Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

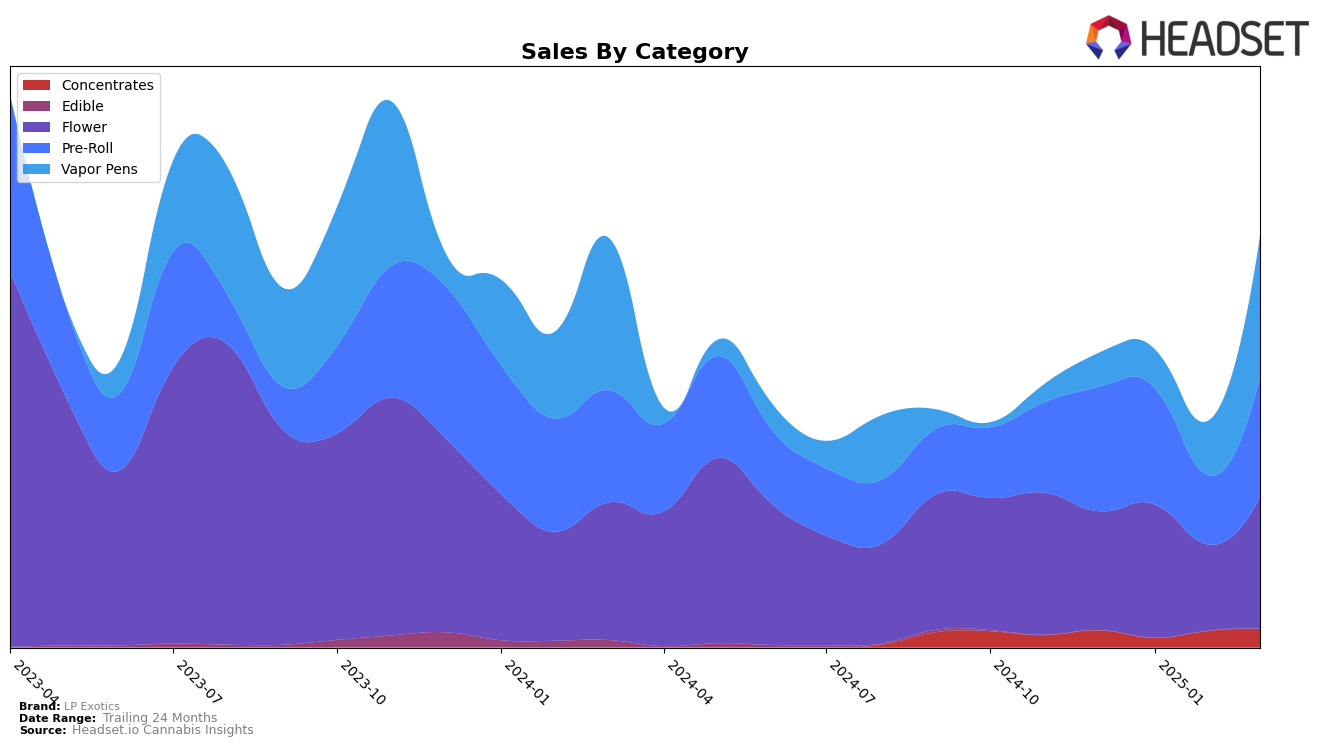

LP Exotics has shown varying performance across different product categories in Nevada. In the Concentrates category, the brand has maintained a relatively stable presence, with rankings fluctuating between 22nd and 27th place from December 2024 to March 2025. Notably, there was a dip in January 2025, but a strong recovery was observed in the following months, indicating a resilient demand for their products. In contrast, the Flower category saw LP Exotics struggle to break into the top 30, highlighting potential challenges or increased competition in this segment. The brand's performance in Pre-Rolls was more promising, where it consistently ranked within the top 20, even reaching the 10th position in December 2024, which suggests a strong consumer preference for their offerings in this category.

The Vapor Pens category exhibited significant upward momentum for LP Exotics in Nevada. Starting at the 38th position in December 2024, the brand improved its rank to 19th by March 2025, showcasing a notable climb within a few months. This ascent could be attributed to strategic marketing efforts or product innovations that resonated well with consumers. While the sales figures across categories reveal fluctuations, the overall trend for Vapor Pens suggests a growing acceptance and market penetration for LP Exotics in this category. The absence of top 30 rankings in some categories, however, underscores the competitive landscape and the need for targeted strategies to enhance brand visibility and sales performance.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, LP Exotics has shown a remarkable upward trajectory in rankings, moving from 38th in December 2024 to an impressive 19th by March 2025. This significant climb in rank is indicative of a strong increase in sales, particularly notable in March 2025, where LP Exotics surpassed several competitors. For instance, Packs (fka Packwoods) experienced a decline in rank from 13th to 20th over the same period, while Royalesque fluctuated but ended slightly ahead at 17th. Meanwhile, Dime Industries re-entered the top 20 in March after being absent in February, suggesting a volatile performance. The consistent improvement of LP Exotics in both rank and sales highlights its growing market presence and competitive edge in the Nevada vapor pen category.

Notable Products

In March 2025, LV Glue Pre-Roll (1g) emerged as the top-performing product for LP Exotics, achieving the number one rank with notable sales of 2074 units. Las Vegas Kush Cake Pre-Roll (1g) climbed to the second position, improving from third place in January and February 2025, with sales increasing significantly to 1645 units. Pineapple Breeze Pre-Roll (1g) dropped to the third position after holding second place in February, indicating a slight decline in its momentum. LV Kush Cake (3.5g) entered the rankings at fourth place, marking its first appearance among the top products. Fire Fumez Pre-Roll (1g) rounded out the list in fifth place, showcasing a strong entry with 1454 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.