Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

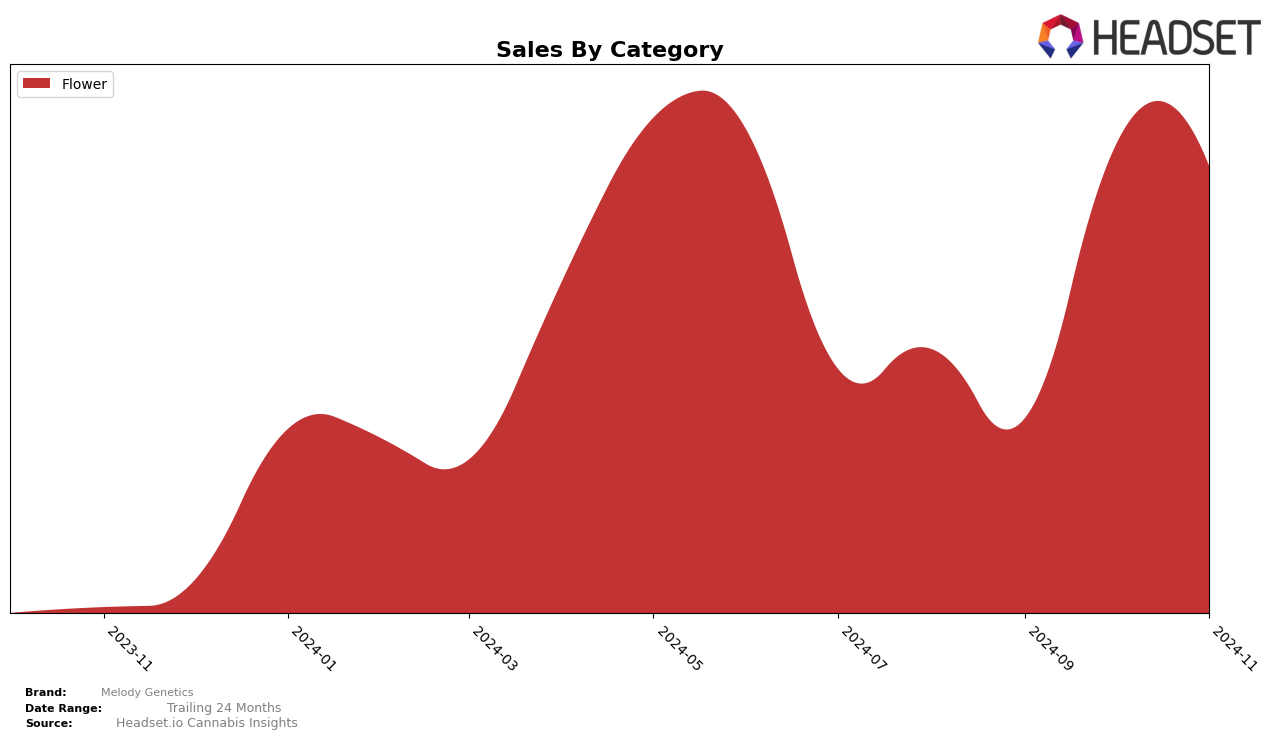

In the state of Colorado, Melody Genetics has shown a notable improvement in the Flower category rankings over the past few months. Starting from a position outside the top 50 in August 2024, they climbed to rank 30 by November 2024. This upward trajectory indicates a strengthening presence in the market, as they were not even in the top 30 in earlier months. The fluctuation in their rankings, particularly the significant jump from 62 to 39 between September and October, suggests that their strategies or product offerings might have resonated well with consumers during this period, leading to a doubling of sales from September to October.

Despite their progress in Colorado, it's crucial to note that Melody Genetics has not yet broken into the top 30 in other states or provinces across different categories. This absence in other markets could be interpreted as either a challenge or an opportunity. On one hand, it highlights areas where the brand has yet to establish a strong foothold, which could be concerning. On the other hand, it presents potential growth areas where strategic initiatives could be implemented to replicate their success in Colorado. Understanding the dynamics that contributed to their rise in Colorado could be key to unlocking similar successes in other regions.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Melody Genetics has shown a notable upward trajectory in recent months. After experiencing a dip in rank from 53rd in August 2024 to 62nd in September, Melody Genetics rebounded significantly to 39th in October and further improved to 30th in November. This positive trend contrasts with competitors such as Rocky Mountain High, which saw a decline from 25th in August to 37th in November, and Sunshine Extracts, which also slipped from 35th to 39th over the same period. Meanwhile, Clarity Gardens showed a similar upward trend, moving from 57th in August to 28th in November, indicating a competitive push in the market. The sales figures for Melody Genetics, although not disclosed here, suggest a robust performance that has likely contributed to its improved ranking, positioning it favorably against its competitors in the Colorado flower market.

Notable Products

In November 2024, Melody Genetics' top-performing product was Pure GMO (Bulk) in the Flower category, regaining its top position with impressive sales of 6044 units. Jelly Mintz (Bulk), also in the Flower category, emerged as the second best-seller, marking its debut in the rankings with a strong performance. Pure GMO Popcorn (Bulk) dropped from its October lead to third place, showing a slight decline in sales compared to the previous month. The Fizz (Bulk) climbed to fourth place after not appearing in the rankings for a few months, indicating a resurgence in popularity. White Truffle (Bulk) completed the top five list, showcasing consistent sales figures since its introduction.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.