Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

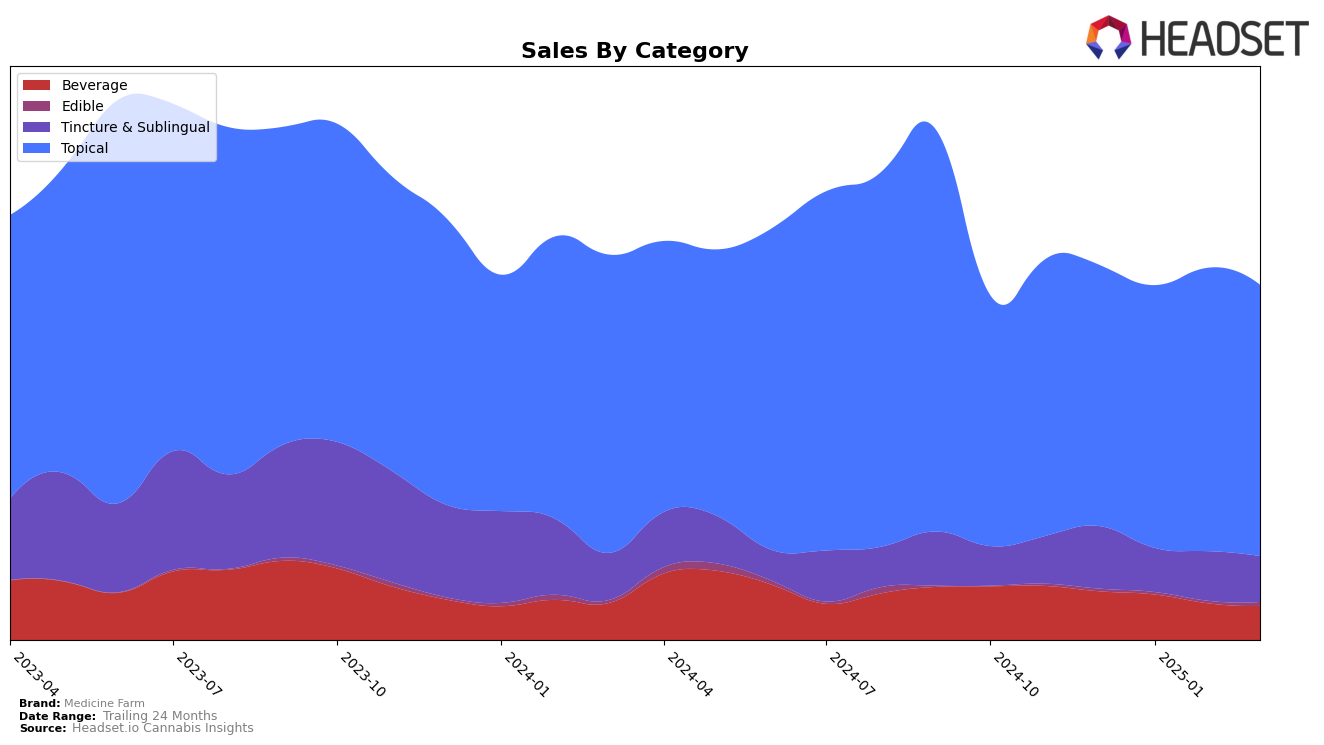

Medicine Farm has demonstrated a varied performance across different product categories in Oregon. In the Beverage category, the brand maintained a steady rank of 9th in both December 2024 and January 2025. However, it is noteworthy that Medicine Farm did not appear in the top 30 rankings for February and March 2025 in this category, suggesting a potential decline in market presence or competition intensifying. This could be a point of concern for the brand, as maintaining a consistent rank is crucial for brand visibility and consumer loyalty. In contrast, the Topical category has been a stronghold for Medicine Farm, consistently holding the 2nd spot from December 2024 through March 2025, indicating a robust market position and possibly a loyal customer base in this segment.

The Tincture & Sublingual category presents an interesting dynamic for Medicine Farm in Oregon. The brand was ranked 12th in December 2024, but did not make it into the top 30 in January 2025, before reappearing at 13th and then improving slightly to 12th place again by March 2025. This fluctuation suggests a competitive landscape where Medicine Farm is struggling to maintain a consistent ranking. Such volatility might indicate opportunities for growth if the brand can identify and address the factors leading to these shifts. Overall, while Medicine Farm shows strength in the Topical category, there is room for improvement and strategic focus in the Beverage and Tincture & Sublingual categories to enhance its market presence across Oregon.

Competitive Landscape

In the Oregon topical category, Medicine Farm consistently holds the second rank from December 2024 to March 2025, maintaining a stable position amidst fluctuating sales figures. Despite this consistency, Medicine Farm faces stiff competition from High Desert Pure, which dominates the top spot with significantly higher sales. While Medicine Farm's sales show a slight upward trend from January to February 2025, they experience a minor dip in March 2025. Meanwhile, Synergy Skin Worx drops from third to fifth place in March, indicating potential market volatility that Medicine Farm could capitalize on. Additionally, Angel (OR) shows a notable rise in rank from sixth to fourth, suggesting increasing competition in the lower ranks. Medicine Farm's consistent ranking indicates strong brand loyalty, but the brand may need to innovate or increase marketing efforts to challenge the market leader and fend off rising competitors.

Notable Products

In March 2025, Medicine Farm's top-performing product was the Phoenix Blend Balm (1000mg THC, 2oz) in the Topical category, reclaiming the number one spot it held in December 2024 after briefly dropping to second in the previous months. The CBD/THC/CBN 2:3:1 Lunar Elixir (600mg CBD, 900mg THC, 300mg CBN, 30ml,1oz) ranked second, maintaining a steady presence in the top three despite a slight decline in sales to 151 units. The CBD/THC 1:1 Mini Phoenix Blend Salve (125mg CBD, 125mg THC, 0.25oz) showed a notable rise, climbing to the third position from fifth in February. Meanwhile, the CBD/THC 1:1 Phoenix Blend Salve (1000mg CBD, 1000mg THC, 2oz) experienced a significant drop to third place from its previous top spot in January and February. The newly introduced Dragons Blend Balm (250mg THC, 2oz) debuted at third place, indicating strong initial sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.