Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

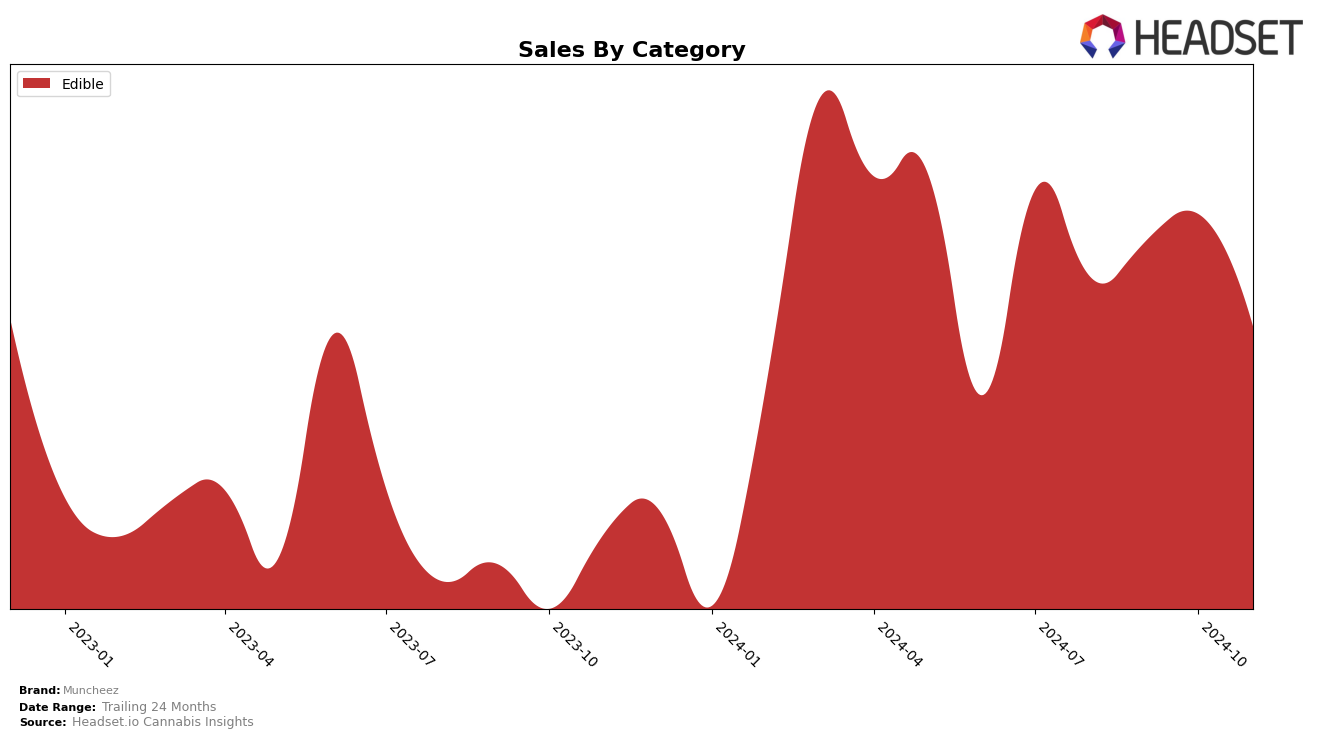

Muncheez has shown varying performance across different states and categories in recent months. In Colorado, the brand has maintained a presence in the Edible category, with rankings fluctuating slightly from August to November 2024. Starting at 24th place in August, Muncheez improved its position to 20th in October before slipping back to 22nd in November. This slight decline in November could be attributed to market saturation or increased competition within the state. Despite the fluctuation in rankings, it's noteworthy that Muncheez has consistently remained within the top 30 in the Edible category, indicating a stable consumer base and potential for growth in Colorado.

While Muncheez has maintained a steady presence in Colorado, the brand's absence in the top 30 rankings in other states and categories might raise concerns about its broader market reach. The lack of presence outside of Colorado could suggest either a strategic focus on specific regional markets or challenges in expanding its competitive edge to other areas. The sales trend in Colorado shows a peak in October, with sales reaching over $81,000, before a noticeable drop in November. This pattern might prompt Muncheez to reassess their strategies to stabilize sales and improve rankings in the coming months. Overall, while Muncheez has a foothold in the Colorado Edible market, there is room for growth and expansion into other states and categories.

Competitive Landscape

In the competitive landscape of the Edible category in Colorado, Muncheez has shown a fluctuating performance in recent months, with its rank moving from 24th in August 2024 to 22nd in November 2024. Despite this slight improvement, Muncheez faces stiff competition from brands like Coda Signature, which has consistently maintained a presence in the top 20, albeit with some volatility, and Nove Luxury Chocolate, which briefly dropped out of the top 20 in September but rebounded in October. Notably, Olio and Spinello Cannabis Co. have shown upward trends, with Olio climbing from 32nd to 24th and Spinello Cannabis Co. improving its rank from 30th to 23rd over the same period. These movements suggest a dynamic market where Muncheez must strategize to enhance its sales and maintain a competitive edge, particularly as it contends with brands that are either improving their sales or maintaining stronger positions in the rankings.

Notable Products

In November 2024, Fruity Krunch Cereal Bar (100mg) maintained its position as the top-performing product for Muncheez, achieving the highest sales figure of 959 units. Following closely, Cookies N Cream Cereal Bar (100mg) secured the second spot, consistent with its October ranking. Cookies Krunch Cereal Treats (100mg) climbed to the third position, marking a notable improvement from its fifth place in October. Cocoa Krunch Cereal Bar (100mg) re-entered the rankings at fourth place, having been unranked in October. Berries N Cream Cereal Bar (100mg) experienced a decline, dropping from fourth to fifth place, continuing its downward trend from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.