Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

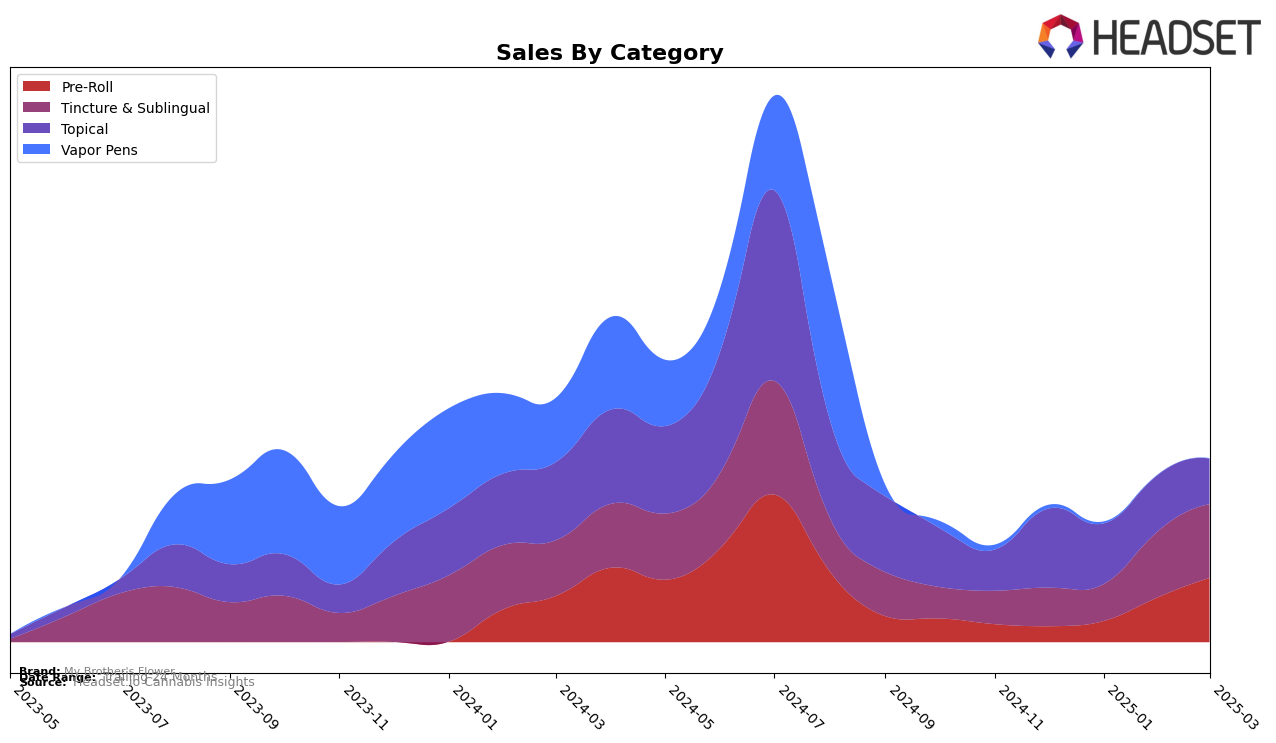

In the state of Colorado, My Brother's Flower has shown varied performance across different product categories. The Pre-Roll category, in particular, has seen a notable upward trend, moving from outside the top 30 in December 2024 to ranking 48th by March 2025. This improvement indicates a growing presence in the market, although there is room for further growth to break into the top tier. Conversely, the Tincture & Sublingual category has consistently performed well, maintaining a strong position by ranking 2nd in both February and March 2025. This stability suggests a solid consumer base and effective market penetration in this category.

On the other hand, the Topical category has experienced a slight decline, with My Brother's Flower dropping from 6th place in December 2024 to 7th place by March 2025. While this movement is minor, it may suggest increased competition or changing consumer preferences in the Topical market segment. Despite this, the brand's overall sales trajectory in Colorado remains positive, particularly in the Tincture & Sublingual category, which has shown impressive sales figures. The brand's ability to maintain a stronghold in certain categories while improving in others highlights its adaptability and potential for continued growth within the state.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Colorado, My Brother's Flower has shown remarkable progress, particularly in the first quarter of 2025. Starting at rank 4 in December 2024, the brand climbed to rank 2 by February 2025, maintaining this position through March. This upward trajectory is significant, especially when compared to consistent market leader ioVia, which has held the top spot throughout this period. Notably, My Brother's Flower surpassed Escape Artists and Care Division, both of which experienced fluctuations in their rankings. Escape Artists dropped from rank 2 in January to rank 4 in February and March, while Care Division consistently held the third position. The sales growth for My Brother's Flower is also noteworthy, with a significant increase from January to March, suggesting a strengthening market presence and consumer preference shift towards their offerings.

Notable Products

In March 2025, the top-performing product for My Brother's Flower was Blueberry Kush Infused Pre-Roll (1.5g) in the Pre-Roll category, which climbed to the number one rank with impressive sales of 655 units. Dusk Infused Pre-Roll (1.5g) followed closely, securing the second position, a slight drop from its top rank in February. The CBD/CBN/THC 10:10:1 Dusk Tincture (1000mg CBD, 1000mg CBN, 100mg THC) consistently held the third rank from January through March. Pineapple Express Infused Pre-Roll (1.5g) made its debut in the rankings at fourth place, indicating a growing popularity. Raw Extra Strength Infused Pre-Roll (1.5g) experienced a decline, dropping to fifth place after previously ranking second in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.