Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

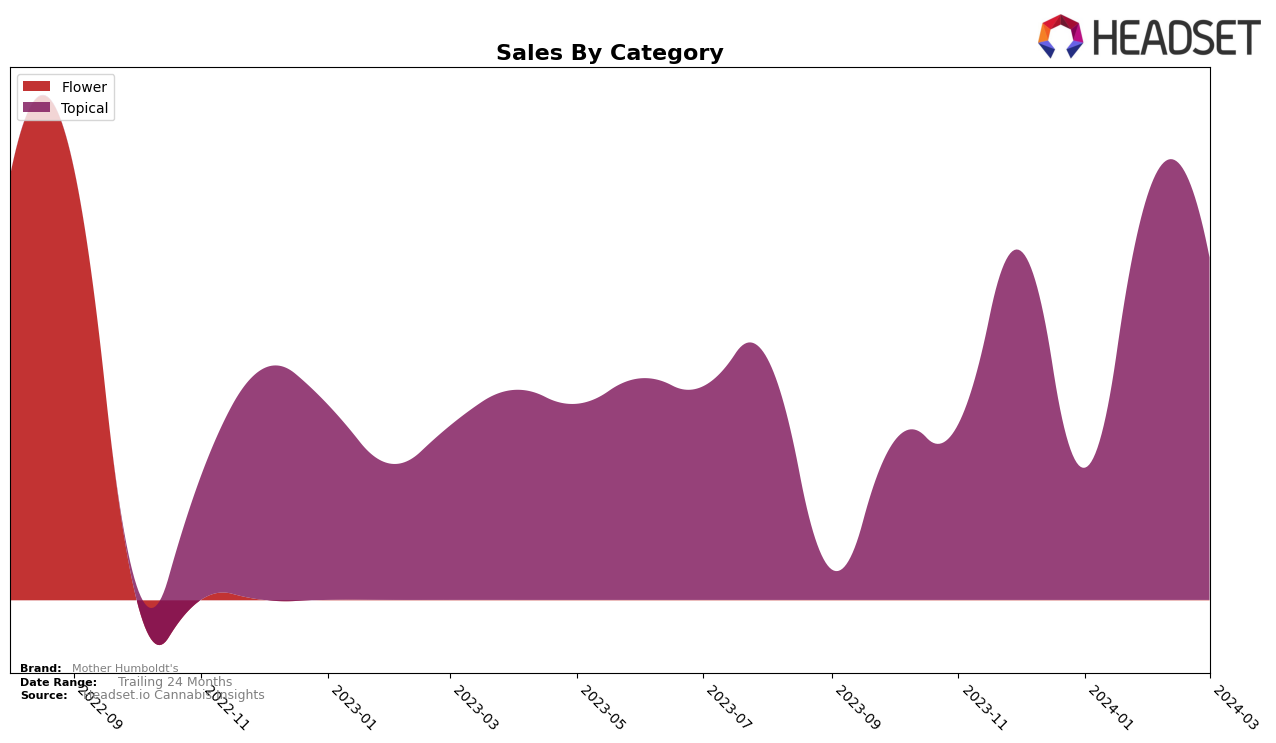

In the competitive cannabis market of California, Mother Humboldt's has shown a consistent performance within the Topical category, managing to stay within the top 30 brands over a four-month period. The brand's ranking slightly fluctuated, starting at 19th in December 2023, dipping to 21st in January and February 2024, before slightly recovering to 20th in March 2024. This indicates a stable presence in the market, although the slight drop in ranking suggests there may be room for improvement or increased competition. Notably, February 2024 saw a significant increase in sales compared to January, suggesting a positive consumer response or effective marketing strategies during this period.

Despite facing the challenges of a fluctuating market, Mother Humboldt's has demonstrated resilience by maintaining its position among the top brands in the Topical category. The sales data for December 2023, starting at 4087 units and seeing a dip in January before rising again in February and slightly decreasing in March, reflects a dynamic consumer demand pattern. This performance highlights the brand's ability to navigate the complexities of the California cannabis market. However, the consistent but not top-tier ranking suggests that while Mother Humboldt's has a solid foothold, there is potential for growth and the opportunity to capture a larger market share with strategic adjustments.

Competitive Landscape

In the competitive landscape of the topical cannabis category in California, Mother Humboldt's has experienced notable fluctuations in its market position. Initially ranked 19th in December 2023, it saw a slight decline to 21st in January 2024 before stabilizing at 20th in March 2024. This shift in rank is reflective of its sales performance, which, after a dip in January, rebounded significantly in February and maintained a strong position in March. Competitors such as Quim, with a more pronounced drop from 15th to 19th, and Cannariginals Emu 420, maintaining a steady 18th rank, highlight the dynamic nature of the market. Notably, Dr. Raw Organics and Jade Nectar have shown significant sales growth but remain below Mother Humboldt's in the rankings. This competitive analysis underscores the importance of monitoring both rank and sales trends to understand Mother Humboldt's position and performance relative to its competitors in the California topical cannabis market.

Notable Products

In March 2024, Mother Humboldt's top-selling product was Topical Balm (37mg CBD, 54mg THC, 2oz) within the Topical category, reclaiming its position as the number one product with 110 sales. Following closely was Topical Balm (60mg CBD, 245mg THC, 4oz), also in the Topical category, securing the second rank with a notable shift from its previous top position in February. The sales figures highlight a competitive edge between these two products, with the former product witnessing a significant rebound in sales to secure the top spot. This shift in rankings from February to March indicates a dynamic consumer preference within Mother Humboldt's product range. The consistent performance of these products over the months underscores their popularity and pivotal role in Mother Humboldt's sales strategy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.