Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

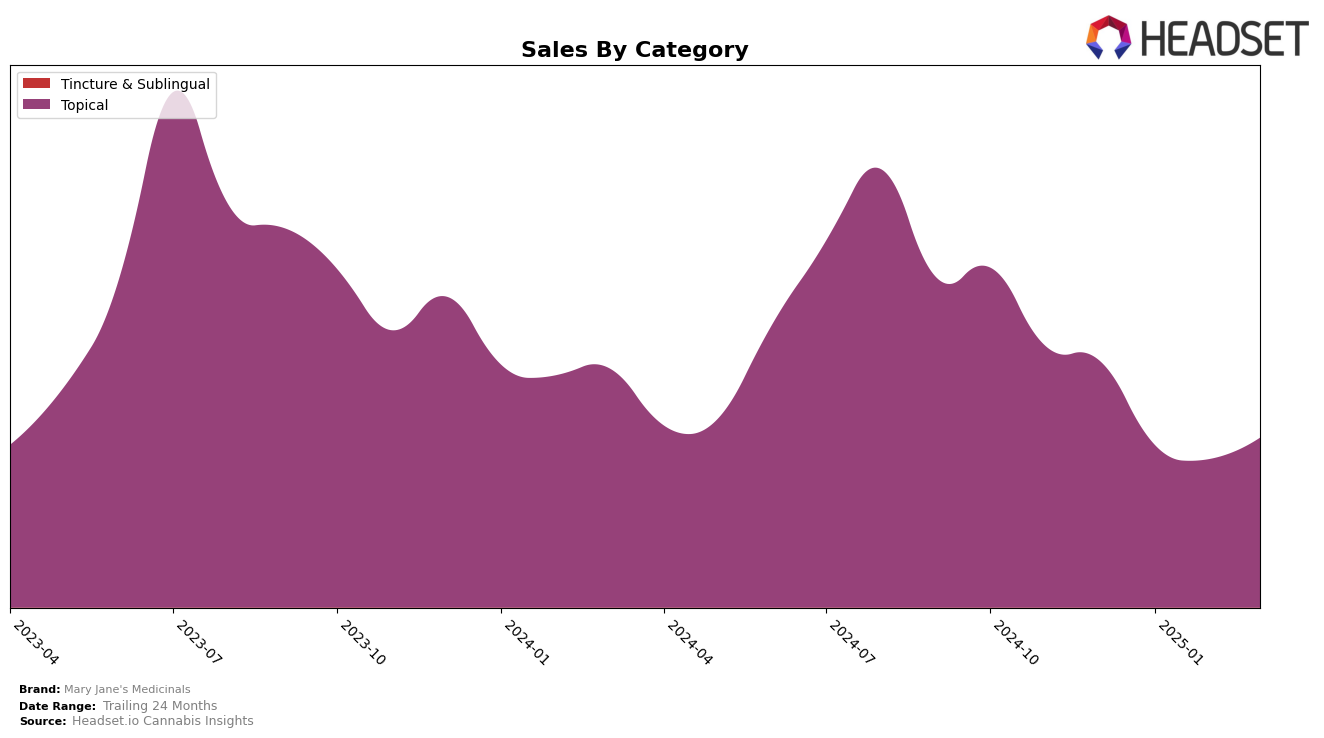

Mary Jane's Medicinals has consistently maintained a strong position in the topical category within Colorado, holding a steady third-place ranking from December 2024 through March 2025. This stability in ranking suggests a robust brand presence and consumer loyalty in the state. While the brand experienced a dip in sales from December to February, the slight recovery in March indicates a positive trend that may suggest effective marketing strategies or product innovations that resonate with consumers. This consistent performance in Colorado highlights the brand's strong foothold in the topical category, a segment where competition can be fierce.

Notably, Mary Jane's Medicinals did not appear in the top 30 rankings in any other states or provinces during this period, which could be seen as a limitation in their market reach or an opportunity for expansion. The absence from rankings in other regions suggests that while the brand is a significant player in Colorado, it may need to explore strategies to replicate this success in other markets. This could involve expanding distribution channels or tailoring marketing efforts to meet the preferences of consumers in different areas. The brand's concentrated success in Colorado provides a solid foundation, but diversifying its geographical presence could be key to sustaining long-term growth.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Colorado, Mary Jane's Medicinals consistently holds the third rank from December 2024 to March 2025. This stability in rank is notable, especially when compared to competitors like Nordic Goddess and Care Division, which fluctuate between fourth and fifth positions. Despite maintaining its rank, Mary Jane's Medicinals faces a significant sales gap with the top two brands. Escape Artists leads the market with a substantial sales margin, while Mary's Medicinals consistently secures the second position with higher sales figures. The sales trajectory for Mary Jane's Medicinals shows a slight recovery in March 2025 after a dip in January and February, indicating potential for growth if strategic marketing efforts are implemented to close the gap with the leaders.

Notable Products

In March 2025, the CBD:THC 1:1 Cloud 9 Bath Bomb (150mg CBD, 150mg THC) continued to dominate as the top-performing product for Mary Jane's Medicinals, maintaining its first-place ranking since December 2024 with a notable sales figure of $702. The CBD/THC 2:1 Lip Bong (3mg CBD, 9mg THC, 0.15oz) held steady in the second position, showing consistent performance over the past few months. The CBD/CBG/THC 5:1:5 Super Strength Nano Cream (1250mg CBD, 250mg CBG, 1250mg THC, 1.7oz) improved its ranking, climbing to third place from fourth in February 2025. Meanwhile, the unnamed Topical product dropped to fourth place after peaking in third position in February. Lastly, the CBD/THC 1:1 Super Strength Salve (500mg CBD, 500mg THC, 3.3oz) slipped to fifth place, marking a decline from its second-place ranking in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.