Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

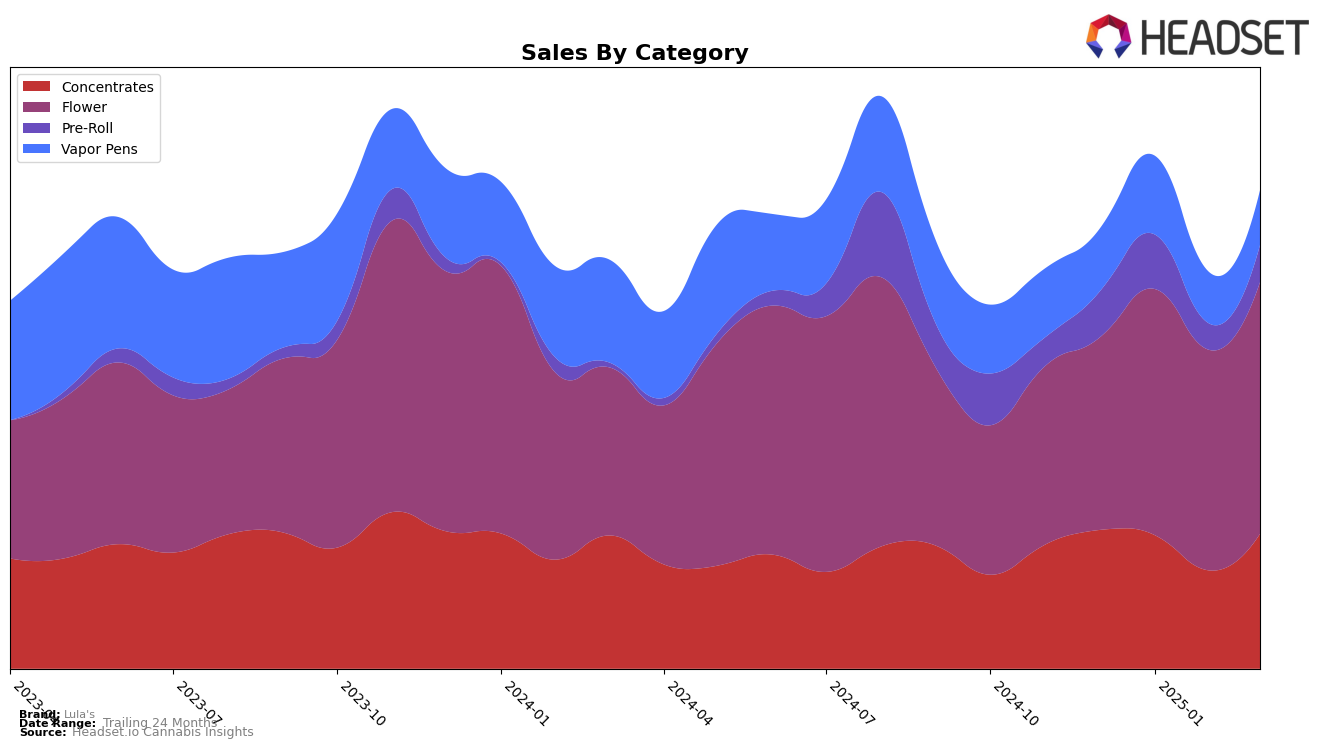

In the state of Illinois, Lula's has shown notable movements across various product categories. Concentrates have consistently performed well, maintaining a top 10 position and improving from a rank of 6 in February 2025 to 5 in March 2025, signaling a positive trend. On the other hand, Vapor Pens have not been as successful, failing to break into the top 30 in March 2025 after briefly rising to 28 in January 2025. This suggests a need for Lula's to reassess its strategy in this category to regain market competitiveness.

The Flower category presents a brighter picture for Lula's in Illinois. The brand has steadily climbed from a rank of 24 in December 2024 to 18 in March 2025, indicating strong consumer demand and effective positioning. However, Pre-Rolls have not experienced the same upward trajectory, slipping slightly to rank 26 in both February and March 2025. This stagnation may require attention to ensure Lula's remains competitive in this segment. Overall, while some categories show promise, others highlight areas for potential improvement.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Lula's has demonstrated a notable upward trajectory in its market positioning from December 2024 to March 2025. Initially ranked 24th in December, Lula's climbed to 18th by March, indicating a positive shift in consumer preference and brand visibility. This improvement is particularly significant given the fluctuating ranks of competitors like UpNorth Humboldt and Paul Bunyan, both of which experienced declines in rank over the same period. Notably, Revolution Cannabis maintained a stronger market presence, consistently ranking higher than Lula's, though it too saw a decline from 10th to 16th place. Meanwhile, Tales & Travels experienced rank volatility, ending March in the same 17th position it held in December. Lula's sales figures have shown a steady increase, contrasting with the sales declines of some competitors, suggesting that Lula's strategic initiatives may be effectively capturing market share in a competitive environment.

Notable Products

In March 2025, Lula's top-performing product was Mint Biscuit Pre-Roll (1g) in the Pre-Roll category, which ascended to the number one rank from second place in February, with sales reaching 6,161 units. Lou's Legacy Pre-Roll (1g) followed closely in second place, having switched positions with Mint Biscuit from the previous month. Lemon Durban Pre-Roll (1g) held the third position, maintaining its presence in the top three since December 2024. Dawgma Sugar Wax (1g) in the Concentrates category entered the rankings at fourth place. Escape (7g) in the Flower category rounded out the top five, marking its debut in the rankings for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.