Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

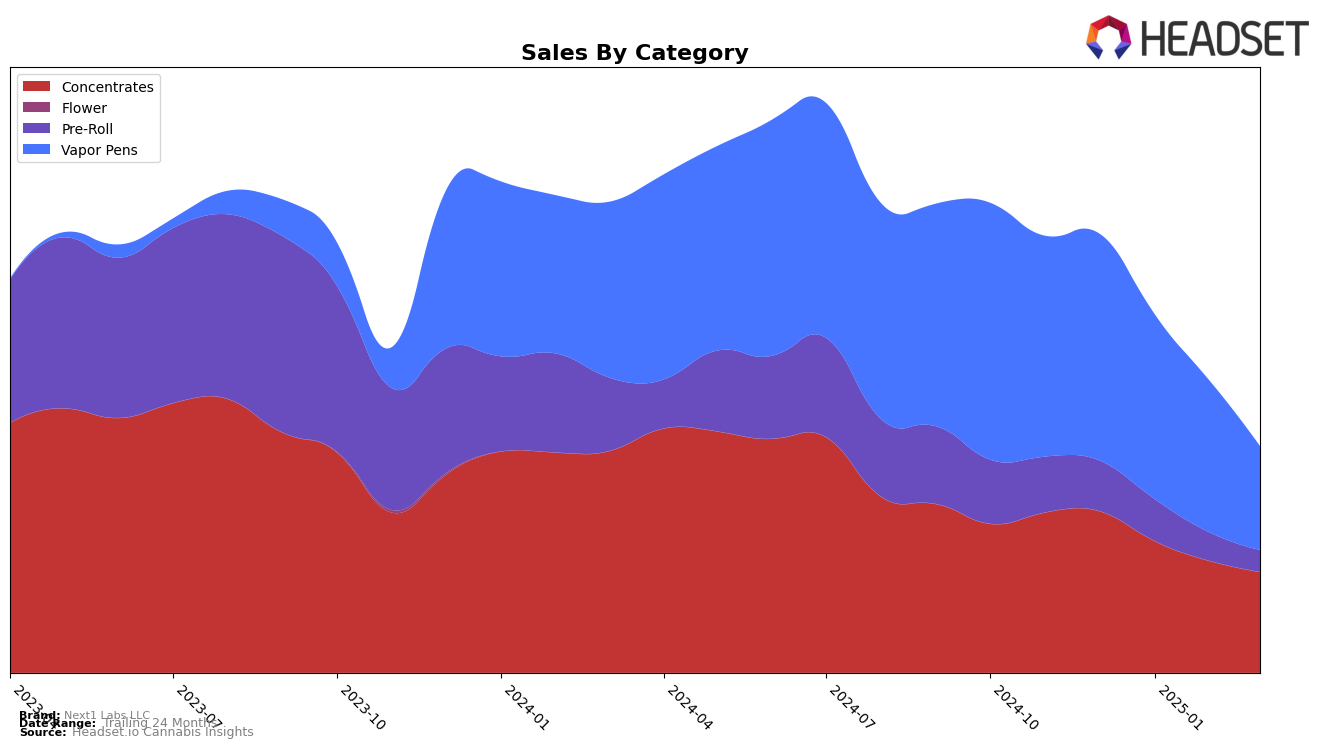

Next1 Labs LLC has shown varied performance across different categories in the state of Colorado. In the Concentrates category, the brand maintained a consistent position within the top 10, ranking 6th in December 2024 but dropping slightly to 9th from January to March 2025. This indicates a stable presence despite a downward trend in sales, which decreased from December 2024 to March 2025. In contrast, the brand's performance in the Pre-Roll category has seen a decline, falling out of the top 30 by January 2025 and continuing to drop to 45th by March 2025. This suggests challenges in maintaining market share in this category.

In the Vapor Pens category, Next1 Labs LLC experienced a similar downward trajectory in Colorado. The brand ranked 17th in December 2024 but fell to 33rd by March 2025. This decline in ranking corresponds with a significant drop in sales, indicating potential issues in competitiveness or consumer preference shifts. The absence of the brand in the top 30 for the Pre-Roll category from January 2025 onwards highlights a particular area of concern, suggesting that Next1 Labs LLC may need to reassess its strategy in this segment to regain its footing. While the brand has maintained a stable position in Concentrates, the overall trend across categories suggests a need for strategic adjustments to address these declines.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Next1 Labs LLC has experienced a notable decline in rank from December 2024 to March 2025, dropping from 17th to 33rd position. This downward trend in rank is mirrored by a consistent decrease in sales over the same period. In contrast, West Edison maintained a relatively stable position, only slightly dropping from 28th to 31st, while Sano Gardens improved its rank from 19th to 30th, despite a similar sales decline. Meanwhile, Dabble Extracts and Pyramid Pens remained outside the top 20, indicating a more challenging market position. The fluctuations in rank and sales for Next1 Labs LLC suggest a need for strategic adjustments to regain competitive standing in the Colorado vapor pen market.

Notable Products

In March 2025, Trop Thunder Distillate Cartridge (1g) from Next1 Labs LLC emerged as the top-performing product, achieving the number one rank in the Vapor Pens category with sales of 2,284 units. Ghost Train Haze Live Resin Cartridge (1g) followed closely, improving its position from fifth to second place compared to February 2025. Sunset Sherbet Distillate Cartridge (1g), which had maintained the top rank in January and February, slipped to third place in March. Grape Stomper Distillate Cartridge (1g) moved down one spot to fourth place, while Cannalope Crush Distillate Cartridge (1g) rounded out the top five, experiencing a decline from fourth position in February. Overall, the rankings demonstrated a dynamic shift in consumer preferences within the Vapor Pens category for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.