Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

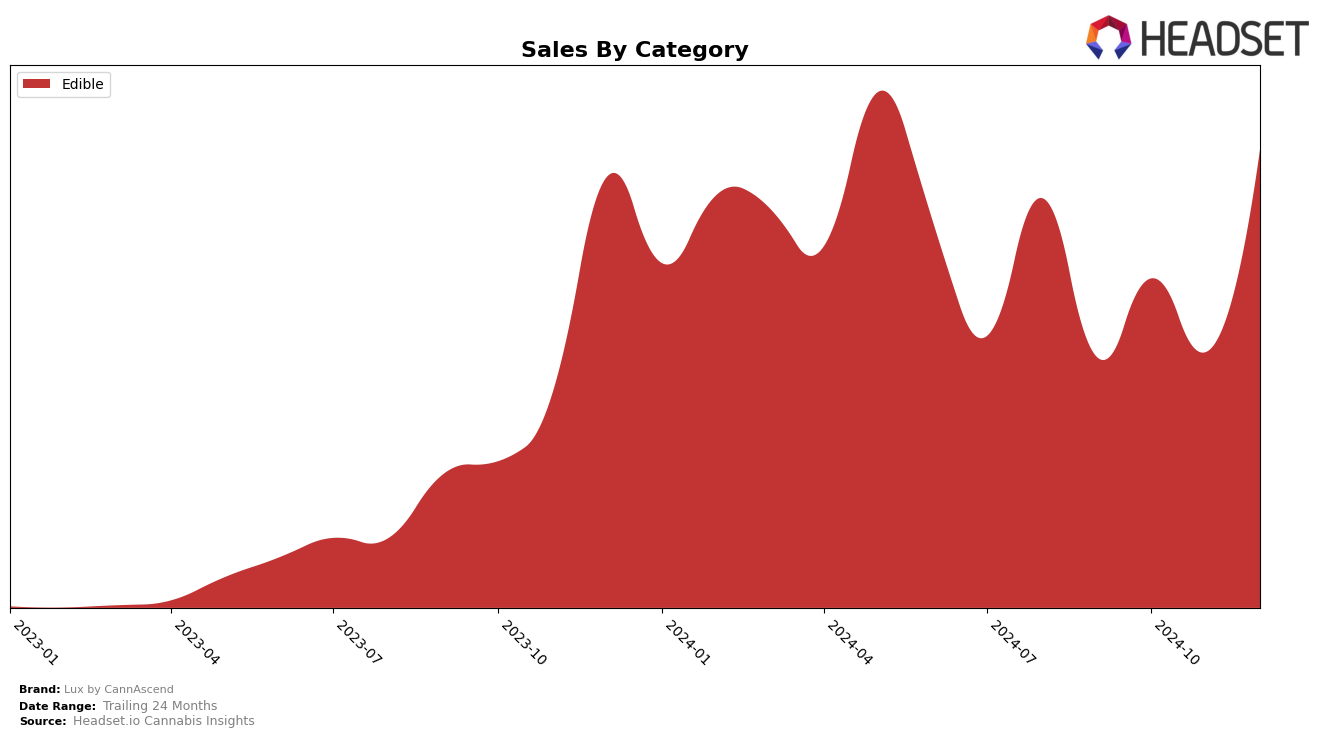

Lux by CannAscend's performance in the edible category across different states shows varying trends. In Maryland, the brand experienced some fluctuations but maintained a presence within the top 30 rankings for three out of the four months. It managed to climb to the 27th position in October 2024, indicating a strong month, although it slipped back to 31st by December. This suggests a competitive market in Maryland, where Lux by CannAscend is striving to hold its ground. The sales figures reflect this volatility, with a notable increase in October before a dip in November followed by a slight recovery in December.

In contrast, Ohio presents a different picture for Lux by CannAscend, where the brand was not consistently in the top 30 rankings until December 2024, when it reached the 29th position. This upward trajectory in Ohio is significant, especially considering it was outside the top 30 in September. The sales data supports this positive trend, with December's sales nearly doubling from the previous months, indicating a potential breakthrough in the Ohio market. This suggests that Lux by CannAscend might be gaining traction in Ohio, possibly due to strategic changes or market conditions favoring their offerings.

Competitive Landscape

In the Ohio edible cannabis market, Lux by CannAscend has demonstrated a notable improvement in its competitive positioning over the last few months of 2024. Starting from a rank of 42 in September, Lux by CannAscend climbed to 29 by December, indicating a positive trajectory in market presence. This upward movement is significant, especially when compared to competitors like Moxie, which also improved its rank from 46 to 27, and Oria, which moved from 35 to 28. However, Appalachian Pharm experienced a decline, dropping from 26 to 30, suggesting a potential opportunity for Lux by CannAscend to capture more market share. Meanwhile, Dialed In Gummies re-entered the top ranks in December at 32, highlighting a competitive landscape that Lux by CannAscend must navigate carefully. The sales trends reflect these rank changes, with Lux by CannAscend's December sales showing a significant increase, aligning with its improved rank, suggesting effective strategies in capturing consumer interest and driving sales.

Notable Products

In December 2024, the top-performing product for Lux by CannAscend was Milk Chocolate Sea Salt Caramels 10-Pack (110mg), maintaining its number one rank from November with a notable sales figure of 1693 units. Milk Chocolate Caramel Coffee 10-Pack (110mg) entered the rankings at the second position, indicating strong demand. The CBD/THC 1:1 Smoked Almond Milk Chocolate Truffles 10-Pack (110mg CBD, 110mg THC) improved significantly from fifth place in November to third in December. Caramel Macchiato Milk Chocolates Truffles 10-Pack (100mg) debuted in the rankings at fourth position, while Dark Chocolate Sea Salt Caramels 10-Pack (100mg) re-entered the rankings at fifth place after being unranked in the previous months. This shift in rankings highlights a growing consumer interest in a variety of edible products from Lux by CannAscend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.