Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

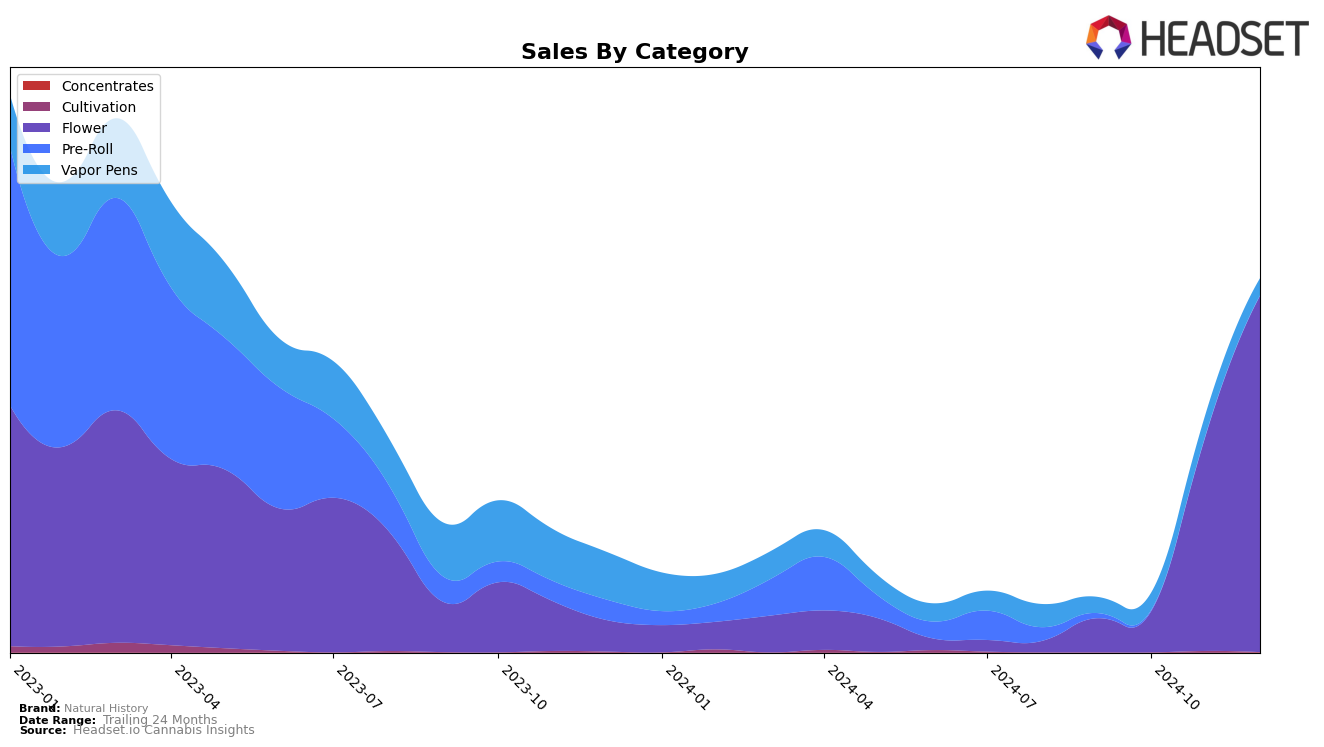

In the rapidly evolving cannabis market, Natural History has shown notable performance across different provinces in Canada. In Alberta, the brand experienced a significant upward trajectory in the Flower category. After not being in the top 30 rankings for September and October 2024, Natural History climbed to the 40th position in November and further improved to 26th by December. This movement indicates a strong growth trend, underpinned by a substantial increase in sales from November to December. The brand's ability to break into the top 30 suggests effective market strategies and growing consumer acceptance in Alberta's competitive landscape.

Conversely, in British Columbia, Natural History did not manage to secure a position in the top 30 rankings for the Flower category throughout the latter part of 2024. The brand's rank was 94th in September, and it did not appear in the top 30 in the following months, which could be seen as a challenge in maintaining a foothold in a market known for its diverse cannabis offerings. This disparity between Alberta and British Columbia may reflect regional preferences or differences in market penetration strategies. Understanding these dynamics could be crucial for Natural History as it seeks to enhance its presence and performance across Canadian provinces.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Natural History has shown a notable upward trajectory in recent months. After not ranking in the top 20 in September and October 2024, Natural History made a significant leap to rank 40th in November and further climbed to 26th in December. This upward movement suggests a positive trend in sales and market penetration. In contrast, QWEST experienced a decline, dropping from 14th in September to 24th by December, indicating a potential loss in market share. Meanwhile, Boaz maintained a steady position, consistently ranking 26th and 27th, suggesting stable performance without significant growth. Tribal and Versus also demonstrated relative stability, with minor fluctuations in their rankings. The dynamic shifts in rankings highlight Natural History's potential to capitalize on its recent momentum and continue its ascent in the competitive Alberta Flower market.

Notable Products

In December 2024, the top-performing product from Natural History was Limited Reserve (7g) in the Flower category, maintaining its first-place ranking from November with sales of 4773 units. The LA Kush Cake (3.5g), also in the Flower category, held steady at the second position, showing a slight decrease in sales from the previous months. Pineapple Express DNA Pax Era Pod (1g) in the Vapor Pens category climbed to the third position, marking a consistent rise from its fourth-place ranking in November. King Louie DNA Cartridge (1g) experienced a drop, moving from third in November to fourth in December. Girl Scout Cookies Cartridge (1g) maintained its fifth-place position, indicating stable performance in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.