Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

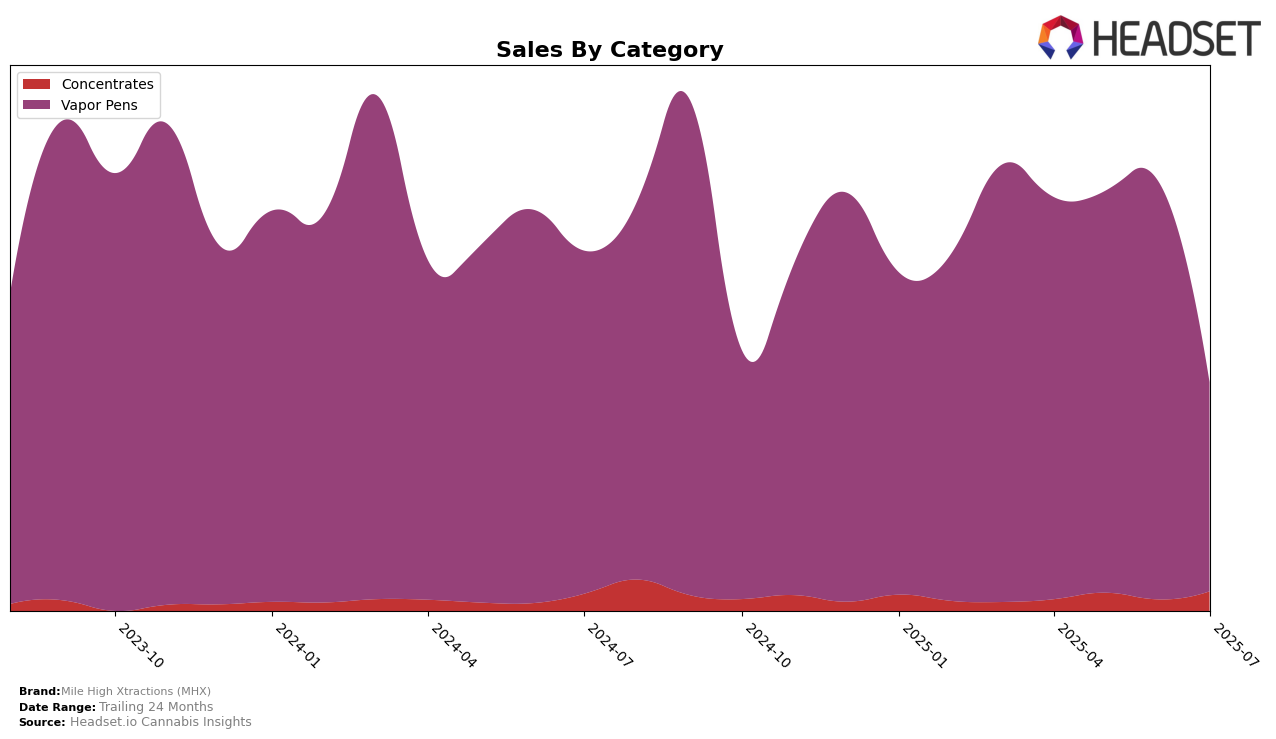

Mile High Xtractions (MHX) has shown varying performance across different product categories in Colorado. In the Concentrates category, MHX has consistently hovered around the 50th rank, with a slight improvement from 58th in April 2025 to 49th by July 2025. This indicates a steady, albeit slow, upward trend in their market presence within this category. However, the sales figures in this segment have fluctuated, with a notable increase in July, suggesting a potential seasonal demand or effective promotional strategies. The brand's absence from the top 30 highlights a competitive landscape, where further strategic efforts might be needed to climb higher in the rankings.

In contrast, MHX's performance in the Vapor Pens category has been relatively stable, maintaining the 23rd position from April through June before slipping to 30th in July. This drop in ranking could be attributed to a significant decrease in sales from June to July, indicating potential challenges such as increased competition or shifts in consumer preferences. Despite this downturn, MHX's consistent presence in the top 30 suggests a solid foothold in the Vapor Pens market within Colorado. Such insights indicate that while MHX has a strong presence in certain categories, there is room for growth and improvement, particularly in the Concentrates market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Colorado, Mile High Xtractions (MHX) has experienced a notable shift in its market position from April to July 2025. Initially maintaining a steady rank of 23rd from April to June, MHX saw a decline to 30th in July. This drop in rank coincides with a significant decrease in sales, from a peak in June to a notable low in July. In contrast, Next1 Labs LLC consistently performed better, maintaining a rank in the high 20s and experiencing a sales peak in June. Meanwhile, Oil improved its rank from 41st in April to 28th in July, with sales peaking in May. Kush Masters (Kush Master LLC) and Revel (CO) also showed upward trends in rank and sales, with Kush Masters climbing from 54th in April to 31st in July. These shifts indicate a competitive and dynamic market where MHX faces challenges in maintaining its earlier position, highlighting the need for strategic adjustments to regain its competitive edge.

Notable Products

In July 2025, the top-performing product for Mile High Xtractions (MHX) was the Blackberry Kush Distillate Cartridge (1g) from the Vapor Pens category, maintaining its leading position from May with sales of 908 units. The Chemmy Jones Distillate Disposable (1g) also performed well, holding steady at the second rank, although its sales decreased from June's figures. Sour Diesel Distillate Cartridge (1g) saw a significant climb, securing the third spot after not being ranked in June. Blue Dream Distillate Cartridge (1g) moved up to fourth place from its fifth position in May, despite a drop in sales. Notably, the Banana Ice Distillate Syringe (1g) entered the rankings for the first time in July, capturing the fifth position in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.