Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

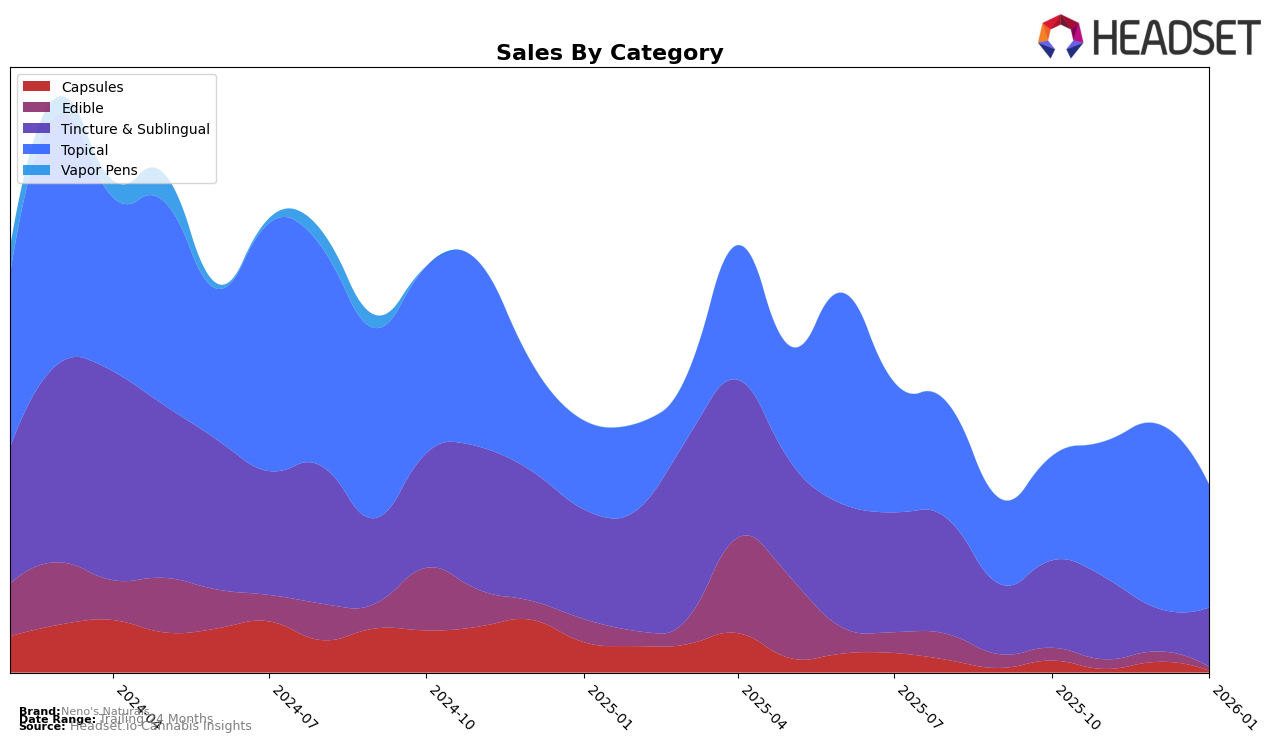

Neno's Naturals has shown a consistent performance in the Topical category in Michigan, maintaining a steady 5th place ranking from November 2025 through January 2026. This stability is notable, especially given the competitive nature of the cannabis market in Michigan. Despite not being in the top 30 in October 2025, their subsequent performance suggests a strong recovery and effective market strategies that have allowed them to gain and hold a significant position in the state. This reflects positively on their brand presence and consumer acceptance in the Topical category.

While Neno's Naturals has managed to secure a stable position in Michigan's Topical market, their absence from the top 30 rankings in other states and categories indicates areas for potential growth and exploration. The brand's ability to jump into the top 5 in Michigan within a month suggests they have the capability to expand their reach if similar strategies are employed in other markets. However, the lack of presence in other states could also be seen as a missed opportunity to capitalize on the growing cannabis industry across the country.

Competitive Landscape

In the competitive landscape of the Michigan topical cannabis market, Neno's Naturals has shown a consistent presence, maintaining a steady rank of 5th from November 2025 through January 2026. This stability is notable given the competitive pressures from brands like Rise (MI), which has consistently held the 3rd rank, and Vlasic Labs, which has maintained the 4th position. Despite Lit Labs entering the top 20 in December 2025 at 6th place, Neno's Naturals has managed to hold its ground. This suggests a resilient market strategy and a loyal customer base. However, the sales figures indicate a need for strategic initiatives to boost sales, as Neno's Naturals' sales are significantly lower than those of the top competitors. The data implies that while Neno's Naturals is a steady player, there is room for growth in sales to improve its competitive standing further.

Notable Products

In January 2026, the CBD/THC 1:1 Balance Transdermal Patches (15mg CBD, 15mg THC) claimed the top spot among Neno's Naturals products, moving up from the consistent second position in previous months, with sales reaching 1,284 units. The THC Transdermal Patch (30mg), which had maintained the first rank from October to December 2025, dropped to second place. The CBD/THC 3:1 Calm Transdermal Patch (30mg CBD, 10mg THC) held steady in the third position throughout the four months. The CBD/THC 3:1 CBD Sweet Mint Calm Tincture (150mg CBD, 50mg THC) remained in fourth place, showing consistent performance. Meanwhile, the CBD/THC 1:1 Lavender Tincture (100mg CBD, 100mg THC) reappeared in the rankings at fifth place after being unranked in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.