Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

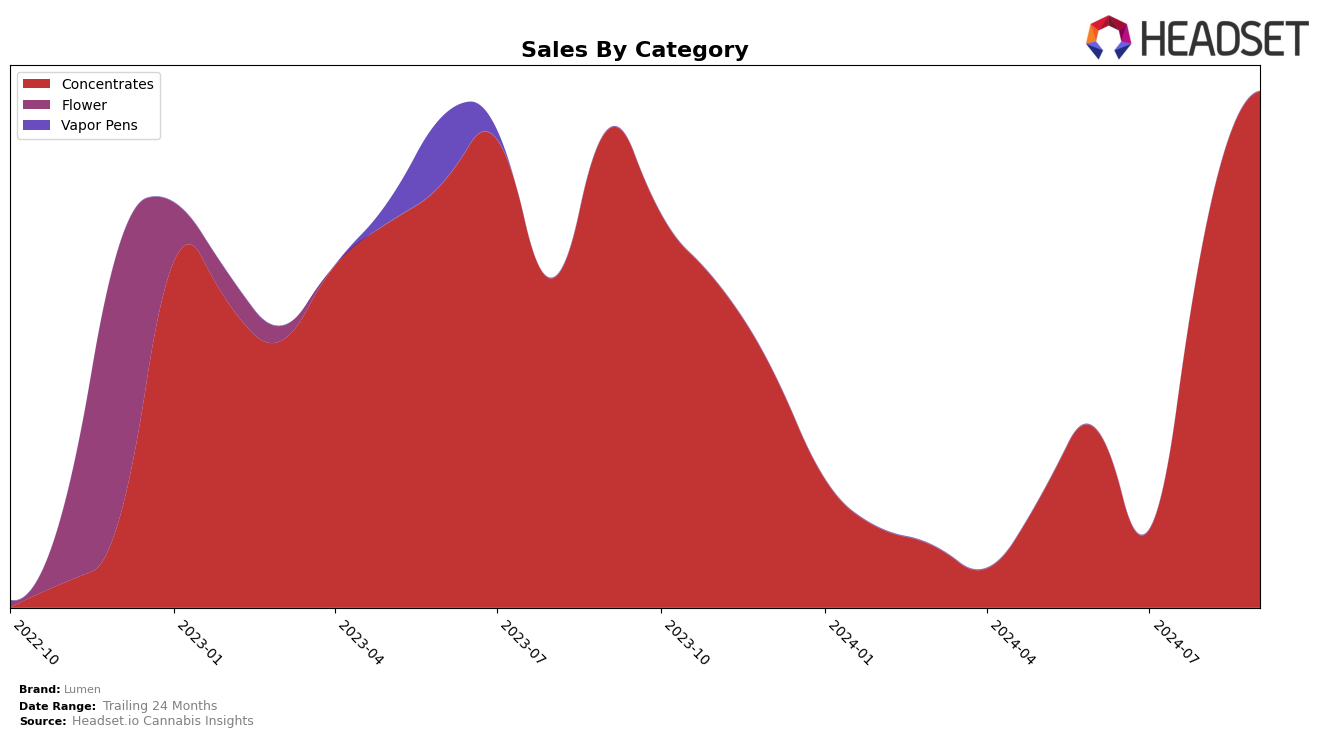

Lumen has shown a notable upward trajectory in the Arizona concentrates category over the past few months. Starting from a rank of 48 in June 2024, Lumen was not ranked in July, indicating it was outside the top 30. However, the brand made a significant comeback in August, climbing to the 38th position, and continued this momentum into September, reaching the 27th rank. This rise in ranking suggests a strong growth in market presence and consumer preference for Lumen's concentrates in Arizona, with sales figures reflecting a consistent increase over the months.

The absence of Lumen in the top 30 rankings for July highlights a potential challenge or shift in strategy during that period, but the subsequent recovery and improvement in ranking indicate resilience and adaptability. The positive trend in Arizona could be indicative of effective marketing strategies, product innovation, or shifts in consumer preferences favoring Lumen's offerings. Observing how Lumen's performance evolves in other states or categories could provide further insights into the brand's overall market strategy and adaptability across different regions.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, Lumen has shown a remarkable upward trajectory in recent months. Starting from a rank of 48 in June 2024, Lumen was not in the top 20 brands, but it has steadily climbed to rank 27 by September 2024. This ascent is indicative of a significant increase in sales, with the brand experiencing a substantial boost from August to September. In contrast, Abundant Organics and Summus have maintained relatively stable positions around the mid-20s to 30s, with Abundant Organics seeing a slight improvement from rank 31 in June to 28 in September. Meanwhile, Nectar Farms has experienced fluctuations, peaking at rank 27 in August before settling at 26 in September. Despite these shifts, Pressd remains a strong competitor, consistently ranking in the top 25, although their sales have shown a downward trend. Lumen's rise in rank and sales suggests a growing consumer preference and market penetration, positioning it as a formidable contender in the Arizona concentrates category.

Notable Products

In September 2024, the top-performing product for Lumen was Gastropop Budder (1g) in the Concentrates category, which climbed to the number one spot with sales of $870. Cali Lightning Sugar Wax (1g) followed closely, dropping to second place from its previous first-place ranking in August. LA Confidential Budder (1g) improved its standing, moving up to third place from fourth in August, while Guava Cross Budder (1g) fell to fourth place after being second the previous month. Larry Lem OG Budder (1g), which was the top-ranked product in June and July, saw a significant drop to fifth place by September. The shifting rankings highlight a competitive landscape in the Concentrates category, with notable fluctuations in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.