Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

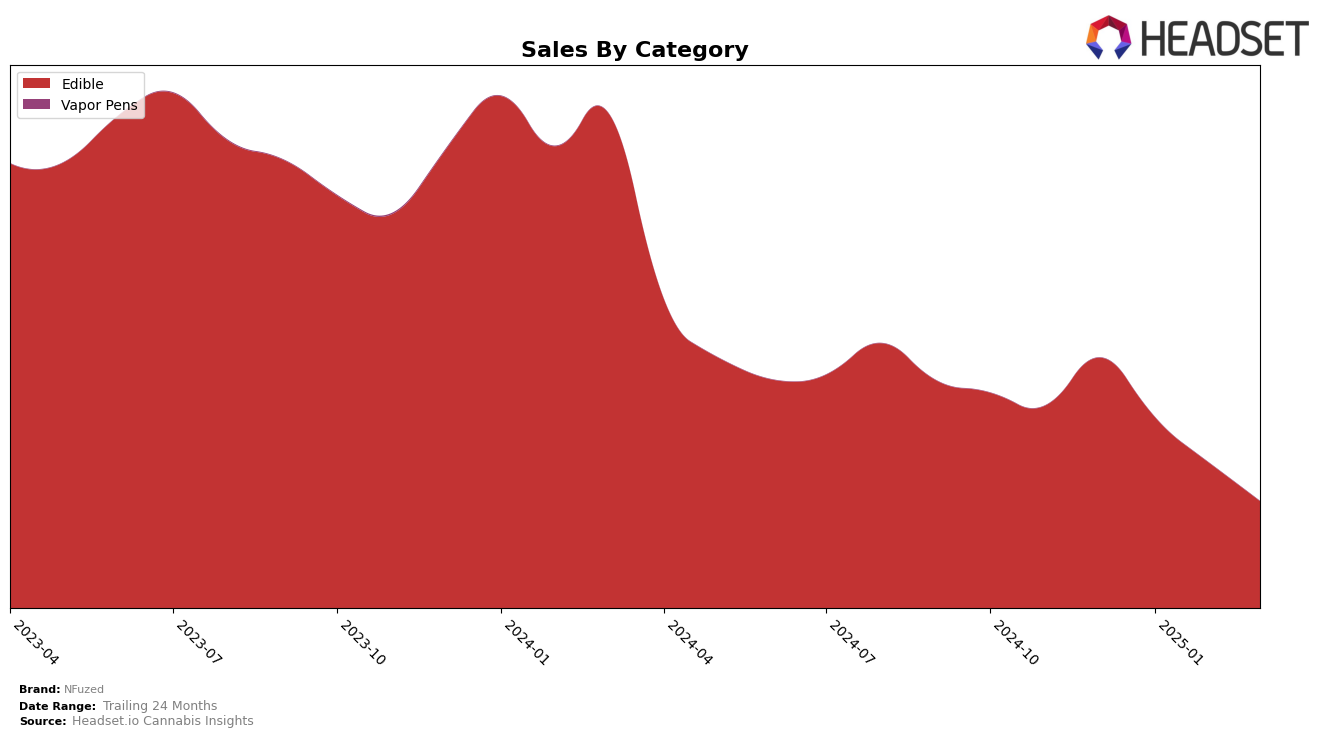

In the dynamic cannabis market, NFuzed has experienced varying performance across different states and categories. In California, the brand has faced challenges in maintaining its standing in the Edible category. Despite a promising start in December 2024 with a rank of 48, NFuzed saw a declining trend, slipping to 60 by March 2025. This drop coincided with a decrease in sales from $47,500 to $19,883, indicating potential challenges in market penetration or competition within the state. The absence of a top 30 ranking in the latest month suggests that the brand needs to reassess its strategies to regain its position in this competitive market.

Conversely, in Colorado, NFuzed has shown a more stable performance, although not without its challenges. The brand maintained a presence within the top 30, starting at rank 16 in December 2024 and dropping to 25 by March 2025. While there was a notable decrease in sales from $139,140 to $59,591 over this period, the brand's ability to remain within the top ranks suggests a stronger foothold in this state compared to California. This performance highlights a potential area of strength for NFuzed, indicating that while there is room for improvement, the brand holds a relatively better position in Colorado's edible market.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, NFuzed has experienced a notable decline in rank from December 2024 to March 2025, dropping from 16th to 25th place. This decline is significant when compared to competitors like Olio, which maintained a relatively stable position, fluctuating between 22nd and 26th place, and Spinello Cannabis Co., which improved its rank from 26th to 23rd. Meanwhile, Dutch Girl showed a positive trend, moving up from 32nd to 27th place. This shift in rankings suggests that NFuzed is losing ground to its competitors, potentially due to a decrease in sales, which fell from 139,140 in December 2024 to 59,591 in March 2025. The competitive pressure from brands like Dutch Girl and Spinello Cannabis Co., which have shown resilience or improvement in their sales figures, highlights the need for NFuzed to reassess its market strategies to regain its competitive edge.

Notable Products

In March 2025, NFuzed's top-performing product was the Sour Classic Variety Gummies 10-Pack (100mg), maintaining its number one rank consistently from December 2024 through March 2025, with a notable sales figure of 3131 units. The CBD/THC 1:1 Sour Classic Variety Fast Acting Gummies held steady in the second position throughout the same period. The Very Berry Sour Fast-Acting Gummies 10-Pack climbed to the third rank in March, improving from its fifth position in February. The CBD/CBN/THC 1:2:4 Indica Sleep Variety Fast Acting Sour Gummies appeared in the rankings for March at fourth place, following a similar position in December and January. Sour Lemon Lifter Rosin Gummies, ranked third in February, dropped to fifth in March, indicating a slight decline in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.