Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

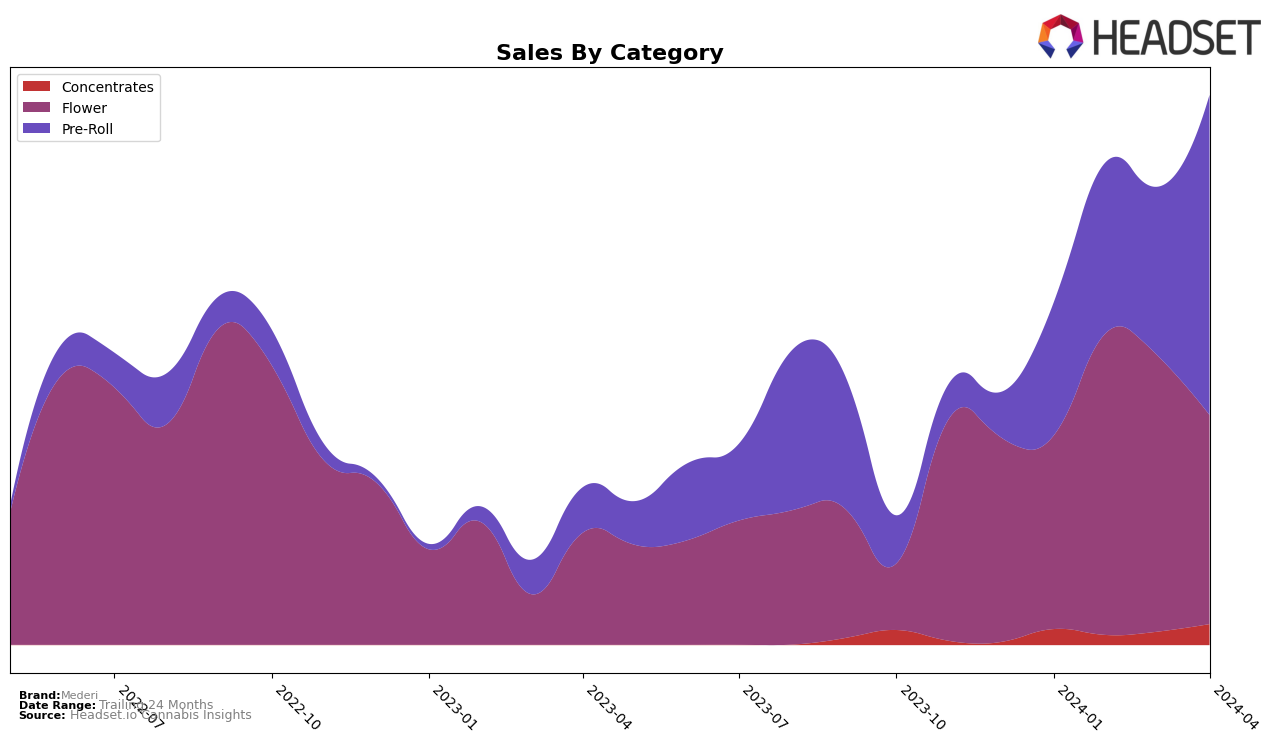

In Massachusetts, Mederi has shown a notable presence across multiple cannabis categories, though its performance varies significantly. The brand's journey in the concentrates category illustrates a challenging market penetration, with rankings of 53rd in January 2024, disappearing from the top 30 in February and March, and then making a comeback at the 50th position in April 2024. This fluctuation highlights a potential struggle in establishing a consistent market position within the concentrates segment. Conversely, Mederi's performance in the pre-roll category tells a different story, showcasing a remarkable improvement. Starting at 51st in January, the brand climbed to the 19th position by April 2024, coupled with a substantial increase in sales from 86,609 in January to 208,369 in April, indicating a strong consumer acceptance and growing brand loyalty in this category.

The flower category also presents an interesting trajectory for Mederi, with initial rankings starting at 66th in January 2024 and experiencing a slight volatility before settling at 59th in April 2024. Despite the fluctuations, Mederi demonstrated a significant sales increase from January to February, though it saw a gradual decline in the subsequent months. This pattern suggests that while Mederi is gaining traction, it faces challenges in maintaining its momentum in the highly competitive flower market. Notably, the absence of Mederi from the top 30 rankings in certain months across different categories underlines the competitive nature of the Massachusetts market and the need for strategic positioning to capture and retain consumer interest. Despite these challenges, the brand's ability to improve its standings, especially in the pre-roll category, reflects a resilience and potential for growth that could be leveraged with the right marketing and product development strategies.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, Mederi has shown a notable improvement in its market position, moving from being outside the top 20 in earlier months to securing the 19th rank by April 2024. This leap in rankings is indicative of a significant increase in sales, suggesting a growing consumer preference or successful marketing strategies. Competing brands such as Fathom Cannabis and Root & Bloom have maintained more consistent rankings within the top 20, indicating stable consumer demand. Interestingly, Perpetual Harvest and Shaka Cannabis Company have experienced fluctuations in their rankings, but both ended up in the top 20 by April 2024, highlighting the dynamic nature of consumer preferences in this category. Mederi's recent surge in rank and sales positions it as a brand to watch, as its upward trajectory could disrupt the current market standings if the trend continues.

Notable Products

In April 2024, Mederi saw Bahama Mama Pre-Roll (1g) leading its sales with a significant jump to the top position from its previous third rank in March, boasting sales figures of 13,185 units. Following closely was Orange Push Pop Pre-Roll (1g), which, despite being a consistent performer and previous leader, moved down to second place. Notably, Chocolate Thai Pre-Roll (1g) made an impressive entrance directly into the third rank, showcasing a strong market demand. The Bahama Mama (3.5g) flower product, previously leading in January, experienced a slight drop to the fourth position, indicating a shift in consumer preference towards pre-rolled products. Lastly, Orange Push Pop Pre-Roll (0.5g) maintained its position in the top five, highlighting the steady popularity of the Orange Push Pop strain across different product sizes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.