Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

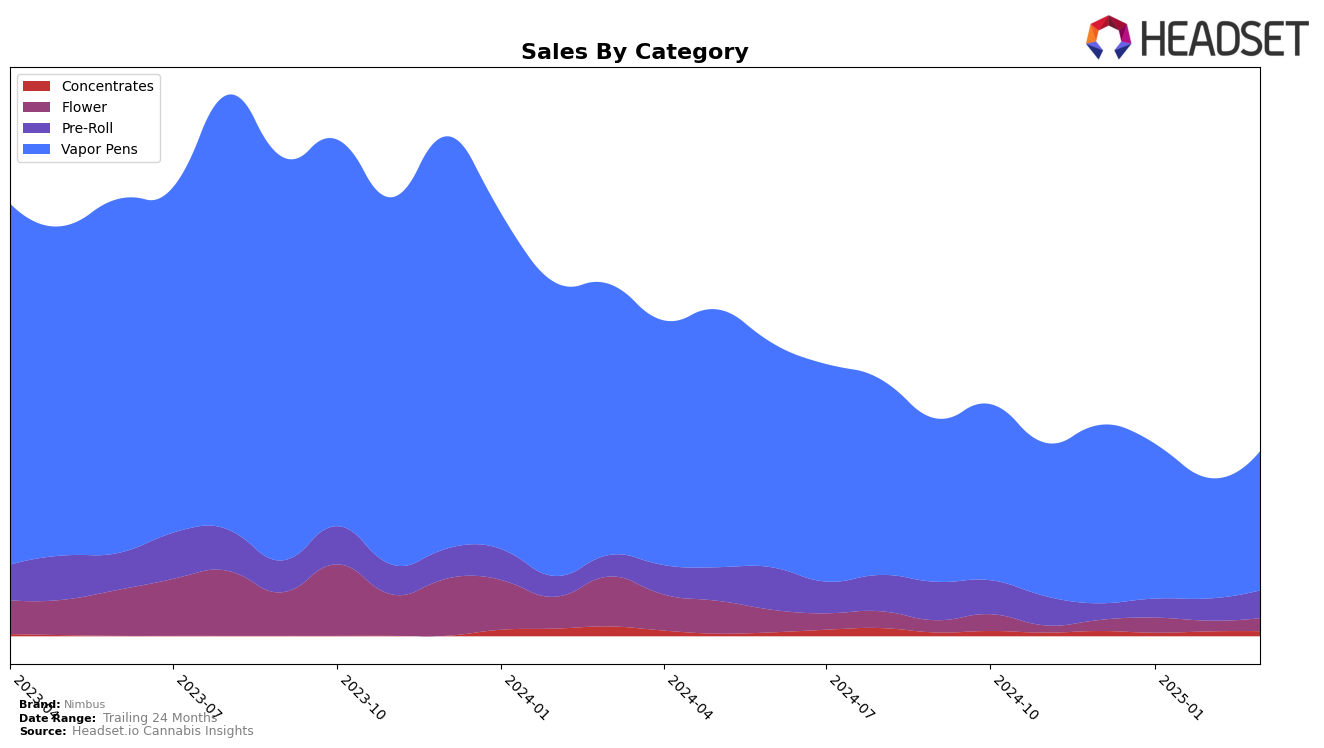

In the state of Massachusetts, Nimbus has shown varied performance across different product categories. The brand's Vapor Pens category experienced some fluctuations, with a drop from 17th place in December 2024 to 22nd in February 2025, before recovering slightly to 18th in March 2025. This indicates a potential challenge in maintaining a consistent market presence. On the other hand, Nimbus has not managed to break into the top 30 for Concentrates, although there was a slight improvement from 50th place in December 2024 to 46th by March 2025. This suggests that while there is progress, the brand still faces significant competition in this category.

Conversely, Nimbus has demonstrated a positive trajectory in the Pre-Roll category in Massachusetts. Starting from the 97th position in December 2024, the brand has climbed steadily to 71st by March 2025. This consistent upward movement indicates a growing acceptance and possibly an expanding market share for their Pre-Roll products. As for sales figures, the Vapor Pens category saw a notable decrease in January 2025, but the subsequent months showed a recovery trend, hinting at potential strategies being implemented to address market challenges. Overall, while Nimbus faces hurdles in certain categories, its performance in Pre-Rolls suggests areas of strength and opportunity.

Competitive Landscape

In the Massachusetts vapor pen market, Nimbus has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Starting at 17th place in December, Nimbus dropped to 20th in January and further to 22nd in February, indicating it was not in the top 20 brands for that month. However, it rebounded to 18th place in March. This volatility is mirrored in its sales trajectory, which saw a decline from December to February before a slight recovery in March. Competitors such as Papa's Herb and Good News maintained more stable positions, with Good News consistently ranking higher than Nimbus, despite a dip in January. Pioneer Valley also outperformed Nimbus in most months, except for March when it fell to 19th place. These dynamics suggest that while Nimbus faces strong competition, there is potential for regaining market share with strategic adjustments.

Notable Products

In March 2025, Masshole Mango Haze Distillate Disposable (1g) reclaimed its position as the top-performing product for Nimbus, with sales reaching 1605 units. Title Town Kush Distillate Disposable (1g) made a strong debut, securing the second rank. Wicked OG Distillate Disposable (1g) also entered the rankings at the third position. Beast Coast Berry Kush Distillate Disposable (1g) maintained a consistent presence, holding the fourth rank. Notably, Masshole Mango Haze improved from its February rank of second to first, showcasing a significant sales boost.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.