Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

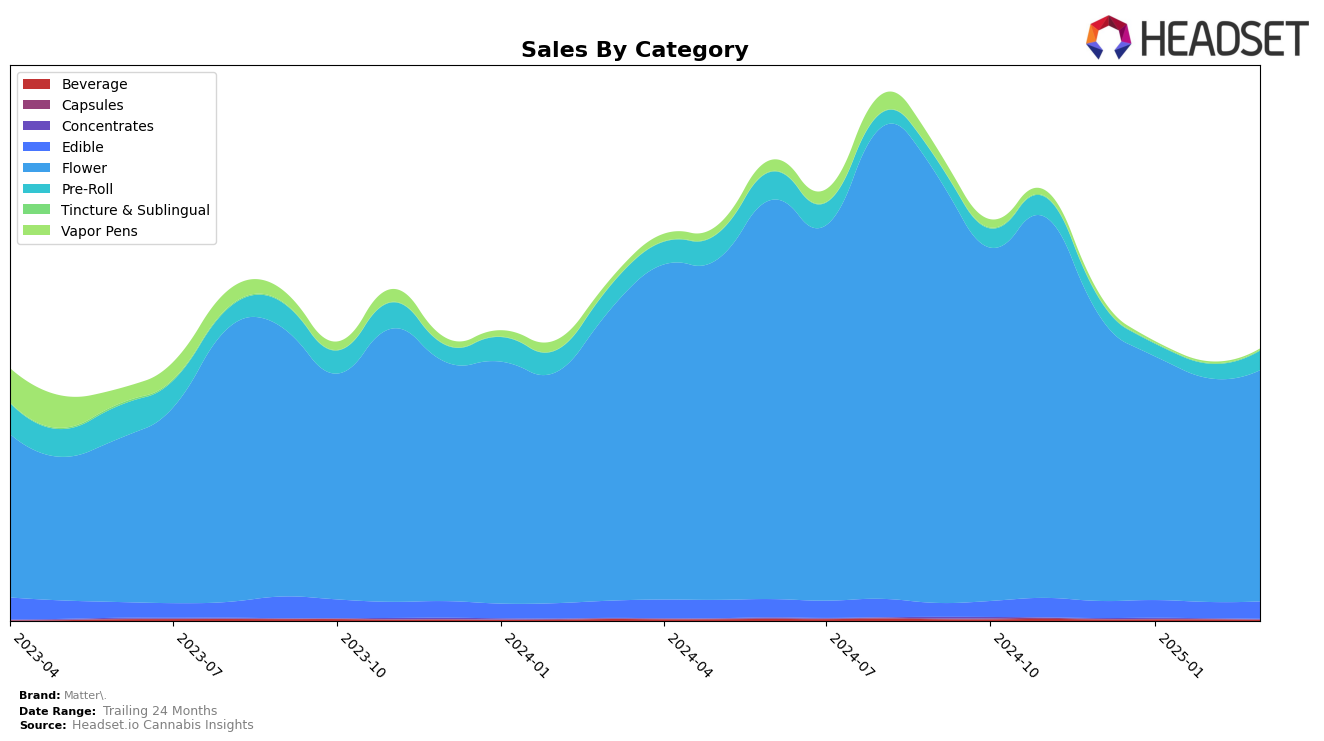

Matter. has shown varied performance across different states and categories, with notable trends in some areas. In Illinois, their Flower category experienced a slight dip in rankings from December 2024 to February 2025, but rebounded in March 2025, indicating potential recovery or market adjustments. Interestingly, Matter. entered the Pre-Roll category in Illinois in March 2025, debuting at rank 40, suggesting a strategic expansion into new product lines. In Massachusetts, the Flower category saw a dip in January 2025, dropping from rank 61 in December 2024 to 82, but it improved to rank 72 by March 2025, highlighting a potential recovery or increased competition in the market.

Meanwhile, in Maryland, Matter. maintained a relatively stable presence in the Flower category, fluctuating slightly but remaining within the top 30. This consistency may reflect a strong brand presence or consumer loyalty in the state. In New York, Matter. performed well in the Flower category, consistently ranking in the top 6, though there was a slight decline from December 2024 to March 2025. However, their Edible category performance in New York remained stable, while their Pre-Roll category saw a gradual decline in rankings, indicating a potential area for improvement or increased competition. Notably, Matter. did not appear in the top 30 for Flower in Ohio after December 2024, which could signal challenges in maintaining market position or shifting consumer preferences.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Matter. has experienced notable fluctuations in its rank and sales over the past few months. Starting from a strong position at rank 3 in December 2024, Matter. saw a slight dip to rank 4 in January 2025, before rebounding to rank 3 in February. However, by March 2025, Matter. dropped to rank 6, indicating increased competition and potential challenges in maintaining its market position. This decline in rank corresponds with a consistent decrease in sales from December to March. In contrast, Find. demonstrated resilience by climbing from rank 4 in December to rank 3 in January, maintaining a competitive edge over Matter. despite a dip in February. Meanwhile, Untitled showed significant improvement, climbing from rank 15 in December to rank 7 by March, reflecting a strong upward trajectory in sales. Additionally, The Plug Pack made a remarkable leap from being unranked in December to securing rank 5 by March, showcasing a rapid increase in market presence. These dynamics suggest that Matter. faces increasing pressure from emerging and established competitors, necessitating strategic adjustments to regain its footing in the New York Flower market.

Notable Products

In March 2025, the top-performing product for Matter was Apex R1 (3.5g) in the Flower category, which secured the first position with sales reaching 1769 units. Larry Burger (3.5g), also in the Flower category, followed closely as the second top performer, experiencing a slight drop from its previous first-place ranking in February. The CBD/THC 4:1 Sour Apple Gummy Bites 20-Pack maintained a consistent presence in the top three, ranking third, and showing a moderate increase in sales compared to February. Cherry Cola Gummies 10-Pack re-entered the rankings in fourth place, indicating a resurgence in popularity. Notably, the CBD/THC 1:1 Sour Kiwi Strawberry Gummies 20-Pack made its debut in the rankings at fifth place, highlighting its growing appeal among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.