Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

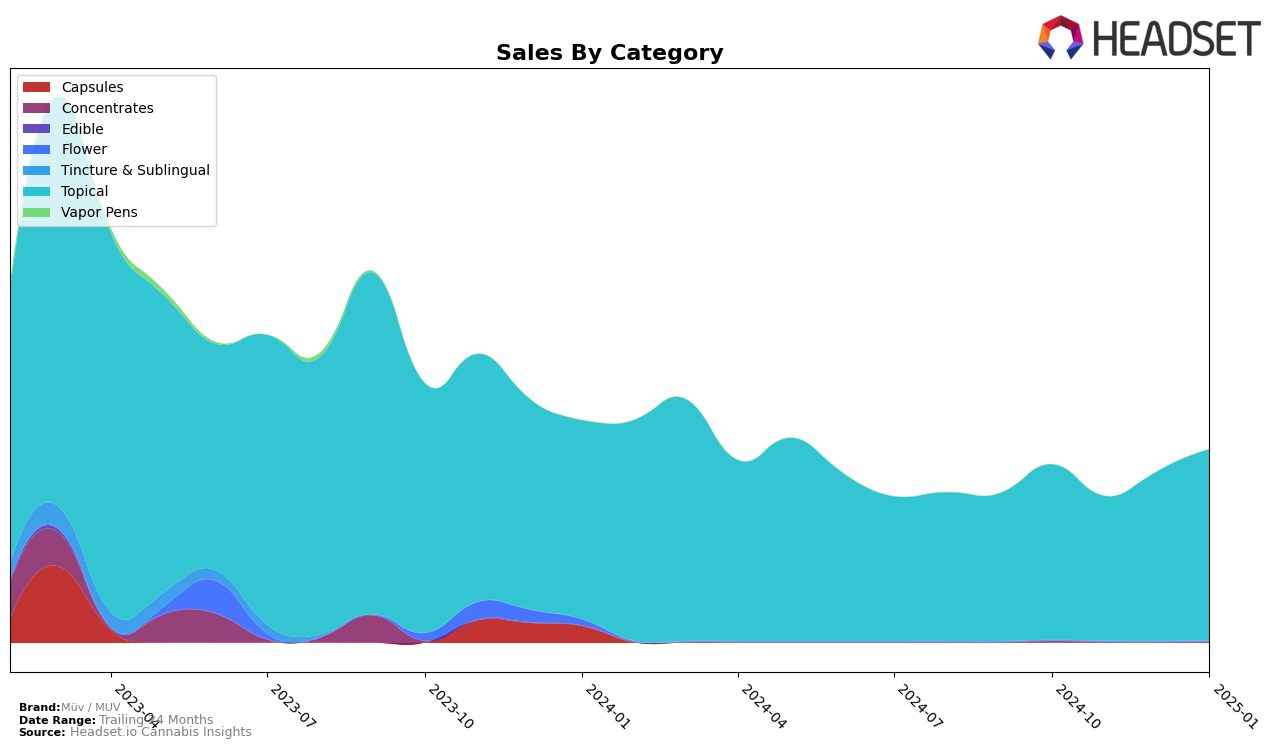

In the state of Arizona, Müv / MUV has shown consistent performance in the Topical category. The brand maintained a steady position, ranking 5th in October 2024, dropping slightly to 6th in both November and December, and then climbing back to 5th in January 2025. This indicates a resilient market presence despite fluctuations in sales, which increased from approximately $23,771 in November to $31,325 in January. The ability to regain a higher rank suggests effective brand strategies or possibly increased consumer interest in their topical products during the winter months.

While Müv / MUV has maintained a notable presence in Arizona's Topical category, the absence of rankings in other states or categories implies that the brand is either not competing in those markets or not breaking into the top 30, which could be seen as a missed opportunity for broader market penetration. This focused performance in Arizona suggests that Müv / MUV might be leveraging specific regional strategies or consumer preferences, but it also highlights potential areas for growth in other states or product categories. Exploring these dynamics could offer valuable insights into the brand's overall strategy and potential avenues for expansion.

Competitive Landscape

In the competitive landscape of the Arizona topical cannabis market, Müv / MUV has shown a consistent presence, maintaining a rank between 5th and 6th place from October 2024 to January 2025. Despite facing strong competition, Müv / MUV's sales have demonstrated resilience, particularly with a notable increase in January 2025, positioning them back to 5th place. This upward movement is significant given the competitive pressure from brands like iLava, which consistently held the top ranks, and Tru Infusion, which improved its rank to 3rd by January 2025. Meanwhile, Gramz has been a close competitor, often swapping ranks with Müv / MUV. The consistent ranking of DermaFreeze at 7th indicates a stable yet less competitive threat. Müv / MUV's ability to regain its 5th position suggests effective strategies in maintaining customer loyalty and adapting to market dynamics, crucial for future growth in this competitive sector.

Notable Products

In January 2025, the top-performing product for Müv / MUV was the Hybrid Gen2 THC Transdermal Patch (20mg), maintaining its position from December 2024 as the leading item with sales of 525 units. Following closely, the CBD/THC 1:1 Transdermal Patch Gen2 (10mg CBD, 10mg THC) moved up to the second position, although its sales dropped compared to the previous month. The CBD/THC 1:1 Soothing Sports Gel (100mg CBD, 100mg THC) remained steady in the third rank, showing a slight decrease in sales figures. Notably, the CBD/THC 1:1 Pain Relief Cream (200mg CBD, 200mg THC) emerged as a new entrant in the rankings, securing the fourth spot. The CBD/THC 1:1 Transdermal Patch (10mg CBD, 10mg THC) consistently held the fifth position, with a minor dip in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.