Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

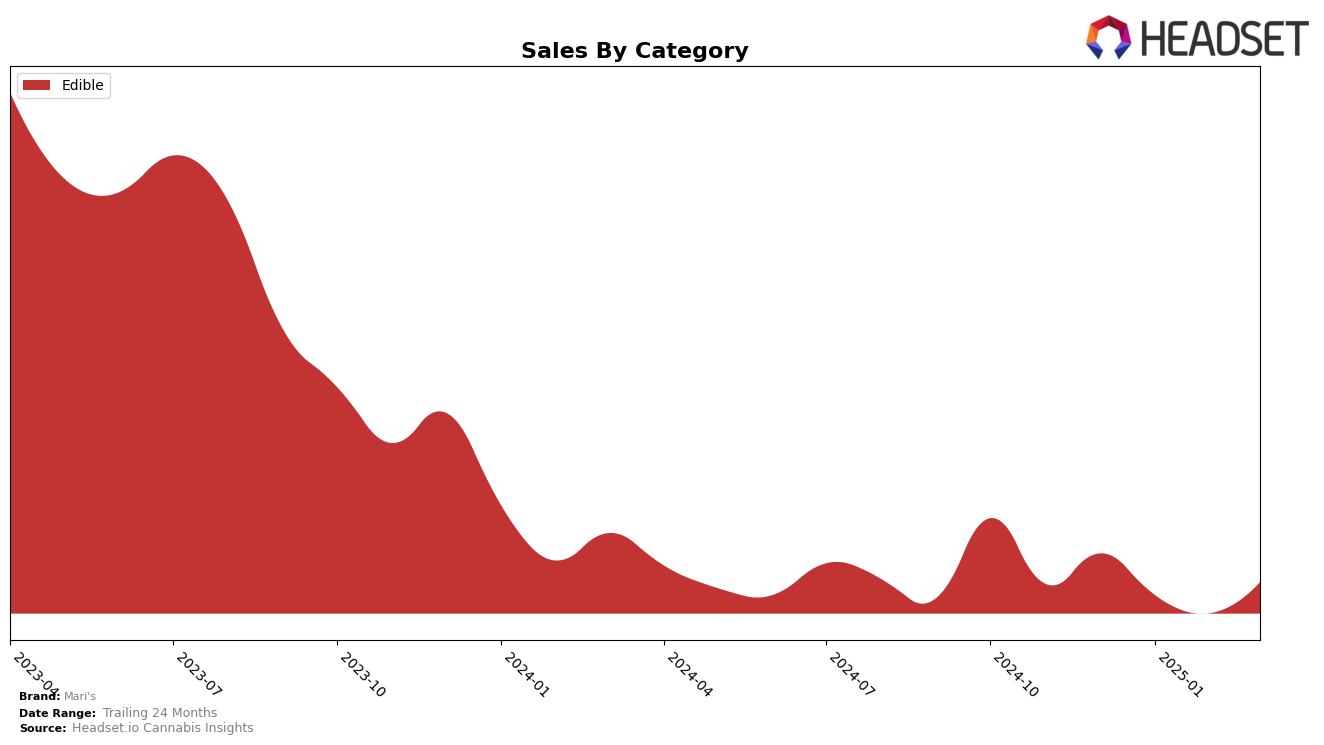

In the state of Washington, Mari's has maintained a consistent presence in the Edibles category, holding steady at the 20th rank from January to March 2025. This stability suggests a loyal consumer base and effective brand positioning within this segment. Despite a slight dip in sales from December 2024 to February 2025, Mari's showed a positive trend with a rebound in March. This indicates a potential seasonal fluctuation or successful promotional efforts that helped regain momentum.

It's noteworthy that Mari's has not appeared in the top 30 rankings for any other category or state/province during this period. This absence could imply a strategic focus on the Edibles market in Washington, or it might suggest opportunities for expansion or increased competition in other regions. Understanding the dynamics of Mari's performance in Washington could provide insights into potential growth areas or necessary adjustments in strategy to enhance their presence in other markets.

```Competitive Landscape

In the Washington Edible market, Mari's has consistently maintained its position at the 20th rank from December 2024 through March 2025. Despite this stability in rank, Mari's experienced a fluctuation in sales, with a notable dip in January 2025 followed by a recovery in March 2025. This trend suggests a potential seasonal or promotional impact on sales. Competitors such as Verdelux and Cosmic Candy have shown a slight decline and improvement in ranks, respectively, with Cosmic Candy surpassing Mari's in March 2025. Meanwhile, Happy Cabbage Farms and Swell Edibles have remained outside the top 20, indicating a less competitive threat to Mari's current standing. These dynamics highlight the competitive pressures Mari's faces, particularly from brands like Cosmic Candy, which could influence strategic decisions to enhance market share and sales performance.

Notable Products

In March 2025, Mari's top-performing product was Sativa Move Mints 10-Pack (100mg), maintaining its consistent number one rank from previous months with sales of 1103 units. The Sativa Wintermint Move Mints 20-Pack (100mg) secured the second spot, unchanged since February 2025, with a slight increase in sales to 861 units. Indica Retire Hot Cinnamon Mints 20-Pack (100mg) moved up to third place, showing a recovery from its rank in February with 830 units sold. Indica Retire Wintermint Mints 20-Pack (100mg) climbed to fourth place, marking a steady improvement in its rankings since December 2024. The Peppermint Move Mints 20-Pack (100mg) entered the rankings in March at fourth place, highlighting its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.