Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

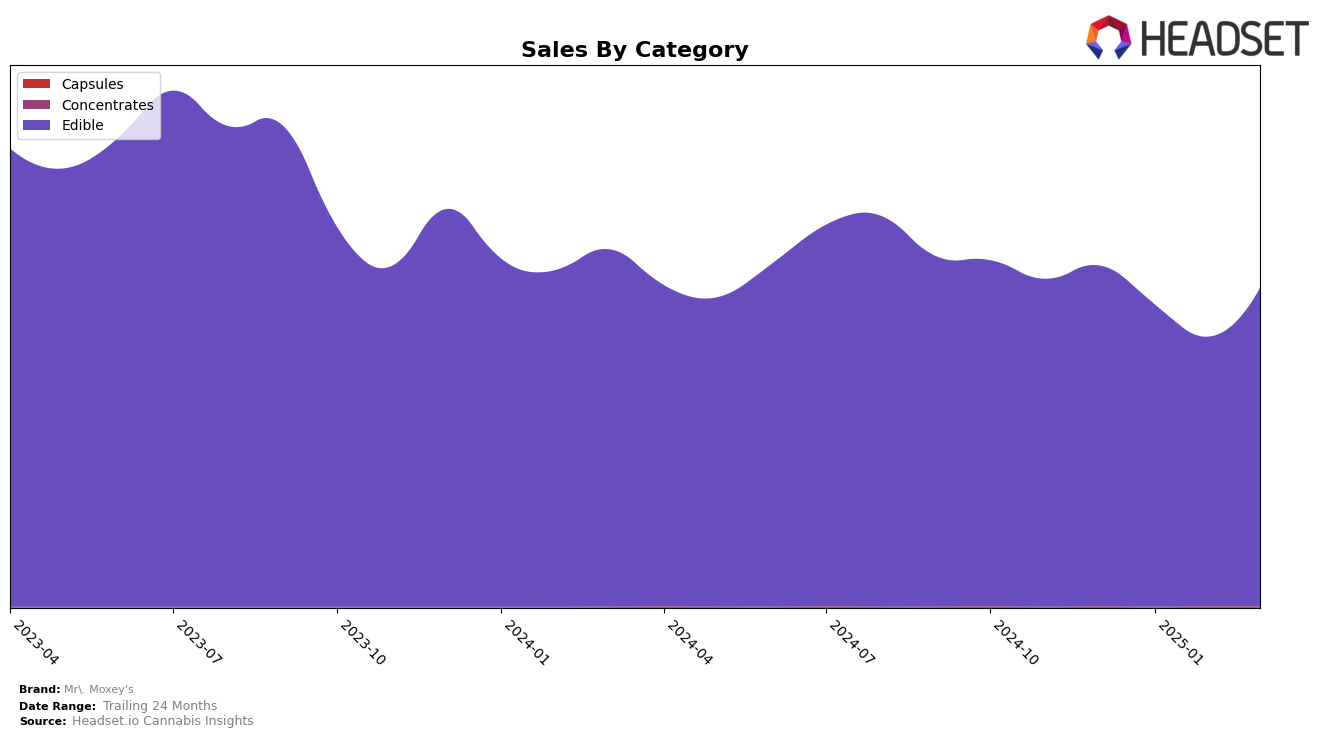

In the state of Colorado, Mr. Moxey's has shown a consistent presence in the edible category, maintaining its rank at 12th place from January to March 2025. This stability is noteworthy, especially considering the competitive nature of the cannabis market. The brand's sales figures in Colorado have demonstrated a positive trend, with a significant increase from February to March 2025. Meanwhile, in Washington, Mr. Moxey's has also held a steady rank of 12th, showing resilience and consistent consumer demand. However, sales in Washington have experienced some fluctuations, with a dip in February followed by a recovery in March 2025.

Contrastingly, in Oregon, Mr. Moxey's has remained at the 15th rank from January to March 2025, indicating a stable but slightly less competitive position compared to Colorado and Washington. The brand's sales in Oregon have seen a decline from December 2024 to February 2025, with a slight rebound in March. In Massachusetts, Mr. Moxey's has not been able to break into the top 30 ranks, with its position slipping from 41st in December 2024 to 56th by March 2025. This downward trend in Massachusetts highlights a potential area for strategic improvement, as the brand's presence in this state is currently limited.

