Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

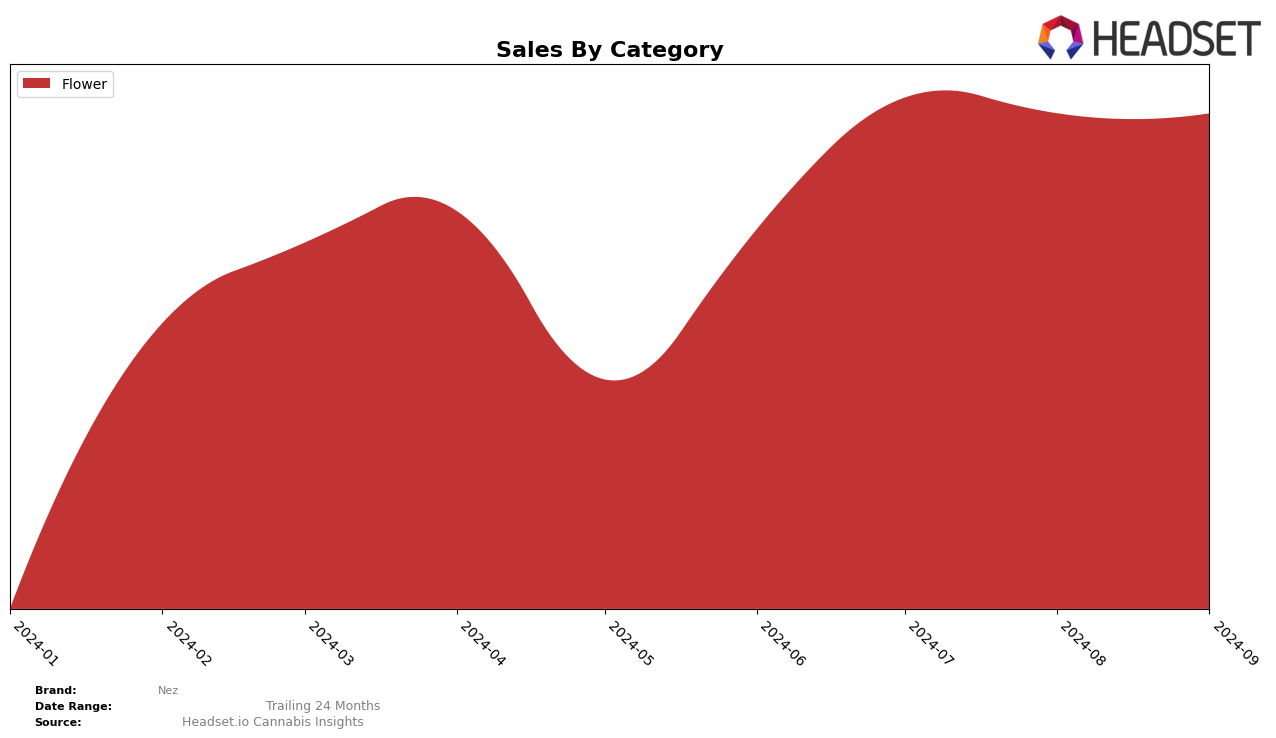

Nez has shown a consistent upward trend in the Illinois market within the Flower category. Starting from a rank of 37 in June 2024, Nez has progressively climbed up, reaching the 30th position by September 2024. This steady improvement indicates a growing market presence and acceptance among consumers in Illinois. The brand's sales figures reflect this positive trajectory, with a notable increase from June to July, although there was a slight dip in August, which stabilized in September. The fact that Nez broke into the top 30 by September is a significant achievement, showcasing its potential to further climb the ranks in the coming months.

While Nez's performance in Illinois is commendable, it is important to note that the brand did not appear in the top 30 rankings in any other states or provinces across the same time period. This absence suggests that Nez's market penetration and brand recognition may currently be limited outside of Illinois, or that it faces stiffer competition in other regions. The focus on Illinois might also indicate a strategic approach to solidifying a strong foothold in a key market before expanding efforts elsewhere. Observing how Nez's strategy unfolds in other states and categories could provide deeper insights into its overall growth trajectory and market strategy.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Nez has shown a promising upward trend in rankings from June to September 2024, moving from 37th to 30th position. This improvement is significant, especially when compared to competitors like Cookies and Legacy Cannabis (IL), both of which experienced fluctuations and lower sales in the same period. Notably, Kaviar, which maintained a steady rank of 23rd until a drop to 32nd in September, saw a substantial decline in sales, indicating potential challenges in maintaining market share. Meanwhile, Nez's consistent sales figures suggest a stable customer base and effective market strategies, positioning it well against competitors like Fig Farms, which also struggled with rank stability. This upward trajectory for Nez highlights its growing influence and potential for increased market penetration in the Illinois flower market.

Notable Products

In September 2024, the top-performing product for Nez was Daily Grapes (3.5g) in the Flower category, maintaining its number one ranking from the previous month with sales of 1938 units. Cadillac Rainbows (3.5g) followed closely in second place, having consistently held the top two positions since June. Sherb Cream Pie (3.5g) saw a notable climb in the rankings, moving up to third place from fourth in August, with a significant increase in sales. Monkey Berries (3.5g) entered the chart for the first time in September, taking the fourth spot. Meanwhile, Cadillac Rainbows Popcorn (14g) remained steady in fifth place, showing resilience despite a drop in sales over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.