Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

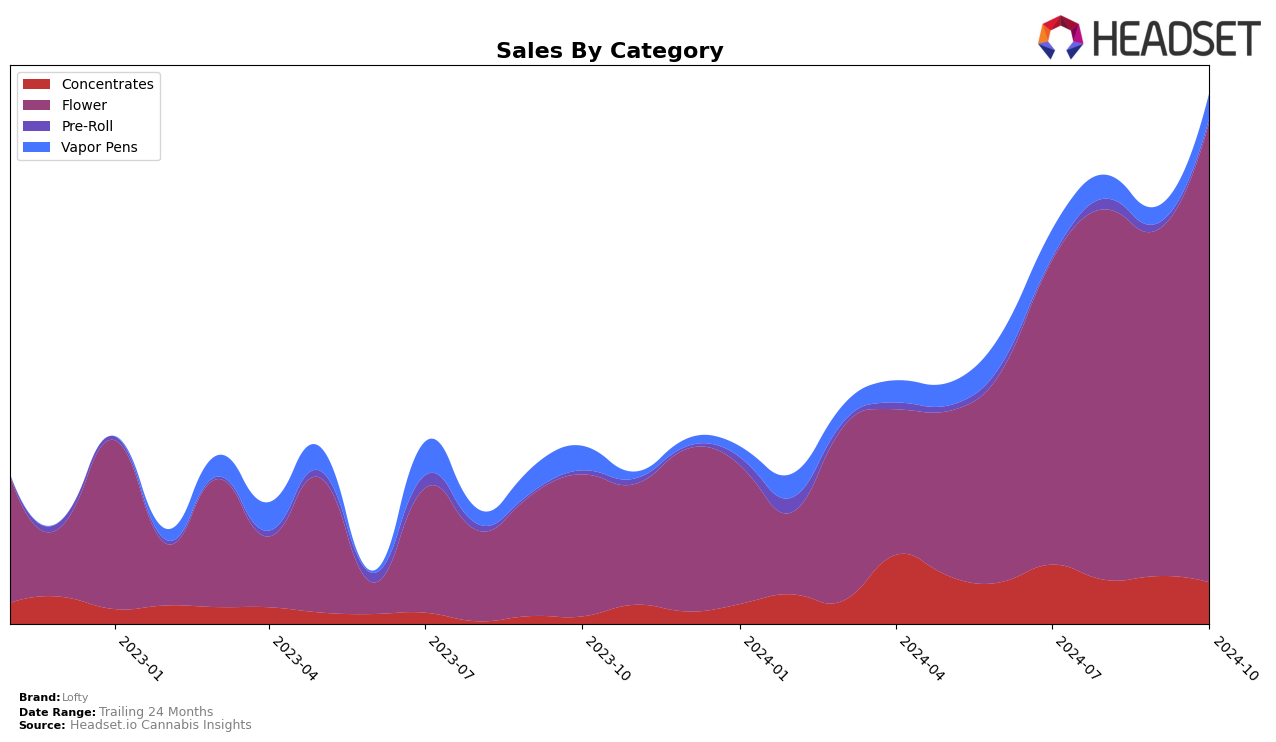

Lofty's performance in the Oregon market has shown varying trends across different product categories. In the Concentrates category, Lofty has been struggling to maintain a top position, as evidenced by its ranking slipping from 38th in July 2024 to 49th by October 2024. This decline in ranking is accompanied by a decrease in sales, which indicates a potential need for strategic adjustments in this category. Conversely, Lofty has demonstrated a strong upward trend in the Flower category, moving up from 33rd place in July to an impressive 22nd in October. This positive shift suggests that Lofty's Flower products are gaining traction among consumers, possibly driven by competitive pricing or enhanced product quality.

In contrast, the Vapor Pens category presents a challenging scenario for Lofty in Oregon. The brand has not managed to break into the top 30, with rankings fluctuating between 75th and 90th over the four-month period. Despite these low rankings, there was a slight recovery in October, moving up to 78th, which could indicate the initial success of recent marketing or product improvements. The sales figures in this category have also seen a modest rebound in the same month, suggesting that while challenges remain, there might be opportunities for growth if Lofty can capitalize on this momentum. Overall, Lofty's performance across these categories highlights the need for a targeted strategy to address areas of weakness while leveraging strengths in the more successful segments.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Lofty has shown a notable upward trajectory in recent months. Starting at rank 33 in July 2024, Lofty maintained this position in August before climbing to rank 30 in September and further improving to rank 22 by October. This positive trend suggests a strengthening market presence, likely driven by strategic marketing efforts or product enhancements. In contrast, Meraki Gardens experienced fluctuations, peaking at rank 15 in August but dropping to 23 by October, indicating potential volatility in their sales strategy or market demand. Meanwhile, Cannabis Nation INC remained relatively stable, hovering around the 16 to 20 rank range, which may suggest consistent consumer loyalty or product offerings. Tao Gardens and Garden First also showed varied performance, with Tao Gardens improving from rank 42 in September to 24 in October, while Garden First maintained a steady position around rank 21. These dynamics highlight Lofty's potential for continued growth in the competitive Oregon flower market.

Notable Products

In October 2024, Blue Dream (Bulk) emerged as the top-performing product for Lofty, claiming the number one rank in the Flower category with a notable sales figure of 2183 units. Strawberry Cream Cake (Bulk) followed closely, securing the second position, marking an improvement from its absence in September. Terdz (Bulk) maintained a consistent presence in the top five, climbing to third place from its previous fifth position in September. Super Buff Cherries (Bulk) also made a notable entry, ranking fourth after not being ranked in September. Humboldt Breath (Bulk) rounded out the top five, experiencing a slight drop from its third position in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.