Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

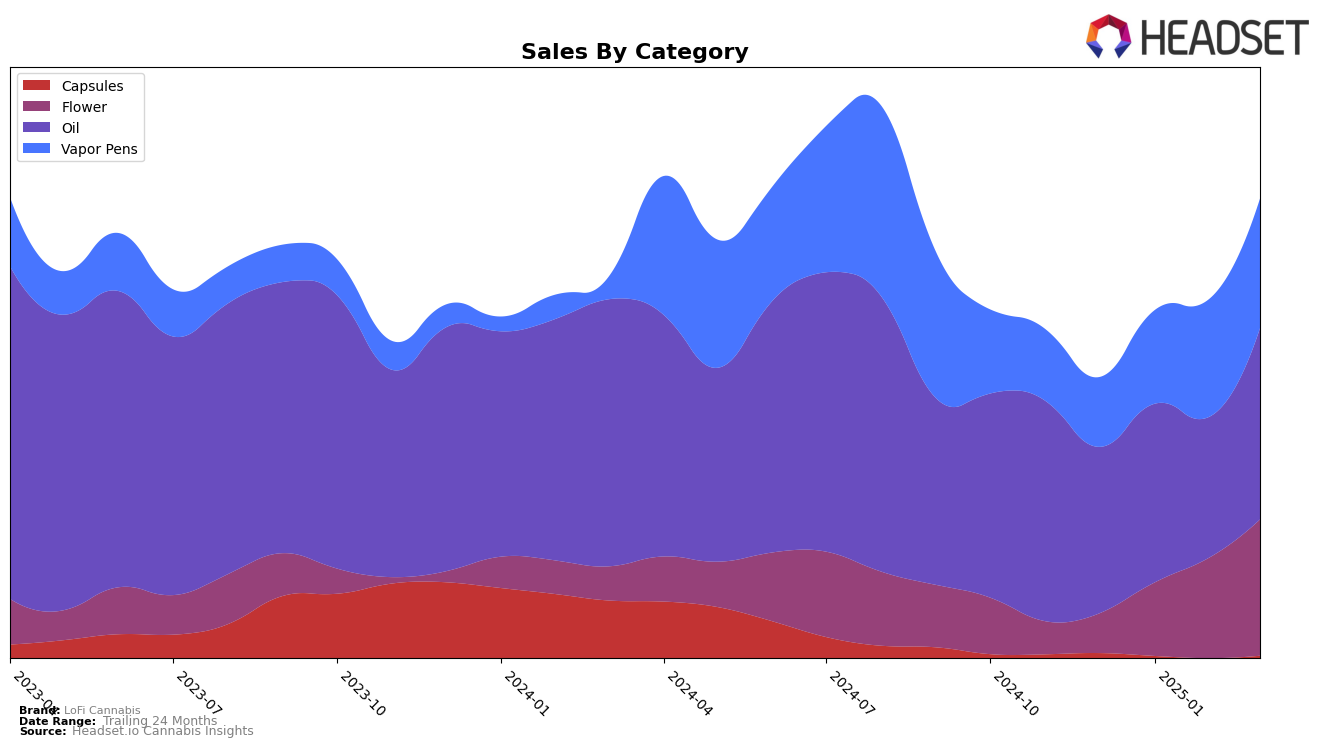

LoFi Cannabis has shown varied performance across different categories and regions. In British Columbia, their presence in the Flower category has been inconsistent, with the brand not appearing in the top 30 for December 2024 and February 2025, but making a notable entry at rank 85 in March 2025. This suggests a potential growth opportunity or a shift in consumer preferences towards their products. In contrast, their performance in the Oil category has been more stable, maintaining a top 10 position throughout the analyzed months, which indicates a strong foothold in this segment. The Vapor Pens category, however, shows a more stagnant performance with little movement, hovering around the 50th rank, which might suggest a need for strategic adjustments to improve market penetration.

In Ontario, LoFi Cannabis has demonstrated a positive trajectory in the Oil category, improving from 18th place in December 2024 to 11th in March 2025. This upward trend highlights their growing popularity and effectiveness in capturing market share in this category. Conversely, their entry into the Vapor Pens category is relatively new, with the brand only appearing in the rankings from February 2025 onwards, starting at rank 90 and slightly improving to 89 by March. This recent entry suggests they are still in the early stages of establishing their presence in this segment, and it will be interesting to observe if they can replicate their success from the Oil category in the coming months.

Competitive Landscape

In the competitive landscape of the oil category in British Columbia, LoFi Cannabis has shown a consistent presence, maintaining a rank between 7th and 8th from December 2024 to March 2025. This stability is noteworthy given the fluctuations observed among its competitors. For instance, MediPharm Labs consistently ranks higher, holding positions between 3rd and 5th, reflecting its strong market presence. Meanwhile, Frank has maintained a steady 6th position, indicating a robust performance slightly ahead of LoFi Cannabis. On the other hand, Purefarma and DayDay have shown less stability, with Purefarma fluctuating between 7th and 8th and DayDay dropping to 10th by March 2025. Despite these dynamics, LoFi Cannabis has managed to increase its sales from January to March 2025, suggesting a positive trend in consumer preference and market penetration, although it still trails behind the sales figures of top competitors like MediPharm Labs and Frank.

Notable Products

In March 2025, Nostalgia (7g) from LoFi Cannabis retained its top position in the Flower category, achieving impressive sales of 1306 units. CBD Super Strength Oil (30ml) moved up to second place in the Oil category, marking a significant rise from its fourth-place ranking in February. CBD 1500 Oil (30ml) saw a slight drop to third place, despite its consistent performance in the previous months. The CBD:THC 1:1 Nostalgia x Rainbow Driver Cured Resin Cartridge (1g) maintained a steady fourth place in the Vapor Pens category. Nostalgia Craft Hemp (7g) held its fifth-place rank, consistent with its debut in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.