Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

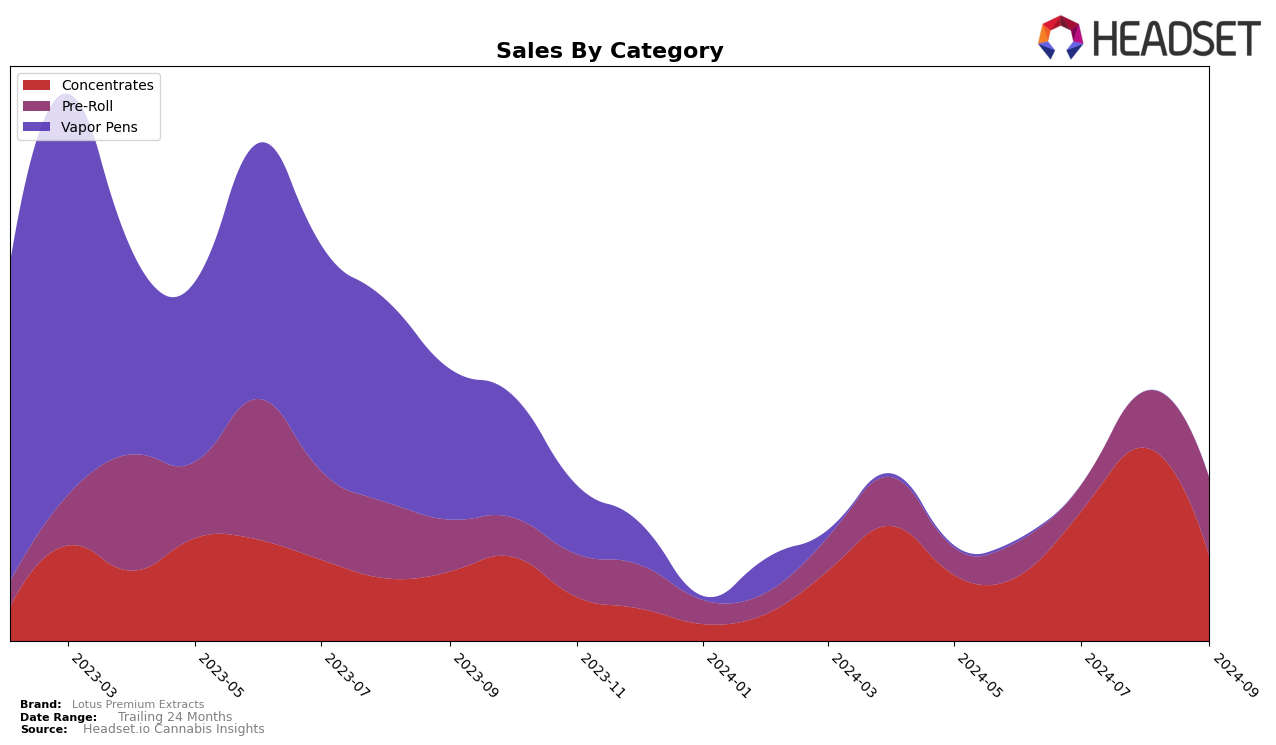

In the state of Missouri, Lotus Premium Extracts has shown a notable performance in the Concentrates category. Over the summer months of 2024, the brand experienced a significant rise in its ranking, moving from 24th in June to an impressive 11th place by August. However, September saw a slight dip to 17th position, indicating some volatility in market positioning. This fluctuation might be attributed to changes in consumer preferences or increased competition within the state. It's worth noting that despite the dip in September, the brand managed to maintain its presence within the top 20, a testament to its resilience and appeal in the Concentrates sector.

The Pre-Roll category presents a different dynamic for Lotus Premium Extracts in Missouri. Starting from a rank of 48 in June, the brand did not feature in the top 30 until August when it climbed to 33rd position, eventually reaching 28th place by September. This upward trend is encouraging, suggesting a growing acceptance and demand for their Pre-Roll products. However, the fact that the brand was outside the top 30 for the initial months highlights the challenges faced in this category. Keeping an eye on whether this positive trajectory continues could provide insights into their strategic positioning and potential market growth in the coming months.

Competitive Landscape

In the Missouri concentrates market, Lotus Premium Extracts has experienced notable fluctuations in its ranking over the past few months, reflecting a dynamic competitive landscape. Starting from a rank of 24 in June 2024, Lotus Premium Extracts made a significant leap to 15 in July, and further improved to 11 in August, before dropping to 17 in September. This volatility suggests that while Lotus Premium Extracts can capture market attention, sustaining that momentum remains a challenge. In contrast, Covert Extraction showed a consistent upward trend, climbing from 22 in June to 14 in September, indicating a steady increase in consumer preference. Meanwhile, COCO Labs maintained a relatively stable position, fluctuating slightly between ranks 14 and 16. Farmer G and Bad Pony experienced declines, with Farmer G dropping from 10 to 18 and Bad Pony remaining in the lower ranks. These shifts highlight the competitive pressure Lotus Premium Extracts faces, emphasizing the need for strategic marketing and product differentiation to regain and sustain higher rankings in the Missouri concentrates market.

Notable Products

In September 2024, Lotus Premium Extracts' top-performing product was Larry Legend Infused Pre-Roll (1.25g) in the Pre-Roll category, maintaining its consistent number one rank from previous months with a notable sales figure of 7615. Blue Cookies Budder (1g) in the Concentrates category surged to the second position, climbing from fifth in August, demonstrating significant growth with sales of 2915. Bubba Fett Sugar Wax (1g) held steady at the third rank, although its sales decreased from the previous month. Lemon Icing Badder (1g) retained its fourth position, showing consistent performance over the months. Notably, Headband Cookies Budder (1g), which was previously ranked second, did not appear in the top ranks for September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.