Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

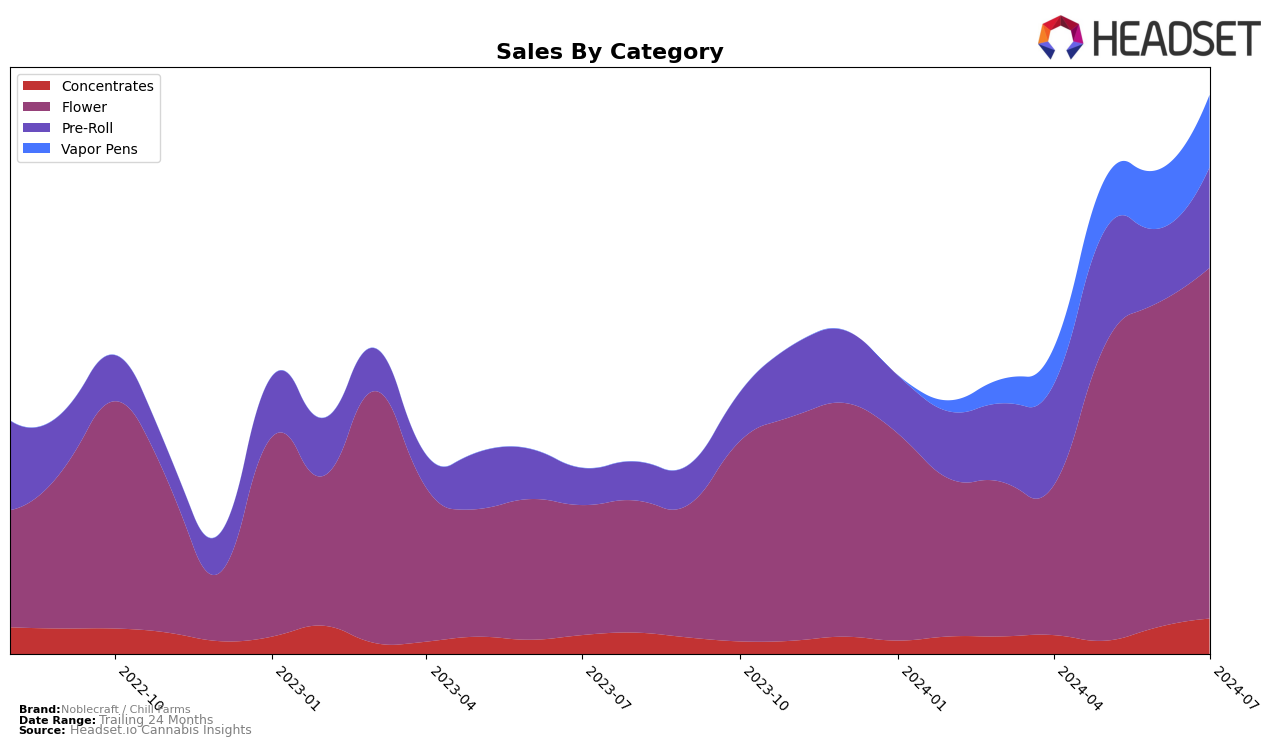

Noblecraft / Chill Farms has shown a dynamic performance across various categories in Oregon. In the Concentrates category, the brand has made significant strides, moving from a rank of 70 in April to 59 by July, indicating a steady upward trend in market presence. However, it is important to note that they did not appear in the top 30 rankings in May, which could be seen as a temporary setback. In the Flower category, Noblecraft / Chill Farms has demonstrated a strong and consistent performance, jumping from rank 70 in April to maintaining a position within the top 30 from May to July, peaking at rank 27 in June. This indicates a solid foothold in the Flower market segment.

The Pre-Roll category has been more volatile for Noblecraft / Chill Farms in Oregon. The brand's ranking fluctuated, dropping from 36 in April to 53 in June before recovering to 44 in July. This suggests that while there is demand, the competition in this category is fierce. Meanwhile, in the Vapor Pens category, the brand has shown a positive and consistent climb, improving its rank from 65 in April to 50 by July. This upward trajectory in Vapor Pens indicates a growing acceptance and preference for Noblecraft / Chill Farms' products in this segment. Overall, the brand's performance across these categories highlights areas of strength and opportunities for further growth.

Competitive Landscape

Noblecraft / Chill Farms has shown significant improvement in the Oregon flower category from April to July 2024, moving from a rank of 70 to 29. This upward trend highlights a positive shift in market presence and consumer preference. In comparison, PDX Organics has maintained a relatively stable position, fluctuating between ranks 23 and 35, while High Noon Cultivation has also seen a steady rise, reaching rank 30 in July. Notably, The Heights Co. has experienced a significant climb, moving from rank 57 to 28, closely trailing Noblecraft / Chill Farms. Meanwhile, Derby's Farm has seen a slight decline, dropping from rank 22 to 36. These shifts suggest that while Noblecraft / Chill Farms is gaining traction, it faces strong competition from brands like The Heights Co. and PDX Organics, which are also vying for higher market shares in Oregon's flower category.

Notable Products

In July 2024, the top-performing product for Noblecraft / Chill Farms was Unicorn Sherbert Pre-Roll (0.5g) in the Pre-Roll category, maintaining its position from June and achieving sales of $4,305. Triple Burger (Bulk) in the Flower category ranked second, dropping from its first-place position in June with a notable decrease in sales to $2,694. Pineapple Express (Bulk) and Pineapple Trainwreck (Bulk), both in the Flower category, ranked third and fourth respectively, with Pineapple Express entering the top ranks for the first time. Unicorn Sherbert Pre-Roll (1g) in the Pre-Roll category ranked fifth, dropping from its third-place position in June. Overall, the rankings saw some shifts, particularly with Triple Burger and Unicorn Sherbert Pre-Roll (1g) moving down the list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.