Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

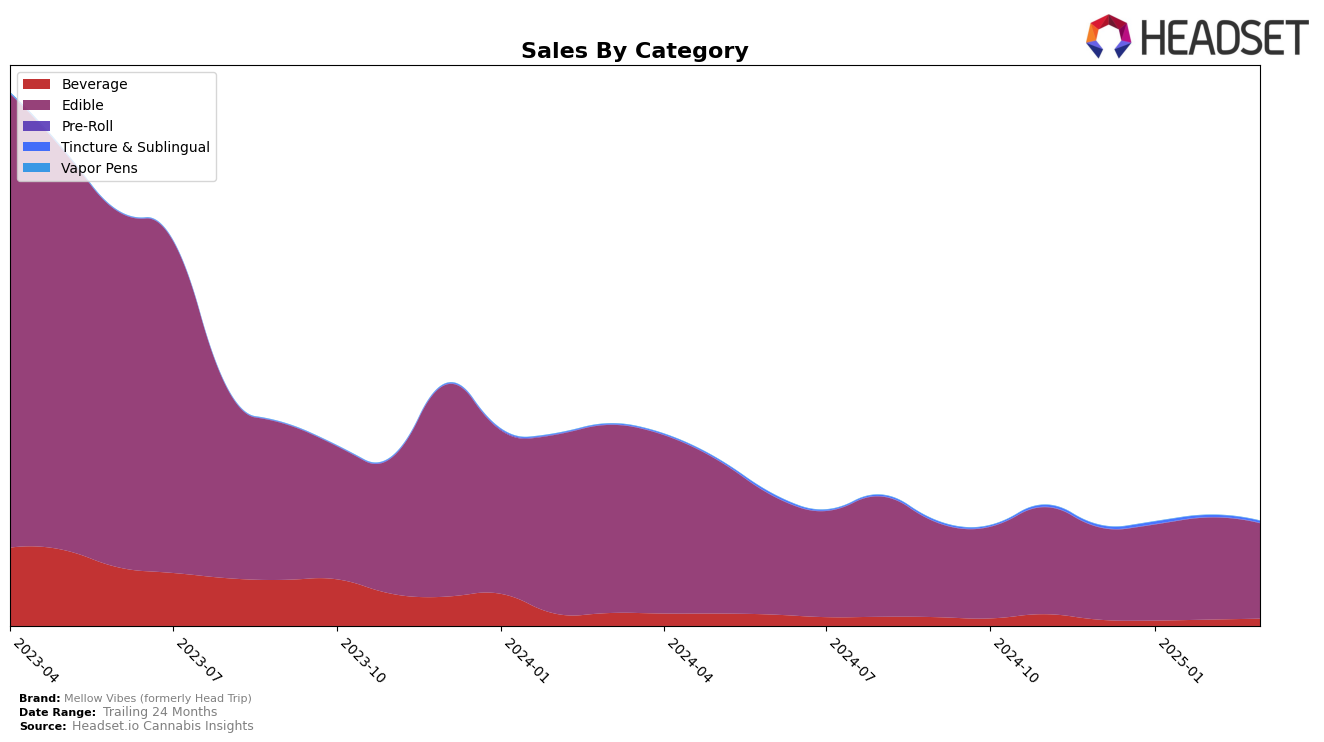

Mellow Vibes (formerly Head Trip) has shown varied performance across different states and categories. In Arizona, the brand has maintained a presence within the top 30 rankings for Edibles, although it experienced slight fluctuations, moving from 23rd in December 2024 to 26th by March 2025. This indicates a relatively stable but slightly declining trend in the Arizona market. Despite this, the brand's sales in Arizona have been consistent, with a minor dip observed in February 2025. This suggests that while Mellow Vibes is holding its ground, there might be increasing competition or market challenges affecting its rank.

In contrast, Oregon has seen a more dynamic shift in Mellow Vibes' performance. The brand improved its ranking from 27th in December 2024 to 20th by February 2025, before settling at 23rd in March 2025. This upward trend in the early months of 2025, particularly in February, coincides with a notable increase in sales, which peaked during that month. The brand's ability to climb the ranks in Oregon suggests a stronger market presence and possibly successful marketing or product strategies that resonated well with consumers. However, the slight drop in March indicates that sustaining this momentum will be crucial for future growth.

Competitive Landscape

In the Arizona edible market, Mellow Vibes (formerly Head Trip) has experienced a slight decline in its ranking over the months from December 2024 to March 2025, moving from 23rd to 26th place. This shift is indicative of a competitive landscape where brands like Chew & Chill (C & C) have made significant gains, jumping from 30th to 25th place in March 2025, surpassing Mellow Vibes. Meanwhile, RR Brothers has shown volatility but ultimately improved its position to 24th in March, further intensifying competition. Despite these challenges, Mellow Vibes maintains a stable sales trajectory, although slightly decreasing, which suggests a need for strategic adjustments to regain its competitive edge. The brand's performance contrasts with the fluctuating sales of O'Geez (WA) and the steady rise of Copperstate Farms, highlighting the dynamic nature of the market and the importance of innovative marketing strategies to capture consumer interest.

Notable Products

In March 2025, the top-performing product for Mellow Vibes (formerly Head Trip) was the Raspberry Lemonade Solventless Gummy (100mg), maintaining its first-place rank for four consecutive months with sales reaching 2830 units. The CBN/THC 2:1 Dream Berry Jelly 5-Pack (100mg CBN, 50mg THC) saw a significant rise to the second position, improving from fourth in February. The Hybrid Mango Guava Gummy (100mg) consistently held the third rank, showing steady sales growth. Sweet Green Apple Live Terp Resin Jelly (100mg) also maintained its position at fourth, while the CBD/THC 1:1 Watermelon Jelly (100mg CBD, 100mg THC) returned to the rankings at fifth place after a brief absence in February. Overall, the top products have shown consistent performance with slight fluctuations in their monthly rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.