Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

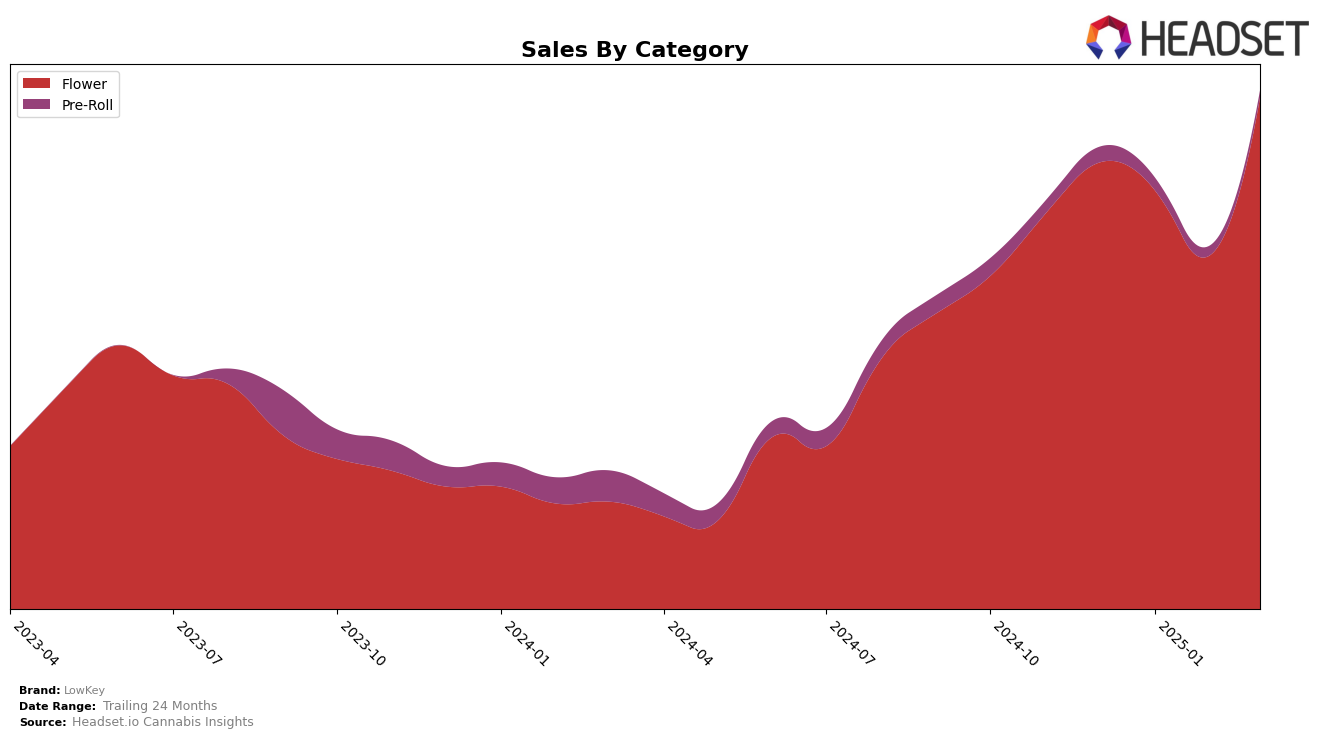

In the Canadian cannabis market, LowKey has shown varied performance across different provinces and categories. In Alberta, the brand has made significant strides in the Flower category, climbing from a rank of 64 in December 2024 to 43 by March 2025. This upward movement suggests a strengthening presence in the province, likely driven by increased consumer demand or strategic market positioning. In contrast, British Columbia presents a more fluctuating scenario, with LowKey starting at rank 34 in December 2024, dipping slightly in February 2025, and then recovering to rank 26 by March 2025. Such volatility could indicate a competitive market landscape or shifting consumer preferences within the province.

In Ontario, LowKey has maintained a relatively stable position in the Flower category, consistently ranking at 16 throughout December 2024 to February 2025, with a slight improvement to 15 by March 2025. This steadiness, coupled with a notable increase in sales, underscores the brand's strong foothold in Ontario's market. However, it's worth noting that in both Alberta and British Columbia, LowKey did not appear in the top 30 brands, which highlights areas for potential growth or strategic adjustments. The brand's performance across these provinces provides a nuanced view of its market dynamics and potential areas for expansion or focus in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, LowKey has shown a consistent presence, maintaining its rank at 16th from December 2024 through February 2025, before improving slightly to 15th in March 2025. This stability in rank is notable given the fluctuations observed among its competitors. For instance, FIGR improved its position from 15th to 14th in January and further to 12th in February, before slipping back to 14th in March. Meanwhile, MTL Cannabis maintained a steady 13th rank until March when it dropped to 16th, indicating a potential opportunity for LowKey to capitalize on. 3Saints, although not in the top 20 initially, showed a positive trajectory, moving from 23rd in December to 17th by March, which could pose a future threat if the trend continues. Pure Laine experienced a decline from 11th in December to 13th in March, suggesting a potential vulnerability. LowKey's sales figures, while lower than some competitors, have shown resilience with a notable increase in March, suggesting effective strategies that could be further leveraged to improve its competitive position.

Notable Products

In March 2025, LowKey's top-performing product was Frost'd Flakes (7g) in the Flower category, maintaining its first-place ranking since December 2024 with sales of 18,492. Cookie'z (7g) also held steady in second place, showing a strong increase in sales compared to previous months. Dessert (3.5g) consistently ranked third, although its sales have seen a decline since December. El Jefe (7g) made a notable entry into the rankings at fourth place, indicating a strong debut performance. Haze (3.5g) dropped to fifth place from its consistent fourth position, reflecting a slight decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.