Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

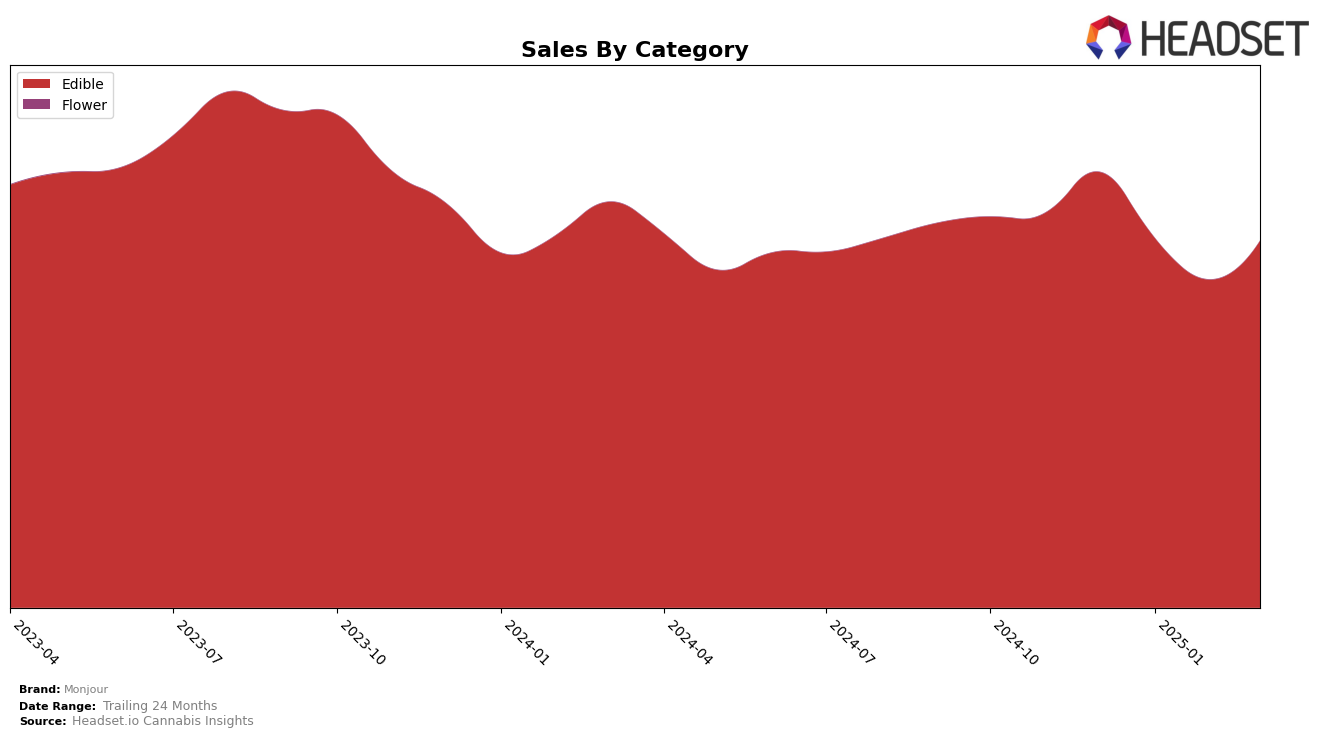

Monjour has demonstrated consistent performance in the Edible category across several Canadian provinces. In Alberta, the brand maintained a steady 5th place ranking from December 2024 through March 2025, despite experiencing a decline in sales in early 2025 before rebounding in March. Similarly, in British Columbia, Monjour consistently held the 6th position during the same period, with a slight fluctuation in sales figures that suggest a recovery in March. In Ontario, the brand slipped from 5th to 6th place between January and February 2025, indicating a competitive market environment, yet it stabilized its ranking by March.

In Saskatchewan, Monjour showed some variability in its rankings, moving from 6th in December 2024 to 7th in January 2025, then climbing back to 5th by March. This suggests that while the brand faces challenges, it also has the potential to ascend in rankings with strategic adjustments. Notably, Monjour's absence from the top 30 brands in any province or category would be a concern, but this is not the case here, as the brand consistently appears in the top rankings across all mentioned provinces. This stable presence across multiple markets underscores Monjour's strong positioning in the Edible category, although the nuances of its performance dynamics may warrant further exploration.

Competitive Landscape

In the Ontario edible cannabis market, Monjour has experienced a slight decline in its competitive position over the first quarter of 2025. Initially ranked 5th in December 2024 and January 2025, Monjour slipped to 6th place by February and maintained this rank through March. This shift is primarily due to the performance of No Future, which improved its ranking from 6th to 5th in February, surpassing Monjour. Despite this, Monjour's sales figures remain relatively robust compared to other competitors like Foray and Chowie Wowie, which consistently held 7th and 8th ranks, respectively, with lower sales figures. However, Monjour faces significant competition from Shred, which has maintained a strong 3rd place position with significantly higher sales. The ongoing competition suggests that Monjour needs to strategize effectively to regain its lost rank and enhance its market share in the coming months.

Notable Products

In March 2025, Monjour's top-performing product was the CBN:CBD:THC 8:3:1 Bedtime Blueberry Lemon Gummies 4-Pack, maintaining its leading position with sales reaching 51,231 units. The CBD Berry Good Day Gummy 30-Pack rose to second place, showing an improvement from its consistent third-place ranking in previous months. The CBD/CBN/CBG 20:5:5 Twilight Tranquility Sugar-Free Gummies 25-Pack slipped to third place, marking a slight decline from its prior second-place standing. The CBD Orchard Medley Gummies 30-Pack held steady in fourth position, while the CBD Me Time Mango Gummies 30-Pack maintained its fifth-place ranking since its introduction in February. Overall, the rankings reflect a stable performance from Monjour's edible products, with minor shifts in the middle tier.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.