Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

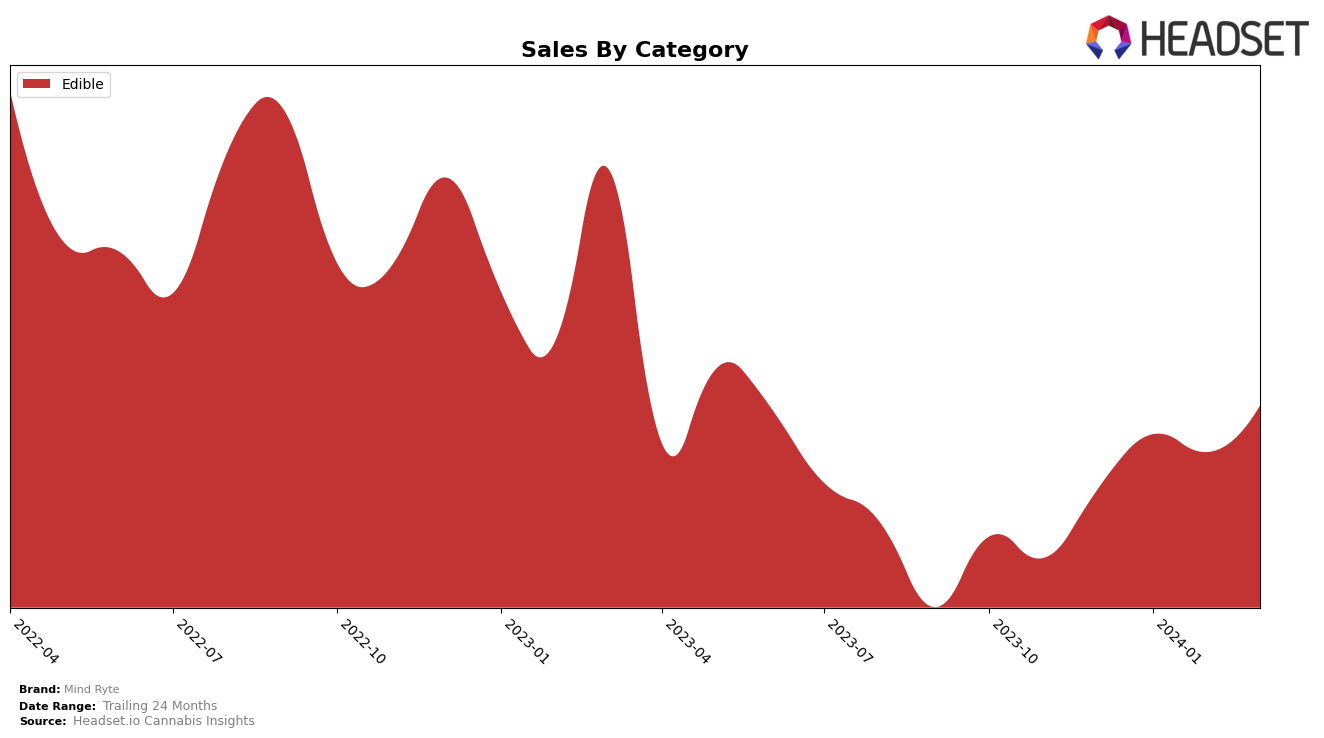

In the Arizona market, Mind Ryte has shown a fluctuating yet promising performance within the Edible category. Starting off at a rank of 32 in December 2023, the brand made a notable ascent to the 26th position by January 2024, indicating a strong start to the year. Although there was a slight dip to the 29th rank in February, Mind Ryte managed to climb back up to the 27th position by March 2024. This resilience in rankings, despite the small setbacks, showcases Mind Ryte's potential to carve out a significant niche in the Arizona edibles market. The increase in sales from $36,798 in December 2023 to $47,929 by March 2024 further underscores the growing consumer interest and market presence of Mind Ryte in Arizona.

However, the data also reveals some challenges faced by Mind Ryte, particularly in maintaining a consistent upward trajectory in the competitive edibles category. The fluctuation in rankings between December 2023 and March 2024, while showing overall progress, indicates a volatile market position that could impact the brand's visibility and consumer loyalty. The absence from the top 30 brands in any month would have been a significant concern, but Mind Ryte managed to stay within this competitive bracket throughout the observed period. This persistent presence in the top 30, despite the slight ups and downs, is a testament to the brand's resilience and the potential for further growth. The brand's ability to navigate the competitive landscape of Arizona's cannabis market will be crucial for its long-term success and expansion into other categories or states.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Mind Ryte has shown a notable trajectory in terms of rank and sales among its competitors. Starting from December 2023, Mind Ryte held the 32nd rank, improving its position to 26th in January 2024, and despite a slight dip to 29th in February, it climbed back to the 27th position by March 2024. This fluctuation in rank is mirrored in its sales performance, with a steady increase from December to March. Competing brands such as Sir Newton's and Sofa King Tasty have shown more significant rank improvements and sales increases, indicating a highly competitive market. However, Mind Ryte's consistent upward trend in sales, despite rank fluctuations, suggests a growing consumer base and resilience in a competitive market. Other competitors like Catri and Tipsy Turtle also show dynamic changes in both rank and sales, highlighting the competitive nature of the Arizona edible cannabis market and the importance of strategic positioning and marketing efforts for brands like Mind Ryte to continue their upward trajectory.

Notable Products

In March 2024, Mind Ryte saw Cherry Drops Hard Candy 10-Pack (100mg) as its top-selling product with sales reaching 576 units, marking a significant rise to first place from its third position in February. Following closely, Green Apple Drops Hard Candy 10-Pack (100mg) secured the second spot, up from fourth in February, showcasing the popularity of hard candy within the Edible category. Sour Strawberries Gummies (100mg), although not listed in previous months, made an impressive entrance to claim the third rank. Sour Worms Gummies 10-Pack (100mg), consistently popular, maintained its third position from February, indicating steady demand. Cherry Rings Gummy 10-Pack (100mg), despite being a previous leader, dropped to fourth, illustrating changing consumer preferences within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.