Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

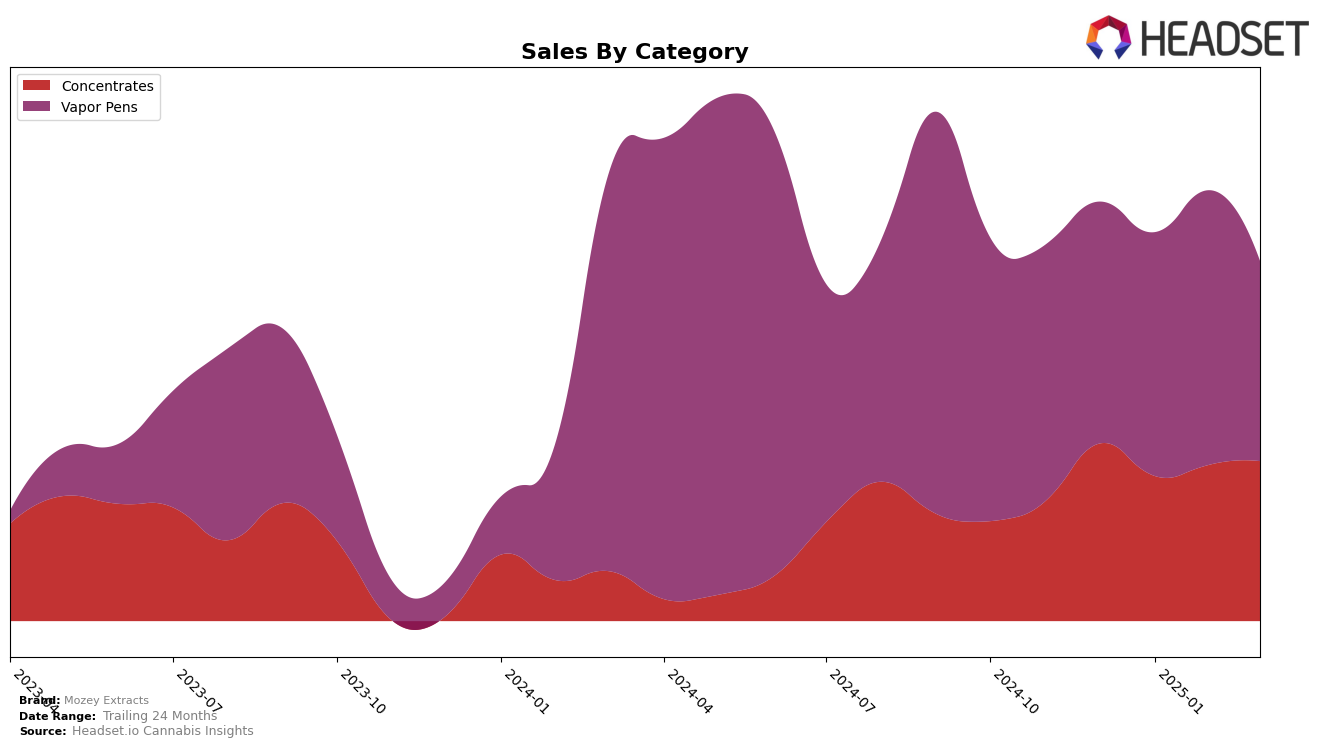

In the state of Arizona, Mozey Extracts has shown a promising upward trend in the Concentrates category. Starting at the 25th position in December 2024, the brand improved its standing to 21st by March 2025, marking a notable rise in rank. This positive movement is accompanied by a significant increase in sales, from $49,510 in February to $74,847 in March. Meanwhile, in Illinois, Mozey Extracts maintained a consistent presence in the top 10 for Concentrates, holding steady at the 9th position from January through March 2025. However, their performance in the Vapor Pens category in Illinois tells a different story, where they slipped out of the top 30 in February and only slightly improved to 32nd by March.

In Michigan, Mozey Extracts has experienced fluctuating fortunes across its product categories. In the Concentrates category, the brand has not managed to crack the top 30, with ranks hovering around the 50s, which might indicate room for growth or a need for strategic adjustments. The Vapor Pens category, however, saw a significant spike in sales in February 2025, reaching $440,773, which was followed by a drop in March. This volatility suggests that while there is potential for strong performance, consistency remains a challenge for Mozey Extracts in this market.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Mozey Extracts has experienced a fluctuating rank over the past few months, indicating a dynamic market presence. While Mozey Extracts held a rank of 30th in December 2024, it slightly improved to 29th in January 2025, before dropping to 33rd in February, and then recovering to 32nd in March. This fluctuation suggests that Mozey Extracts is facing stiff competition from brands like Breeze Canna, which maintained a higher rank for most of the period, and Cheetah, which ended March with a slightly better rank of 30th. Notably, Tales & Travels showed a significant upward trend, moving from 59th in December to 35th by March, potentially posing a growing threat. Despite these challenges, Mozey Extracts' sales figures indicate resilience, with a notable recovery in March, suggesting strategic adjustments that could stabilize or improve its market position in the coming months.

Notable Products

In March 2025, Blockberry Live Resin (1g) emerged as the top-performing product for Mozey Extracts, achieving the number one rank in sales. Citrus Bliss Distillate Cartridge (1g) followed closely in the second position, marking its entry into the top ranks. Peach Perfect Distillate Cartridge (1g), which held the top spot in February, slipped to third place, with notable sales of 3,655 units. Dante's Inferno Live Resin (1g) secured the fourth rank, consistently maintaining its presence among the top products. Orange Cookies Distillate Cartridge (1g) retained its fifth position from February, demonstrating steady performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.