Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

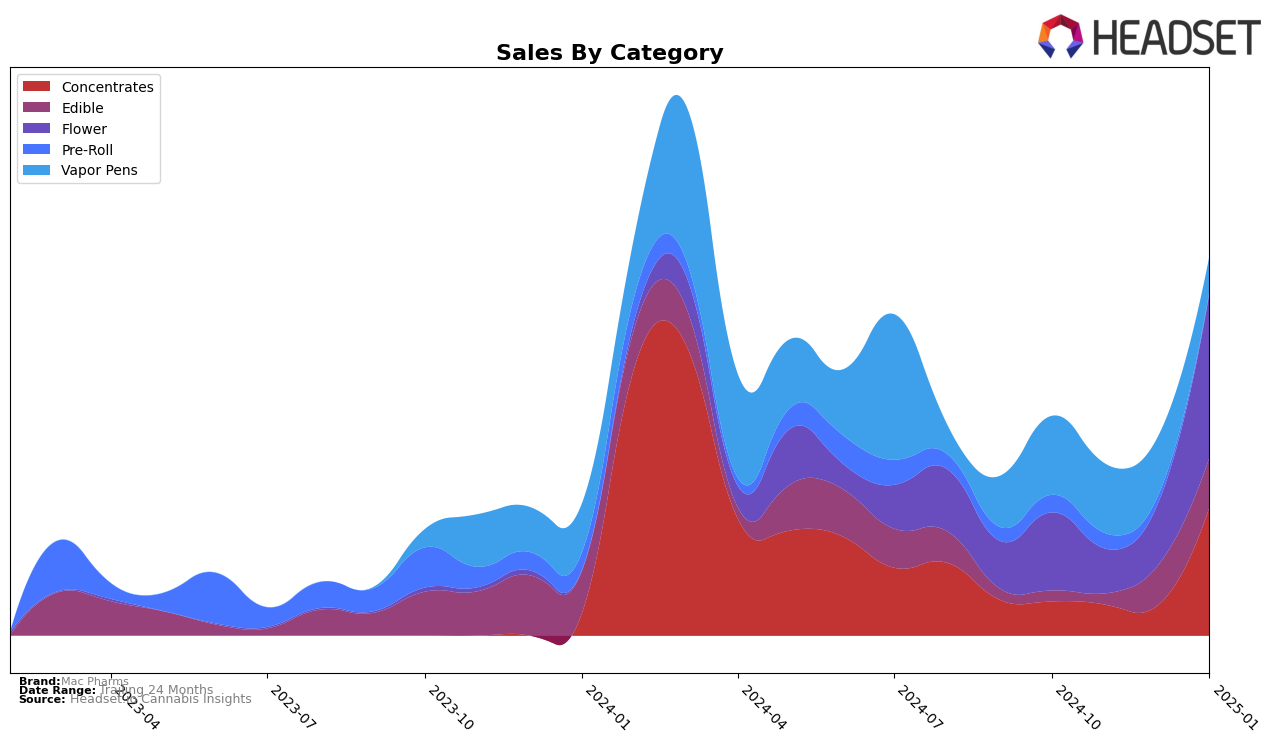

Mac Pharms has demonstrated a notable upward trajectory in the Michigan concentrates category over the past few months. Starting from a rank of 68 in October 2024, the brand climbed to rank 30 by January 2025. This significant leap into the top 30 indicates a strong performance and increased consumer acceptance in the concentrates market. In contrast, their presence in the vapor pens category has seen a decline, dropping from rank 79 in October to rank 100 by January, suggesting potential challenges or increased competition in this segment. The brand's absence from the top 30 in this category may be a point of concern for stakeholders monitoring their market share.

In the edibles category, Mac Pharms has shown a steady improvement in Michigan, moving from rank 97 in October to 58 in January. This positive trend highlights the brand's growing foothold and potential for further expansion in the edibles market. The sales figures for this category reflect a consistent upward trajectory, indicating a successful strategy or product line resonating with consumers. Despite these gains in edibles and concentrates, the brand's overall market presence could benefit from addressing the challenges faced in the vapor pens category, where they did not make it into the top 30 rankings by January 2025.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Mac Pharms has demonstrated a remarkable comeback in recent months. After being absent from the top 20 rankings from October to December 2024, Mac Pharms surged to the 30th position by January 2025. This upward trajectory is noteworthy, especially when compared to competitors like Rise (MI), which fluctuated between ranks 20 and 31, and Element, which experienced a decline from 15th to 36th place over the same period. Meanwhile, Goodlyfe Farms maintained a relatively stable presence, hovering around the 28th to 39th positions. The significant increase in Mac Pharms' sales in January 2025, which aligns with its improved ranking, suggests a successful strategy that could potentially disrupt the current market dynamics if sustained.

Notable Products

In January 2025, Raspberry Gummies 5-Pack (200mg) maintained its top position as the leading product from Mac Pharms, continuing its streak from November and December 2024, with a notable sales figure of 8,479. Sour Apple Gummies 5-Pack (200mg) held steady at the second position, showcasing consistent popularity since November 2024. London Purpz (3.5g) rose to third place, improving from its December rank of fifth, indicating a growing preference for this flower product. Cereal Milk (3.5g) entered the top rankings at fourth place, having not been ranked in the previous months, suggesting a new surge in demand. Fried Oreoz Live Resin (1g) debuted in the rankings at fifth position, marking its first appearance with a solid sales figure.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.