Competitive Landscape

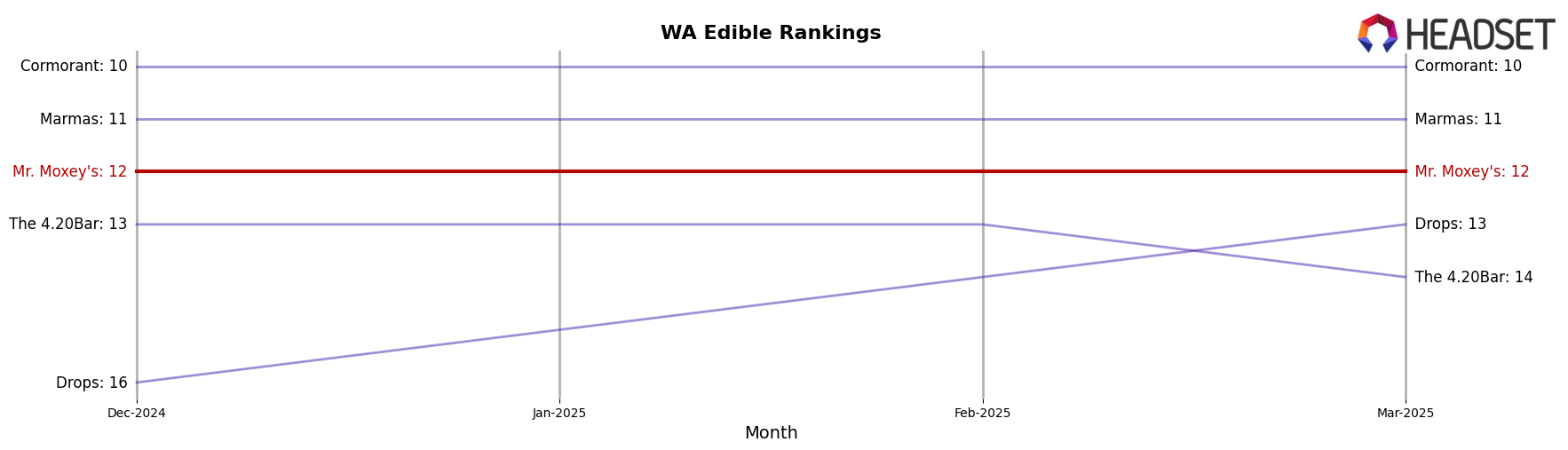

In the competitive landscape of the edible cannabis market in Washington, Mr. Moxey's has maintained a consistent rank of 12th from December 2024 through March 2025. This stability in rank is notable, especially when compared to competitors like The 4.20Bar, which experienced a slight decline from 13th to 14th place over the same period. Meanwhile, Drops showed a positive trajectory, climbing from 16th to 13th place, potentially posing a future threat to Mr. Moxey's position. Despite these shifts, Mr. Moxey's sales figures demonstrate resilience, with a notable rebound in March 2025, suggesting effective strategies in customer retention or product appeal. However, the brand still trails behind Marmas and Cormorant, which consistently hold the 11th and 10th ranks, respectively, with higher sales figures, indicating areas for potential growth and competitive strategy adjustments for Mr. Moxey's.

Notable Products

In March 2025, Mr. Moxey's top-performing product was the Energizing Peppermint Mints 20-Pack (100mg), maintaining its number one rank consistently since December 2024, with sales reaching 4656 units. The CBG/CBD/THC 1:1:1 Relief Lemon Ginger Mints 20-Pack climbed to second place, improving from its third place ranking in previous months. The CBD/THC 1:1 Balance Peppermint Mints 20-Pack dropped to third place, despite a slight increase in sales compared to February 2025. The CBC/THC 1:1 Energize Peppermint Mints 20-Pack held steady in fourth place without any change in rank across the months. Notably, the Relax Cinnamon Mints 20-Pack entered the top five for the first time, securing the fifth spot in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.