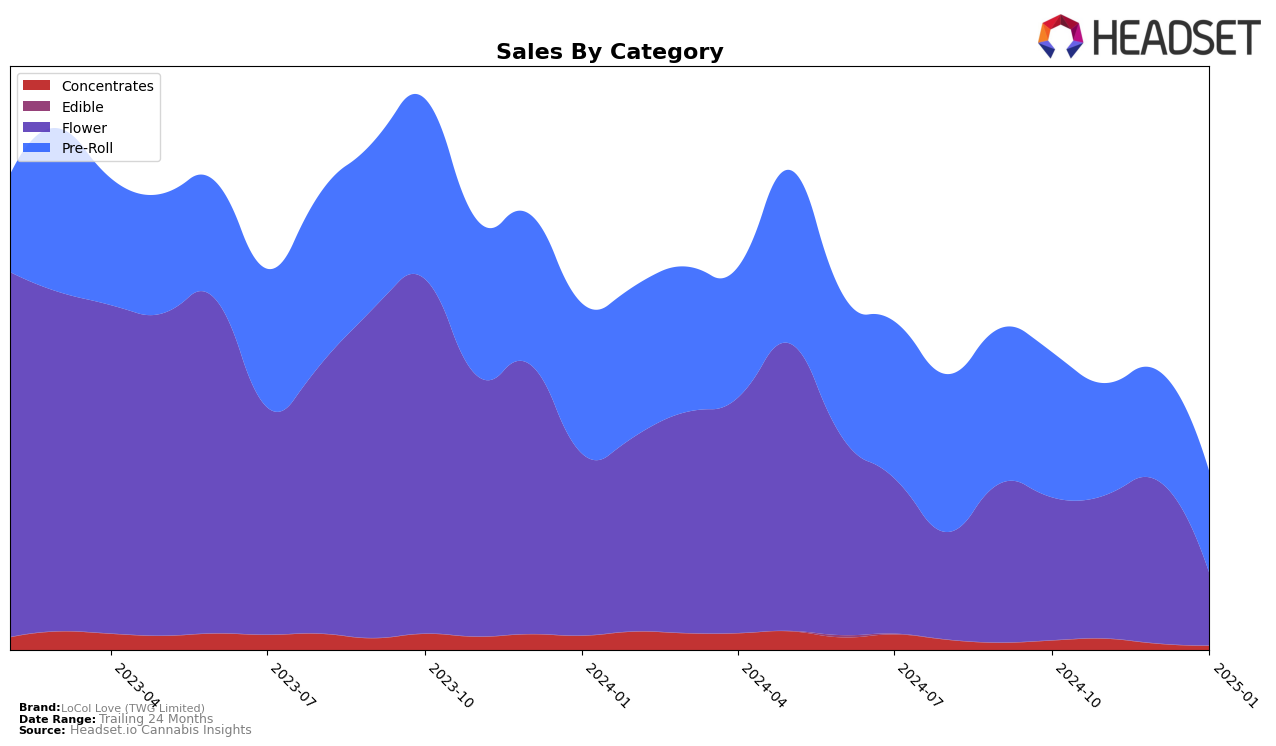

LoCol Love (TWG Limited) has shown varied performance across different product categories in Colorado. In the Concentrates category, the brand has struggled to break into the top 30 rankings, with positions ranging from 55th to 61st between October and December 2024, and failing to make the top 30 by January 2025. This indicates a potential area for growth or a need for strategic adjustments. On the other hand, their Flower category has displayed more stability, maintaining a presence within the top 30, although it experienced a noticeable decline from 20th in December 2024 to 38th in January 2025. This drop could be attributed to seasonal factors or increased competition, suggesting a need for further analysis to understand the underlying causes.

In contrast to their performance in Concentrates, LoCol Love has maintained a strong position in the Pre-Roll category, consistently ranking within the top 11 from October 2024 to January 2025. Despite a slight dip in November and December 2024, where they ranked 10th and 11th respectively, the brand rebounded to 8th place by January 2025. This resilience highlights their competitive edge in the Pre-Roll market, possibly due to product quality or brand loyalty among consumers. Such performance suggests that while there are challenges in certain categories, LoCol Love has the potential to capitalize on its strengths in others, particularly in Pre-Rolls, to enhance its market presence in Colorado.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll market, LoCol Love (TWG Limited) has experienced notable fluctuations in its ranking and sales over the past few months. Starting at 7th place in October 2024, LoCol Love saw a dip to 10th and 11th in November and December, respectively, before rebounding to 8th in January 2025. This rebound is significant, especially when compared to Green Dot Labs, which saw a steady decline from 4th to 9th place over the same period. Meanwhile, Bonsai Cultivation improved its position from 11th to 7th, and Seed & Strain Cannabis Co. consistently climbed from 10th to 6th. Despite these challenges, LoCol Love's ability to regain its footing in January suggests resilience and potential for growth, particularly as it remains competitive against brands like Billo, which made a significant leap from outside the top 20 to 10th place by January. This dynamic environment underscores the importance for LoCol Love to leverage strategic marketing and product differentiation to maintain and improve its market position.

Notable Products

In January 2025, the top-performing product for LoCol Love (TWG Limited) was the Q Cone - Kush Minties Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one spot with notable sales of 8713. The Grape Cream Cake (Bulk) from the Flower category emerged as the second best-seller, marking its debut in the rankings. The Q Cone - Crystals & Gold Pre-Roll (1g) maintained a steady position, ranking third with improved sales from December 2024. Following closely were the Q Cone - Lemon Berry Mintz Pre-Roll (1g) and Q Cone - Strawberry Lemon Sherbert Pre-Roll (1g), ranking fourth and fifth, respectively. Notably, the Q Cone - Kush Minties Pre-Roll (1g) showed a significant leap from its previous rankings in the last months of 2024, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.