Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

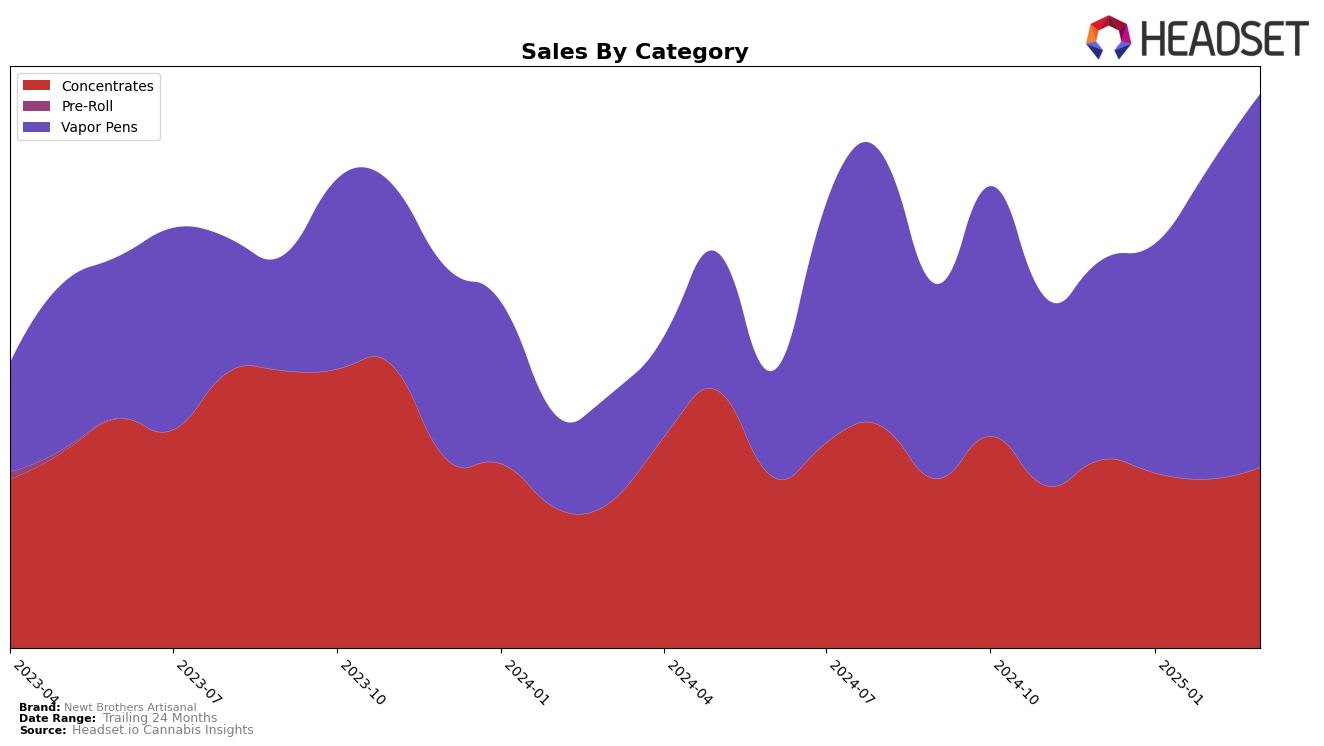

Newt Brothers Artisanal has shown a consistent presence in the Colorado market, particularly in the Concentrates category. Over the span from December 2024 to March 2025, their ranking hovered around the mid-20s, indicating a stable but not dominant position. Notably, they maintained their presence within the top 30, a sign of steady performance amidst competitive pressures. The sales figures in this category, while fluctuating slightly, suggest a resilience in maintaining market share, with a slight rebound in March 2025. This consistent ranking in Concentrates could be an indicator of loyal customer base or effective product differentiation strategies.

In contrast, the Vapor Pens category in Colorado has witnessed a more dynamic performance from Newt Brothers Artisanal. Starting from a position outside the top 30 in December 2024, the brand has climbed steadily to reach the 38th rank by March 2025. This upward trajectory is accompanied by a significant increase in sales, reflecting a growing consumer interest and possibly successful marketing or product innovation strategies. The absence from the top 30 in December 2024 was a challenge, but the subsequent rise suggests a strategic pivot or an untapped market potential that the brand has begun to leverage effectively.

Competitive Landscape

In the competitive landscape of the vapor pen category in Colorado, Newt Brothers Artisanal has shown a promising upward trajectory in the rankings from December 2024 to March 2025. Starting at rank 53 in December 2024, Newt Brothers Artisanal climbed to rank 38 by March 2025. This notable improvement in rank suggests a positive reception and growing market share, even as competitors like Dabble Extracts and AO Extracts experienced fluctuations, maintaining ranks in the mid-30s to 40s. Meanwhile, Pyramid Pens and Juicy have shown more stable positions, but Newt Brothers Artisanal's consistent sales growth, closing the gap with these brands, indicates a strengthening competitive edge. This trend positions Newt Brothers Artisanal as a rising contender in the market, potentially poised to challenge the more established brands if the momentum continues.

Notable Products

In March 2025, Newt Brothers Artisanal's top-performing product was the Strawberry Wine Axolotl Sugar Wax (1g) from the Concentrates category, securing the number one spot with sales of 543 units. The Diesel Fuel Live Resin Cartridge (1g) climbed to the second position among Vapor Pens, improving from its fifth-place ranking in February 2025. Chocolate Gelato Live Resin Cartridge (1g) debuted in third place, while Love Dawg Live Resin Cartridge (1g) held steady in fourth. Stargazer Live Resin Cartridge (1g) rounded out the top five, maintaining its position from the previous month. This analysis highlights a strong performance in the Vapor Pens category, with significant shifts in rankings compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.