Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

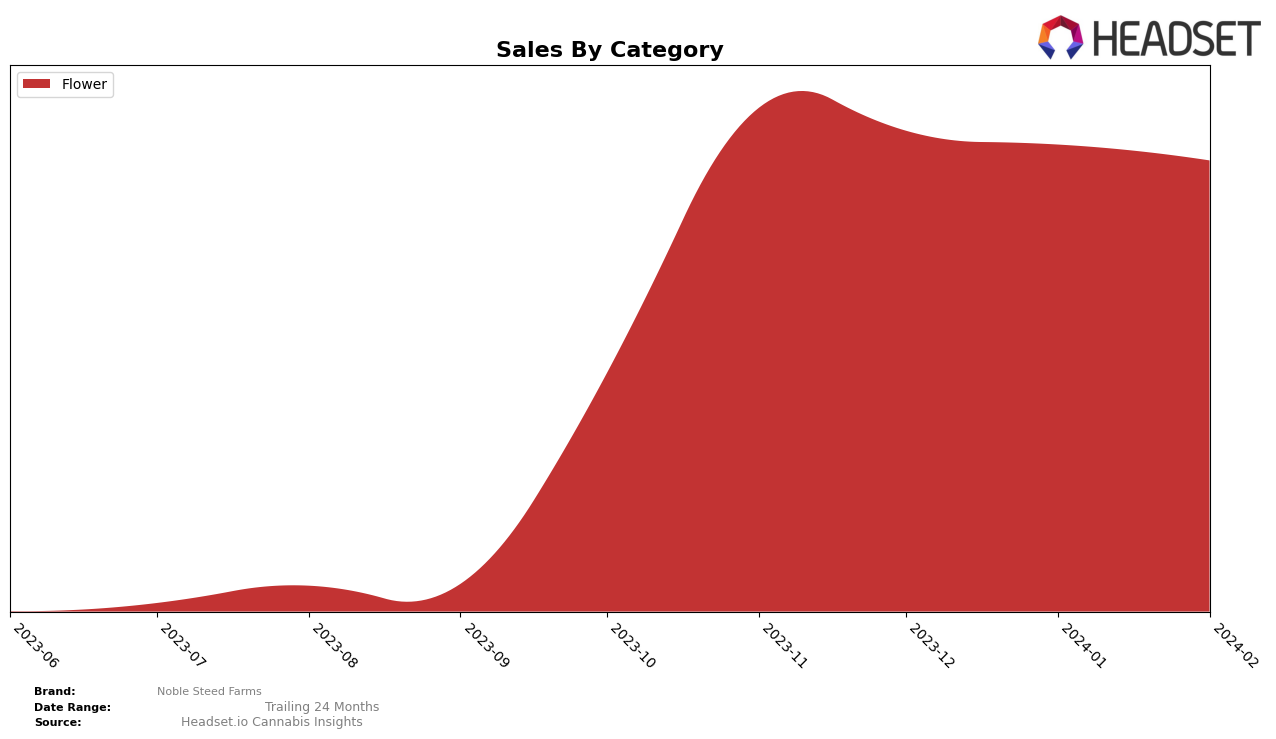

In New York, Noble Steed Farms has shown a consistent presence in the competitive cannabis flower category, maintaining a position within the top 30 brands over the last four months. Beginning in November 2023 with a rank of 16th, the brand experienced a slight decline, moving down to 25th by February 2024. This downward trend, while indicating a decrease in their competitive standing, also showcases their ability to remain relevant in a highly saturated market. The sales figures, starting at $121,987 in November 2023 and gently decreasing to $109,589 by February 2024, reflect this slight dip in rank, yet the brand's perseverance in staying within the top 30 is noteworthy. The steady, albeit declining, sales and rankings suggest a brand that is facing challenges but is still a significant player in the New York flower market.

While the data provides a clear snapshot of Noble Steed Farms' performance within the flower category in New York, it leaves room for speculation regarding their strategies and potential areas for improvement. The gradual ranking decline could be attributed to various factors, including increased competition or changes in consumer preferences. However, the brand's consistent presence in a competitive market also hints at a loyal customer base and a potentially strong brand identity. The absence of rankings in other states or provinces suggests a focused market strategy or potential areas for expansion. Noble Steed Farms' journey through the ranks offers valuable insights into the dynamics of the cannabis industry in New York, though it also invites curiosity about their operations beyond the provided data.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Noble Steed Farms has experienced a slight decline in its ranking over the recent months, moving from 16th in November 2023 to 25th by February 2024. This shift indicates a challenging environment, especially when considering the performance of its competitors. Notably, Glenna's has shown a remarkable surge, entering the rankings at 59th in December 2023 and skyrocketing to 23rd by February 2024, surpassing Noble Steed Farms. This is indicative of Glenna's significant sales increase and market acceptance. On the other hand, Mfny (Marijuana Farms New York) saw a peak in December 2023, ranking 9th, but experienced a notable drop to 24th by February 2024. Similarly, Rolling Green Cannabis and Aeterna have also seen fluctuations but remained relatively stable in their lower rankings. These dynamics suggest a volatile market where brands like Noble Steed Farms must navigate carefully to maintain and improve their market position amidst aggressive competition and changing consumer preferences.

Notable Products

In February 2024, Noble Steed Farms saw Mimosa (3.5g) reclaim its position as the top-selling product with impressive sales of 870 units, highlighting its consistent popularity in the market. Following closely was Dream House (28g), which rose to the second spot from its previous third position in January, indicating a growing interest in bulk purchases. Stink Finger OG (28g) made its debut in the rankings, securing the third position, a notable entry demonstrating market demand for new strains. Elon's Musk (3.5g), despite a slight dip in sales, maintained a strong presence by ranking fourth, showcasing its steady consumer base. Lastly, High Voltage (28g) entered the rankings at the fifth position, suggesting that consumers are exploring a wider variety of Noble Steed Farms' offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.