Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

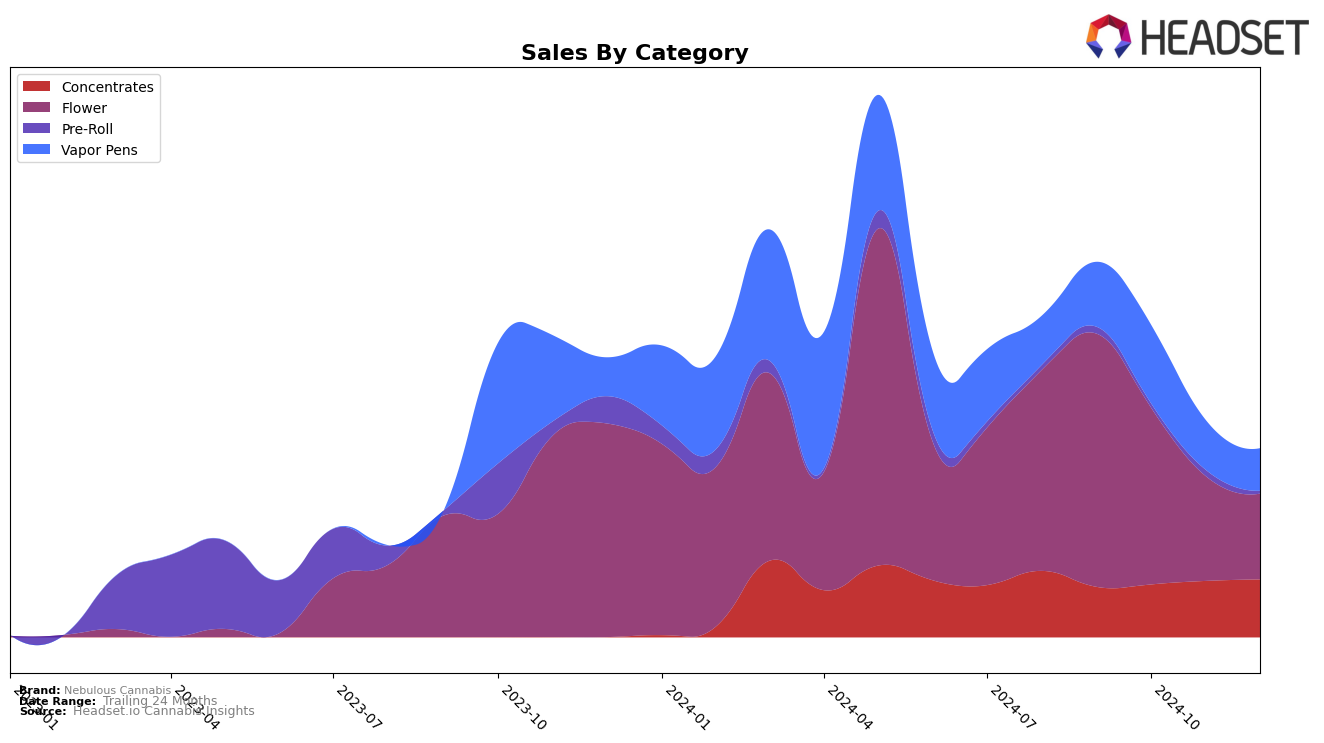

Nebulous Cannabis has shown notable performance in the Alberta market, particularly within the Concentrates category. Over the last quarter of 2024, the brand made a significant leap in rankings, moving from 31st place in September to 29th place by December. This upward trend is indicative of a positive reception and growing consumer preference for their concentrates. In contrast, the Flower category tells a different story; Nebulous Cannabis started at 45th place in September but fell out of the top 50 by December, indicating a potential area for improvement or a shift in consumer demand away from their flower products.

The Vapor Pens category for Nebulous Cannabis in Alberta also experienced a decline in rankings, moving from 56th to 68th by the end of December. Despite this drop, the brand's sales figures reveal fluctuating consumer interest, suggesting that while they are not in the top 30, there remains a committed base. It's essential to note that Nebulous Cannabis is not currently within the top 30 brands in any category in Alberta, which could be seen as a challenge to overcome or an opportunity for strategic growth. The brand's performance across these categories highlights both strengths and potential areas for strategic focus as they aim to improve their market position.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Nebulous Cannabis has experienced a notable decline in rank and sales from September to December 2024, dropping from 45th to 85th place. This downward trend suggests increasing competition and challenges in maintaining market share. Notably, Common Ground has also seen a decline in rank, albeit less severe, moving from 53rd to 82nd, while maintaining relatively higher sales figures compared to Nebulous Cannabis. Meanwhile, Battle River Bud has shown resilience, improving its rank from 73rd to 81st, despite a decrease in sales, which indicates a potential strategic shift or market adaptation. Brands like Grasslands and Bold have also experienced fluctuations in rank, but their sales figures suggest they are better positioned in the market. These dynamics highlight the competitive pressures Nebulous Cannabis faces, emphasizing the need for strategic adjustments to regain its footing in the Alberta Flower market.

Notable Products

In December 2024, Nebulous Cannabis's top-performing product was Cosmic Clusters (7g) in the Flower category, maintaining its first-place ranking consistently from September through December, although sales have decreased to 1210 units. Galactic Sap Live Resin (1g) held steady in second place within the Concentrates category, with sales slightly declining to 679 units. Vanilla Bean ICC Co2 Cartridge (1g) in the Vapor Pens category also remained in third place throughout the months, showing a slight increase in sales in December. Peach Candyland Co2 Cartridge (1g) climbed back to fourth place in December after a previous absence in November, indicating a recovery in its sales performance. Meanwhile, Frutti Bedrock Live Resin Cartridge (1g) consistently ranked fifth, showing a steady decline in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.