Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

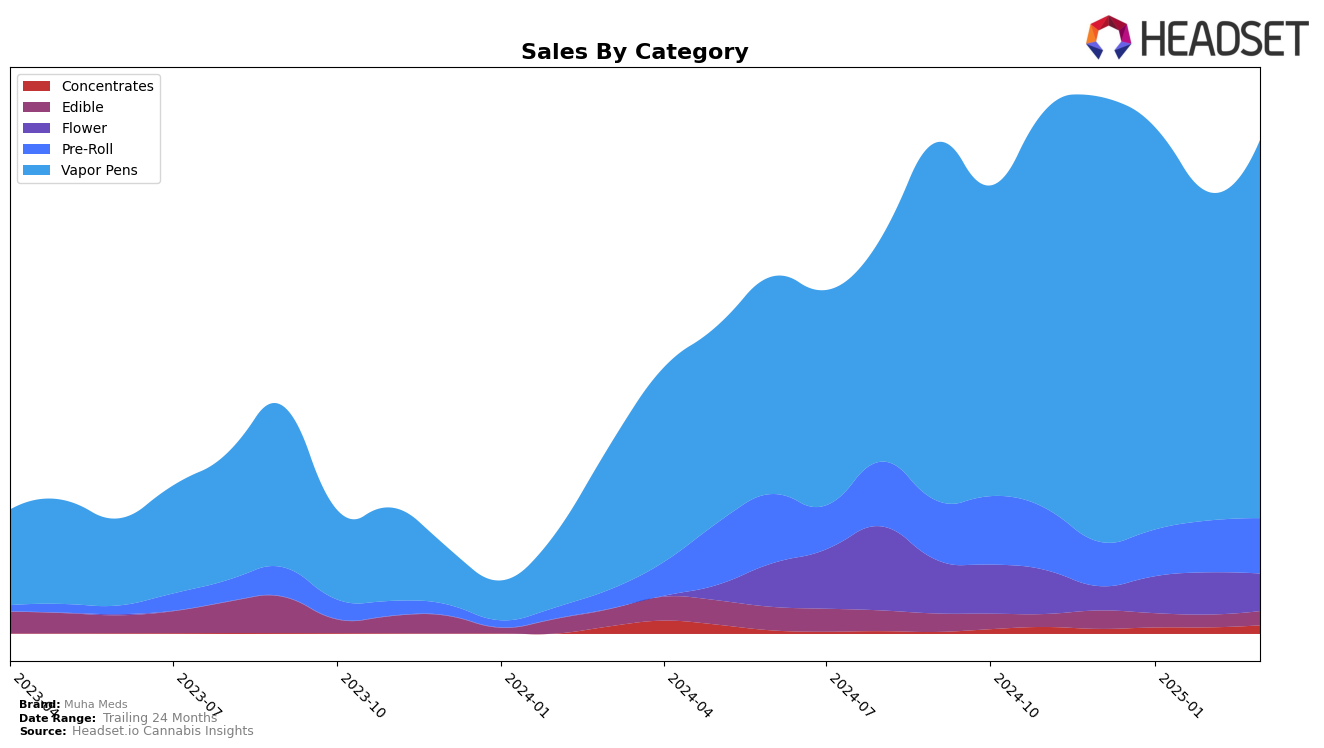

Muha Meds has shown varied performance across different states and product categories. In California, their presence in the Vapor Pens category has been relatively stable, maintaining a rank just outside the top 30, with some minor fluctuations from December 2024 to March 2025. Despite not breaking into the top 30, there is a positive trend in sales, with a noticeable increase in March 2025, suggesting a growing consumer interest in their vapor pens. This steady climb in sales could indicate a potential breakthrough into higher rankings if the trend continues.

In Michigan, Muha Meds has had a more dynamic performance. Their Vapor Pens have consistently held the impressive rank of 2nd place, demonstrating a strong foothold in this category despite some sales fluctuations. Meanwhile, the Pre-Roll category has seen them maintain a solid position within the top 15, with a slight improvement over the months. However, their Edible category performance has been less robust, consistently ranking outside the top 30. This discrepancy highlights the brand's stronger market presence in vapor-related products compared to edibles. Additionally, the Flower category saw a significant improvement in ranking from December to February, though it slightly declined in March, indicating a competitive landscape.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Muha Meds has maintained a consistent rank of 2nd place from December 2024 through March 2025. Despite this stable ranking, Muha Meds experienced a notable decline in sales, dropping from December's figures to a low in February before slightly recovering in March. This sales trend contrasts with the leading brand, Mitten Extracts, which held the top position throughout the same period, showcasing a sales dip in January and February but rebounding significantly by March. Meanwhile, MKX Oil Company consistently ranked 3rd, with relatively stable sales, and Breeze Canna fluctuated between 3rd and 5th place, reflecting more volatility in both rank and sales. These dynamics highlight the competitive pressure Muha Meds faces, particularly from Mitten Extracts, and suggest a need for strategic adjustments to regain sales momentum.

Notable Products

In March 2025, Muha Meds' top-performing product was the Strawberry Mimosa Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from February with impressive sales of 34,469 units. Following closely was the Moroccan Peaches Distillate Cartridge (1g), which climbed from third place in February to second in March. The Guava Mango Runtz Distillate Cartridge (1g) debuted in the rankings at third place, indicating a strong market entry. The Platinum Pineapple Distillate Cartridge (1g) experienced a slight drop from second to fourth place, while the Nightcap OG Distillate Cartridge (1g) held steady at fifth. These shifts suggest a competitive landscape within the Vapor Pens category, with new products making significant impacts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.