Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

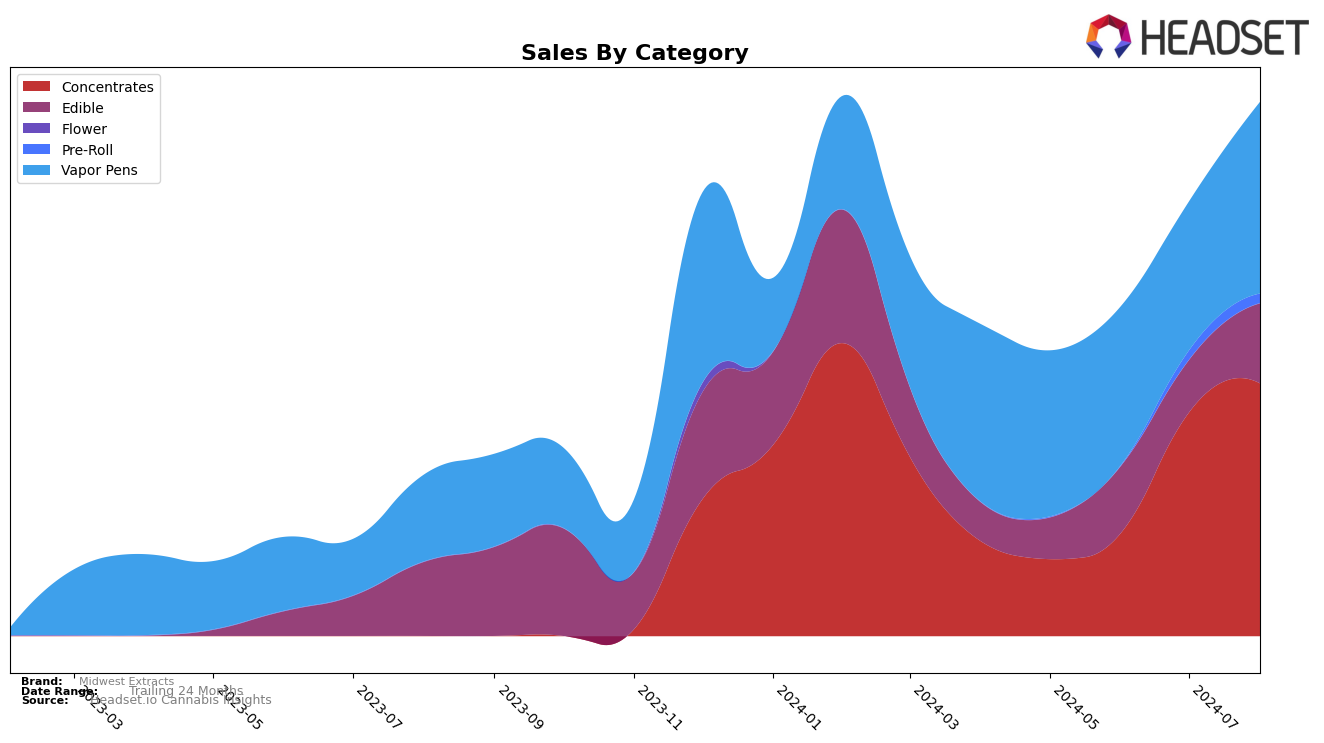

Midwest Extracts has exhibited notable performance in the Michigan market, particularly in the Concentrates category. Over the summer months, the brand has shown a significant upward trend, moving from a rank of 51 in May to an impressive 15 by August. This positive trajectory is accompanied by a substantial increase in sales, culminating in $273,521 in August. The brand's ability to break into the top 30 and maintain its position demonstrates a growing acceptance and demand for its products in this category.

In contrast, Midwest Extracts' performance in the Edibles category in Michigan has been less consistent. While there was a slight improvement, moving from a rank of 71 in May to 48 in August, the brand still struggled to secure a strong foothold. However, the Vapor Pens category showed a more stable performance with a gradual climb from rank 50 in May to 41 in August. The sales figures in this category also reflect a healthy growth pattern, indicating a steady consumer interest. This mixed performance across categories highlights areas where Midwest Extracts is thriving and others where there is potential for growth and improvement.

Competitive Landscape

In the Michigan concentrates market, Midwest Extracts has shown a remarkable upward trajectory over the past few months. Initially ranked 51st in May 2024, the brand has climbed steadily to reach the 15th position by August 2024. This significant improvement in rank is indicative of a strong increase in sales and market presence. Comparatively, Dazed (MI) and Uplyfted Cannabis Co. have also seen positive movements, but their growth has been less dramatic. Notably, GreenCo Ventures and Strait-Fire have maintained higher ranks, with GreenCo Ventures reaching the 12th position and Strait-Fire the 14th position by August 2024. The rapid ascent of Midwest Extracts suggests a strong competitive edge and potential for continued growth, making it a brand to watch closely in this dynamic market.

Notable Products

In August 2024, the top-performing product from Midwest Extracts was Apple Gummies 10-Pack (200mg), which returned to the number one spot after being ranked second in July 2024. Mango Gummies 8-Pack (200mg) emerged as the second best-seller with notable sales of 3,853 units. Pineapple Gummies 8-Pack (200mg) climbed to third place from fourth in July 2024, showing a significant increase in sales. Strawberry Gummies 8-Pack (200mg) dropped one rank to fourth, despite maintaining strong sales figures. Watermelon Gummies 8-Pack (200mg) entered the top five for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.