Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

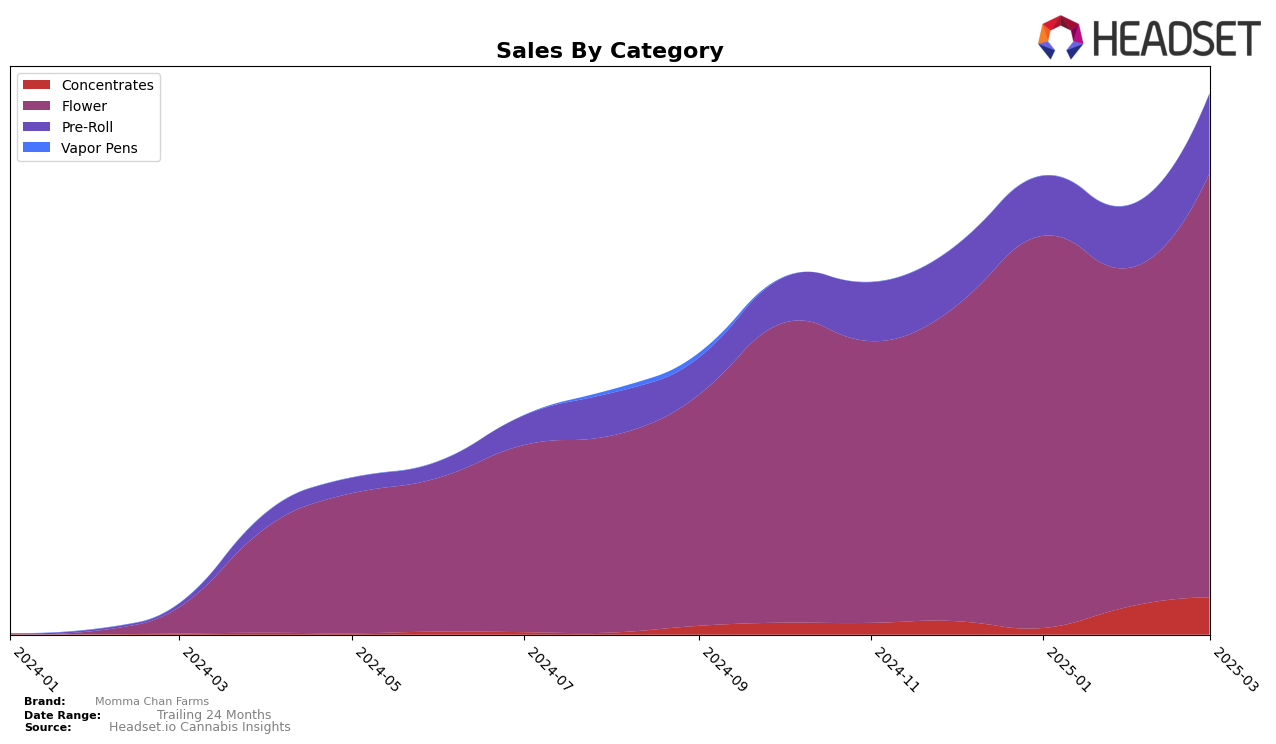

Momma Chan Farms has shown a varied performance across different product categories in Washington. In the Flower category, the brand has demonstrated a strong presence, initially ranking 30th in December 2024 and improving to 19th by March 2025. This upward trend is indicative of their growing popularity and market penetration, as evidenced by a consistent increase in sales over these months. However, in the Concentrates category, Momma Chan Farms did not make it into the top 30 rankings, highlighting a potential area for growth or reevaluation of strategy. This absence from the top tier could suggest either a lack of focus on this category or stiff competition within the Washington market.

In the Pre-Roll category, Momma Chan Farms has been making steady progress, moving from 86th place in December 2024 to 58th place by March 2025. This improvement suggests a positive reception and increasing consumer interest in their pre-roll offerings, although there remains significant room for growth to break into the top 30. The brand's strategic efforts in this category are beginning to bear fruit, as evidenced by the upward movement in rankings and sales. This performance across categories and the overall market in Washington provides a snapshot of areas where Momma Chan Farms is thriving and where it might need to bolster its efforts to capture a larger market share.

Competitive Landscape

In the competitive landscape of the Washington state flower category, Momma Chan Farms has shown a notable upward trajectory in its market position from December 2024 to March 2025. Starting from a rank of 30 in December, Momma Chan Farms improved significantly to reach rank 19 by March, indicating a strategic gain in market presence. This ascent is particularly impressive when juxtaposed with competitors like Smokey Point Productions (SPP), which fell from rank 14 to 21, and Agro Couture, which also saw a decline from rank 12 to 20 over the same period. Meanwhile, Mama J's experienced fluctuations, ultimately dropping from rank 13 to 18, and Mini Budz showed a slight improvement from rank 20 to 17. This competitive shift suggests that Momma Chan Farms is effectively capturing market share, likely due to strategic marketing or product differentiation efforts, as evidenced by its rise in rank and sales, while some competitors are experiencing a downward trend.

Notable Products

In March 2025, Popsicles Pre-Roll 2-Pack (1g) emerged as the top-performing product for Momma Chan Farms, climbing from a rank of 3 in February to secure the number 1 spot, with a notable sales figure of 3032 units. Hallie Berry Pre-Roll 2-Pack (1g), which was previously ranked 1 in February, dropped to the second position. Crazy 88 Pre-Roll 2-Pack (1g) maintained a strong presence, although it fell from second to third place despite a sales increase to 2472 units. Crazy 88 (4g) held steady at rank 4, showing consistent performance over the months. Finally, Popsicles (4g) improved its standing, rising back to fifth place after being unranked in February, demonstrating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.