Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

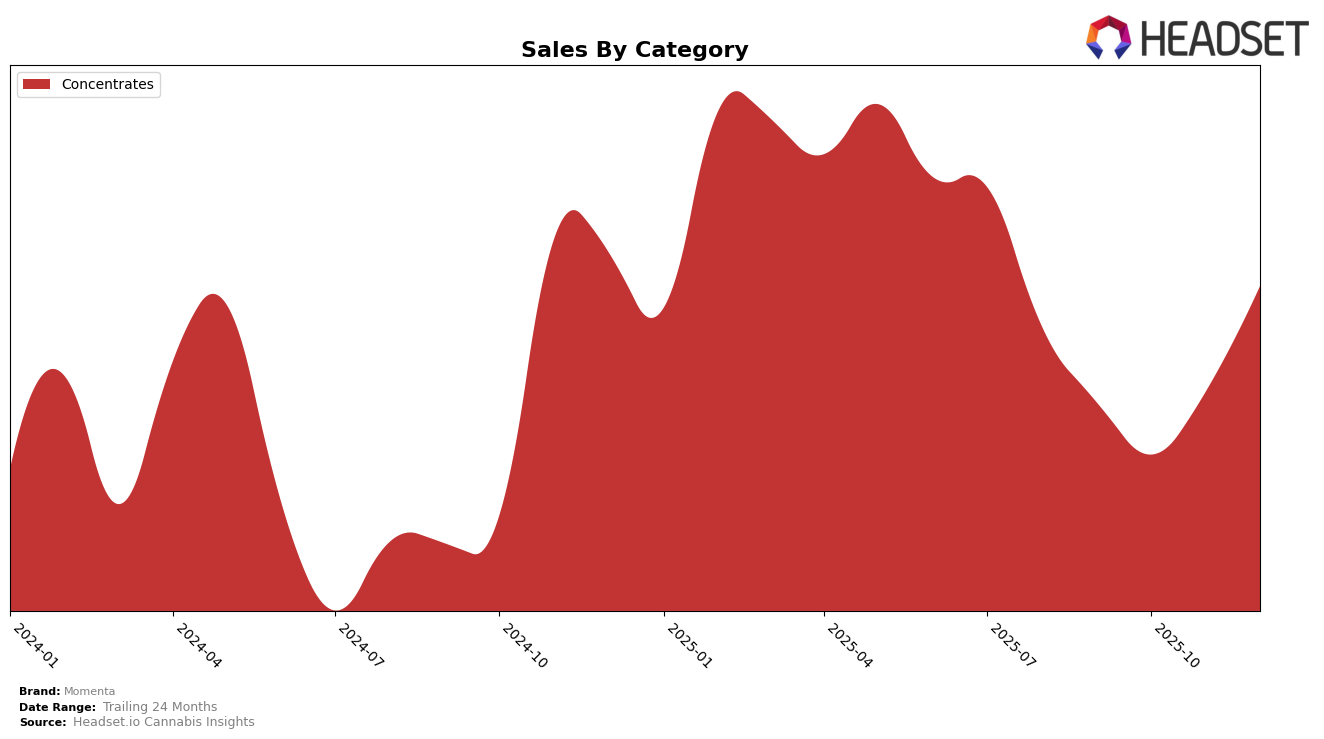

In the state of Maryland, Momenta has shown a noteworthy entry into the Concentrates category by securing the 29th rank in December 2025. This is significant given that the brand was not in the top 30 in the preceding months of September, October, and November of the same year. This upward movement into the rankings suggests a positive trend and potential growth in market presence within the concentrates category. While specific sales figures for the earlier months are not available, the December sales figure indicates a promising foothold that could be leveraged for further market penetration in Maryland.

Momenta's absence from the top 30 rankings in the months leading up to December could initially be seen as a challenge; however, their entry into the rankings in December highlights a potential strategic shift or successful marketing efforts in the Concentrates category. This development could be indicative of a broader trend or a targeted effort to enhance their standing in specific markets. Observing these movements and the factors contributing to their December success could offer valuable insights into Momenta's market strategies and future potential in the Maryland cannabis industry.

Competitive Landscape

In the Maryland concentrates market, Momenta has recently emerged in the rankings, securing the 29th position in December 2025. This marks its first appearance in the top 30, indicating a potential upward trajectory in market presence. In contrast, Avexia has experienced a decline, dropping from 19th in October to 27th in December, suggesting a possible opening for Momenta to capture market share. Meanwhile, Belushi's Farm has maintained a stable presence, hovering around the 26th to 28th ranks, which could pose a consistent competitive pressure for Momenta. The absence of Amber from the rankings after September further highlights the dynamic shifts in this category, providing Momenta with opportunities to capitalize on the evolving market landscape.

Notable Products

In December 2025, the top-performing product for Momenta was Soul Safari RSO Syringe (1g) in the Concentrates category, maintaining its number one rank from November with a notable sales figure of 140 units. Pure Cake Breath x Animal Cookies RSO Syringe (1g) climbed to the second position, showing a significant improvement from its absence in the November rankings. MAC V2 RSO Syringe (1g) held steady in third place, while Romance Runtz RSO Syringe (1g) remained consistent at fourth. Sour Gremlin RSO Syringe (1g), previously ranked first in September and October, dropped to fifth place by December. Overall, the rankings reflect a dynamic shift in consumer preferences within the Concentrates category over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.