Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

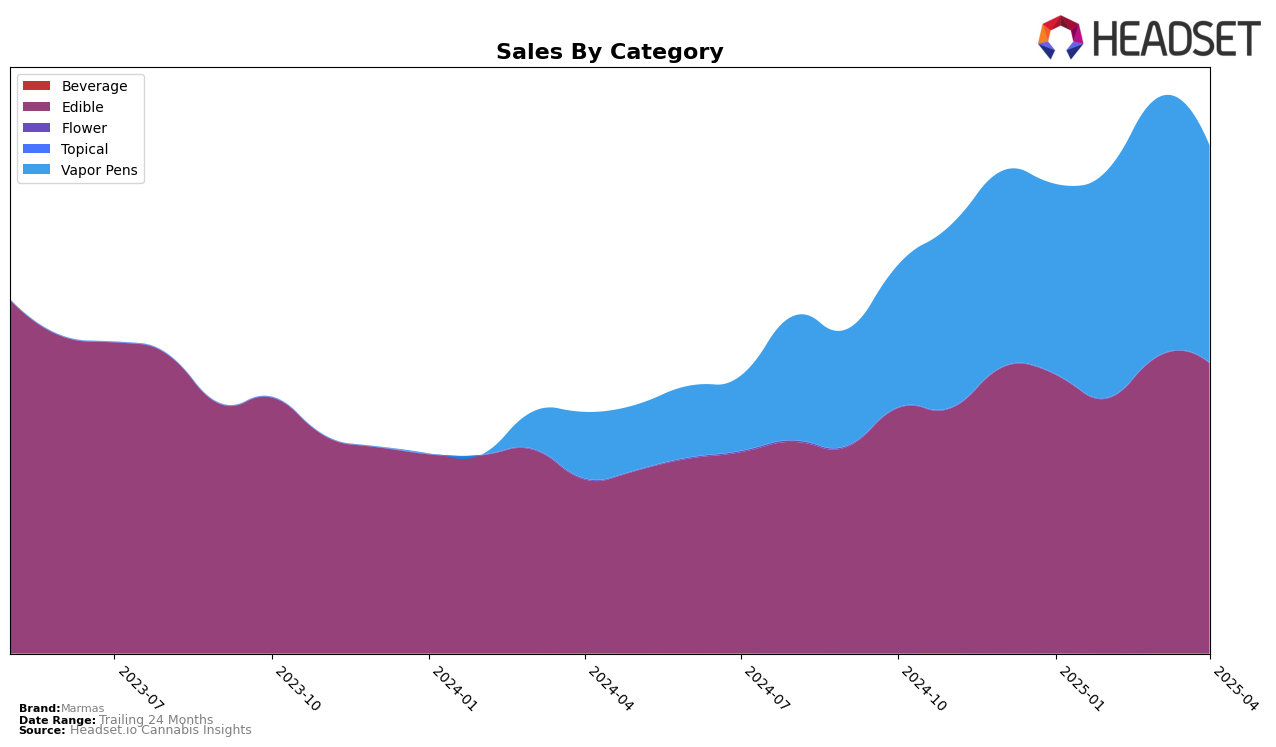

Marmas has shown a varied performance across different states and categories. In Illinois, the brand's presence in the Vapor Pens category saw a steady climb, moving from a rank of 59 in January 2025 to 50 by April 2025. This upward trajectory suggests a growing acceptance and demand for their products in this category, even though they have not yet broken into the top 30. Meanwhile, in Massachusetts, Marmas has been experiencing fluctuations in the Vapor Pens category, with a notable dip in April, falling back to 39th place from 31st in February. This inconsistency could point to competitive pressures or changing consumer preferences in the state.

In the Edible category, Marmas has maintained a strong and consistent performance in Washington, holding steady at the 11th position from January through April 2025. This stability indicates a solid foothold in the market and possibly a loyal customer base. In contrast, in Massachusetts, Marmas has seen some volatility, yet managed to improve from 31st in January to 29th in April. Despite not always being in the top 30, these movements suggest potential opportunities for growth if they can capitalize on the positive trends. The varying performance across states and categories highlights the dynamic nature of the cannabis market and the importance for brands like Marmas to adapt to regional demands and competitive landscapes.

Competitive Landscape

In the competitive landscape of the Edible category in Washington, Marmas has consistently maintained its position at rank 11 from January to April 2025. Despite this stability, Marmas faces stiff competition from brands like Cormorant, which holds the 10th rank and has shown a steady increase in sales over the months, indicating a stronger market presence. Meanwhile, Ceres consistently ranks at 9th, demonstrating a robust sales performance that Marmas has yet to surpass. Additionally, Marmas is ahead of Mr. Moxey's and Drops, both of which have shown slight improvements in their rankings and sales figures. This competitive environment suggests that while Marmas maintains a stable position, there is a need for strategic initiatives to enhance its market share and potentially climb the rankings amidst rising competitors.

Notable Products

In April 2025, Marmas' Tranqility- CBD:THC 4:1 Huckleberry Marmalade Candy Bites 10-Pack maintained its top position, continuing its streak as the number one product since January 2025, with a notable sales figure of 3,140 units. The Strawberry Marmalade Candy Bites held steady at the second rank, showing consistent demand. Blue Raspberry Marmalade Candy Bites 10-Pack remained in the third position, while Indica Huckleberry Gummies 10-Pack consistently ranked fourth throughout the months. The Mango Liquid Diamond Disposable made its debut in the rankings at the fifth position, signaling a new entry in the top-performing list. These rankings highlight a stable preference for Marmas' edible products, with slight fluctuations in sales figures across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.