Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

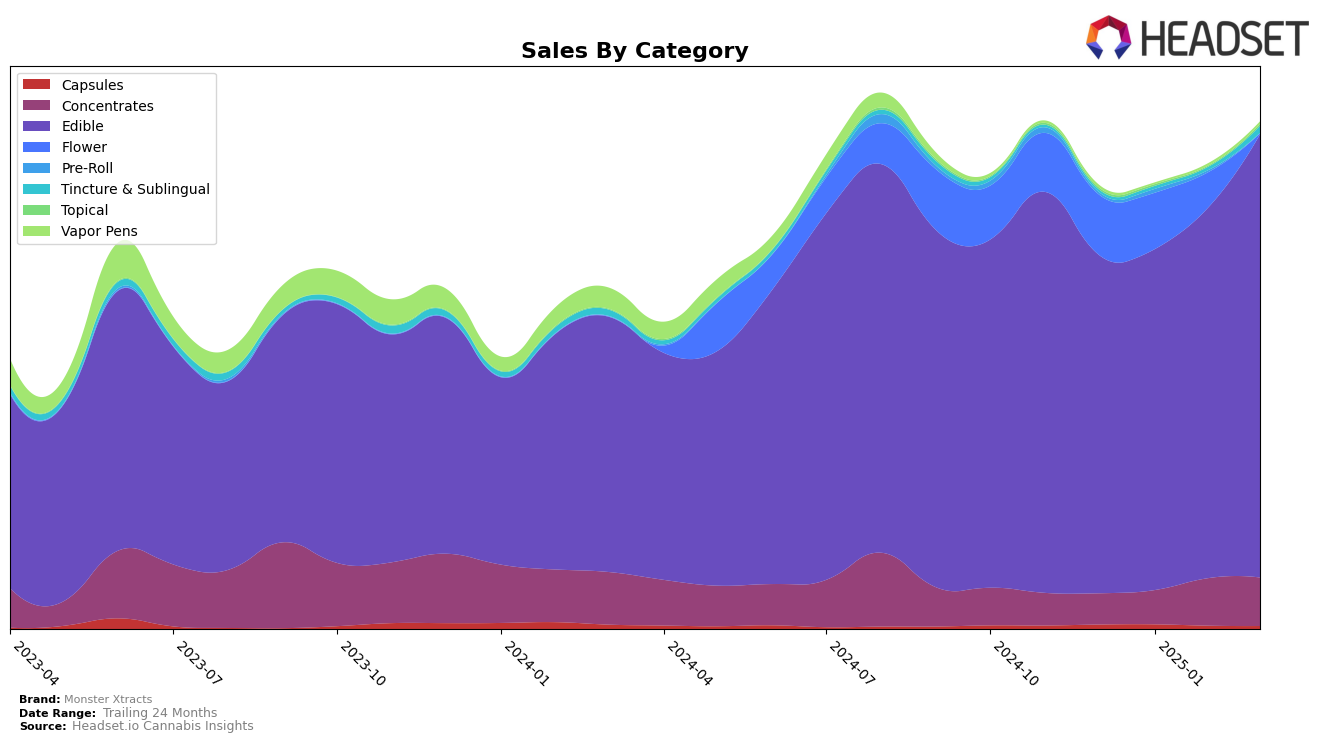

Monster Xtracts has demonstrated notable performance across various categories in Michigan. In the concentrates category, the brand has shown a steady improvement, climbing from a rank of 54 in December 2024 to 37 in February 2025, before slightly dropping to 43 in March 2025. Despite not breaking into the top 30, the upward movement in early 2025 signifies a positive trend, supported by a significant increase in sales from January to February. This indicates a growing acceptance and demand for their concentrate products, even if not yet achieving top-tier status.

In contrast, Monster Xtracts has been performing exceptionally well in the edibles category within Michigan. Maintaining a strong presence, the brand held steady at rank 7 for the months of December 2024 and January 2025, before advancing to rank 5 in February and further to rank 4 in March 2025. This consistent rise in rankings, paired with a substantial increase in sales, reflects a robust demand and consumer preference for their edible products. The brand's ability to climb within the top 5 highlights its competitive edge and potential for further growth in this category.

Competitive Landscape

In the competitive landscape of Michigan's edible cannabis market, Monster Xtracts has shown a notable upward trajectory in rank and sales over the first quarter of 2025. Starting in December 2024 at rank 7, Monster Xtracts climbed to rank 4 by March 2025, indicating a significant improvement in market position. This upward movement contrasts with the stable ranks of competitors like Choice, which maintained a consistent second place, and MKX Oil Company, which held steady at third. Meanwhile, Wana and Camino experienced more static positions, with Wana remaining around the 5th and 6th spots and Camino fluctuating slightly between 4th and 5th. Monster Xtracts' sales growth, particularly in March 2025, where sales surpassed the million-dollar mark, underscores its increasing consumer appeal and competitive edge in the market.

Notable Products

In March 2025, Monster Xtracts' top-performing product was Monster Medibles - Raspberry Lemonade Gummies 10-Pack (200mg), which climbed to the number one spot after being ranked second in February. The Blue Raspberry Gummies 10-Pack maintained a strong performance, holding steady at the second position, with sales reaching 19,019 units. The Hybrid Cherry Bomb Single Blaster Naut Gummy, previously ranked first for three consecutive months, slipped to third place. The Tropical Thunder High Dose Gummies 10-Pack saw a resurgence, moving up to fourth from an unranked position in February. The Sativa Amped Green Apple Single Blaster Naut Gummy remained consistently in the top five, securing the fifth position after slight fluctuations in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.