Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

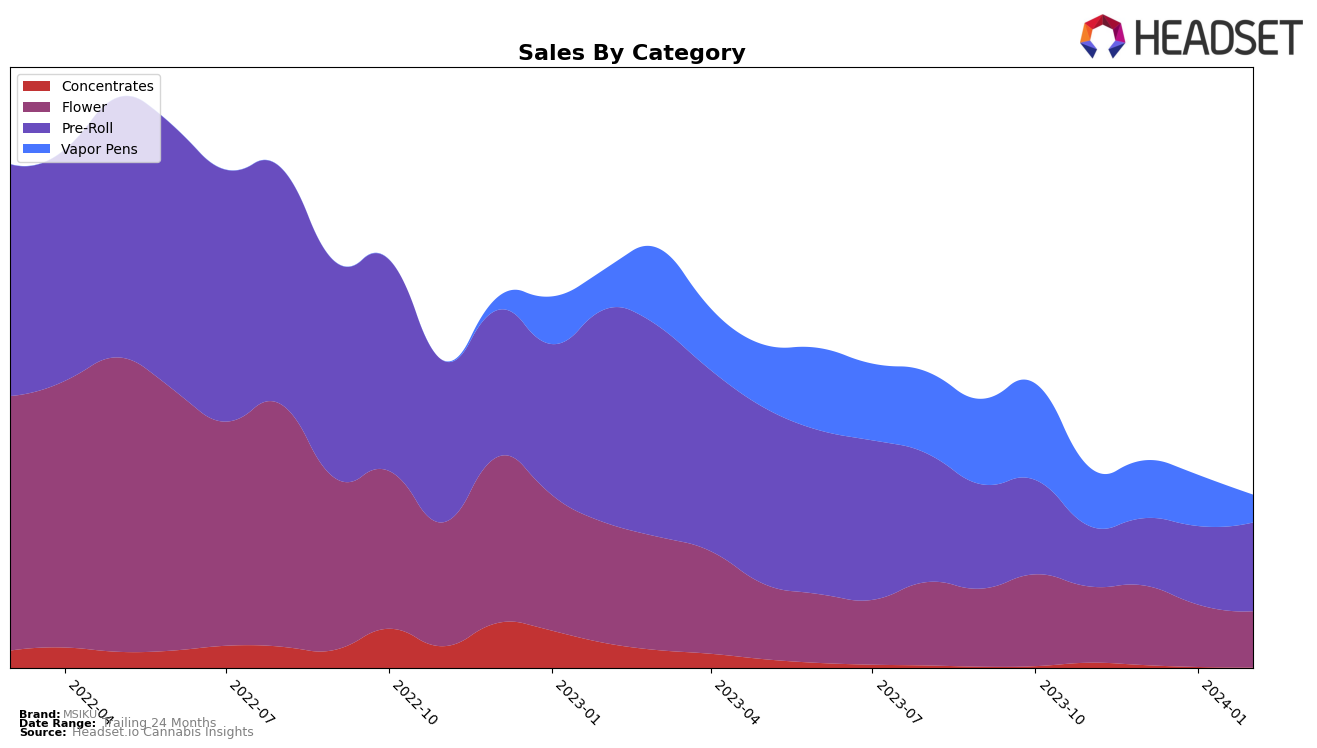

In the evolving landscape of the Canadian cannabis market, MSIKU has shown a varied performance across different provinces and categories. Notably, in Alberta, MSIKU's presence in the Vapor Pens category has experienced a downward trend, moving from rank 36 in November 2023 to rank 96 by February 2024, which signifies a significant drop in their market position. This movement is mirrored in their sales figures, plummeting from 71,926 in November 2023 to a mere 4,011 by February 2024, indicating a substantial decrease in consumer demand or possible distribution challenges. Conversely, in British Columbia, the brand has seen positive movement within the Pre-Roll category, climbing from rank 48 in November 2023 to rank 41 by February 2024, coupled with an increase in sales from 101,563 to 125,415 over the same period, showcasing a strong consumer preference and market penetration in this category.

Shifting focus to Ontario, MSIKU's performance presents a mixed bag with notable fluctuations. The brand's Concentrates category saw a gradual decline in rankings from 49 in November 2023 to 88 by February 2024, alongside a stark decrease in sales, suggesting challenges in maintaining market share against competitors. However, the Pre-Roll segment in Ontario tells a different story, with a significant improvement moving from not being in the top 30 in November 2023 to ranking 59 by February 2024, and a corresponding increase in sales, highlighting a successful recovery and growth strategy in this category. Meanwhile, in Saskatchewan, the Vapor Pens category stands out for MSIKU, with a consistent top 30 ranking over the observed period and an impressive sales increase, underscoring the brand's strong market presence and consumer loyalty in this segment.

Competitive Landscape

In the competitive landscape of the Flower category within Ontario, MSIKU has experienced fluctuations in its ranking over the recent months, moving from 66th in November 2023 to 72nd by February 2024. This trend indicates a struggle to maintain or improve its position in a highly competitive market. Notably, its competitors have shown varied performances; Ness has demonstrated a more stable ranking close to MSIKU, ending up slightly lower at 70th in February 2024, despite having higher sales figures in the preceding months. BZAM, another competitor, has also seen an improvement in February 2024, ranking just two places below MSIKU. Meanwhile, LowKey and Seeker have shown significant upward movements in rankings, with Seeker notably jumping from 93rd in November 2023 to 67th by February 2024, surpassing MSIKU. This dynamic shift among competitors, especially the significant rise of Seeker and the steady performance of Ness, suggests a challenging environment for MSIKU, which may need to reassess its strategies to regain or improve its market position amidst these changes.

Notable Products

In February 2024, MSIKU's top-performing product was the Star Struck Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from previous months with impressive sales of 8653 units. Following in second place was The Tenner Pre-Roll 10-Pack (5g), which saw a significant jump to the second rank in February from the fourth position in January. The Peach Chementine Pre-Roll 3-Pack (1.5g) secured the third spot in its debut month, showcasing strong market entry. Mills (7g) in the Flower category dropped to the fourth position in February from the third rank in January, indicating a slight shift in consumer preference. Lastly, Peggy's Pride Pre-Roll 3-Pack (1.5g) experienced a decline, moving from the second rank in previous months to the fifth in February, reflecting changing consumer trends within MSIKU's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.