Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

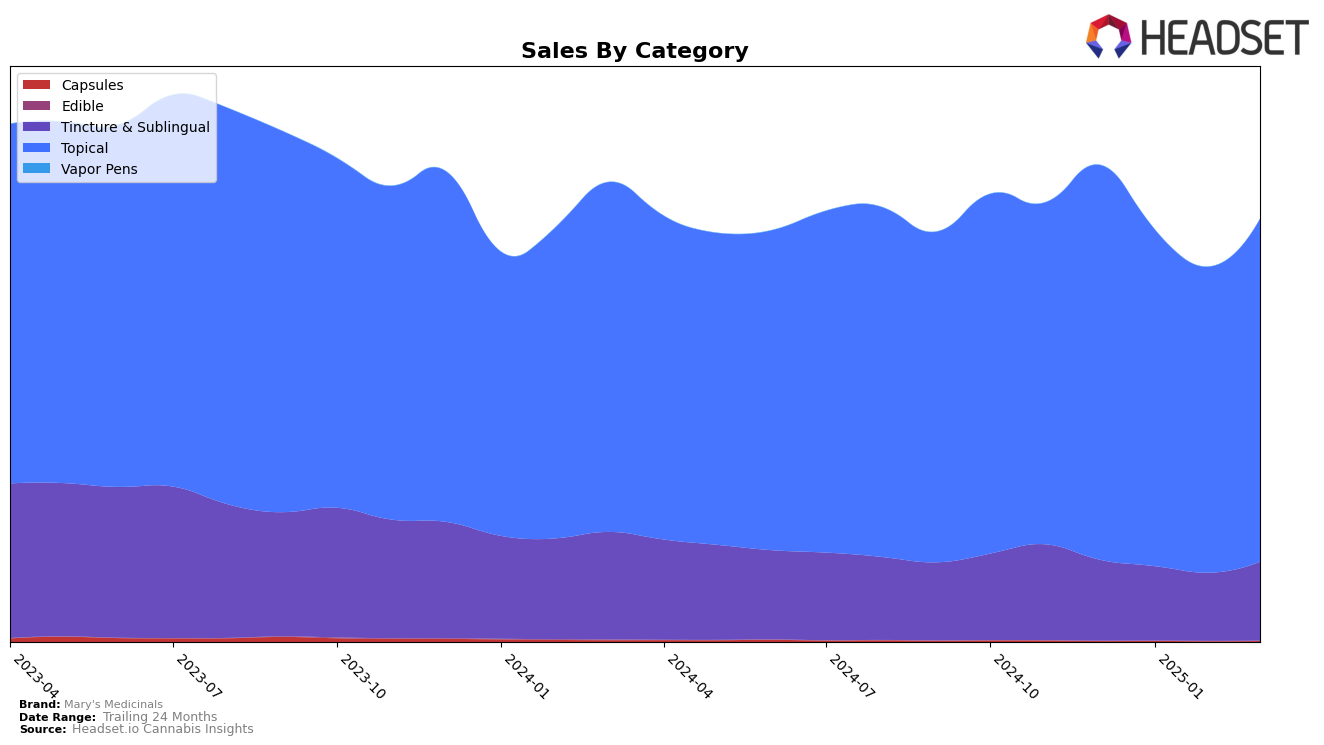

Mary's Medicinals has shown a consistent performance across several states, particularly in the Topical category. In California, the brand maintained a steady second-place ranking from December 2024 through March 2025, despite a slight dip in sales from December to February. Similarly, in Colorado and Michigan, the brand held onto the second spot throughout the same period, indicating strong market penetration and consumer loyalty in this category. Notably, in Missouri, Mary's Medicinals claimed the top position in Topical sales consistently, suggesting a dominant presence in that market.

In the Tincture & Sublingual category, Mary's Medicinals experienced a more varied performance. In California, the brand fluctuated between the fifth and sixth positions, with a notable recovery to fifth place in March 2025. Meanwhile, in Michigan, Mary's Medicinals improved its ranking from fourth in December 2024 to third by February 2025, maintaining this position through March. This upward trend in Michigan contrasts with the brand's inability to break into the top three in California, highlighting potential areas for strategic growth. The absence of a ranking in other states for this category suggests opportunities for expansion or increased competition that may require attention.

Competitive Landscape

In the California topical cannabis market, Mary's Medicinals consistently holds the second rank from December 2024 through March 2025, demonstrating a stable position despite a gradual decline in sales over the period. This stability in ranking is notable given the dominance of Papa & Barkley, which maintains the top position with significantly higher sales figures. The sales gap between Mary's Medicinals and Papa & Barkley suggests a strong brand loyalty and market presence for the latter, which could be a challenge for Mary's Medicinals to overcome. Meanwhile, Buddies and Carter's Aromatherapy Designs (C.A.D.) consistently rank third and fourth, respectively, with sales figures that are considerably lower than those of Mary's Medicinals, indicating that while Mary's Medicinals faces stiff competition at the top, it remains well ahead of other competitors in the market.

Notable Products

In March 2025, the top-performing product from Mary's Medicinals was the Indica Relax Transdermal Patch (20mg), which climbed from the third position in previous months to secure the first rank with sales of 4,962 units. The CBD/THC 1:1 Relief Transdermal Patch (10mg CBD, 10mg THC) maintained its second position, despite a slight decline in sales. The CBD/THC/CBN 2:3:1 Formula Transdermal Patch (10mg CBD, 15mg THC, 5mg CBN) dropped to third place from its top position in February. A new entry, the CBD Transdermal Patch (10mg CBD), debuted in fourth place. The Sativa Energy Transdermal Patch (20mg) remained steady in fifth position, showing consistency in its sales ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.