Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

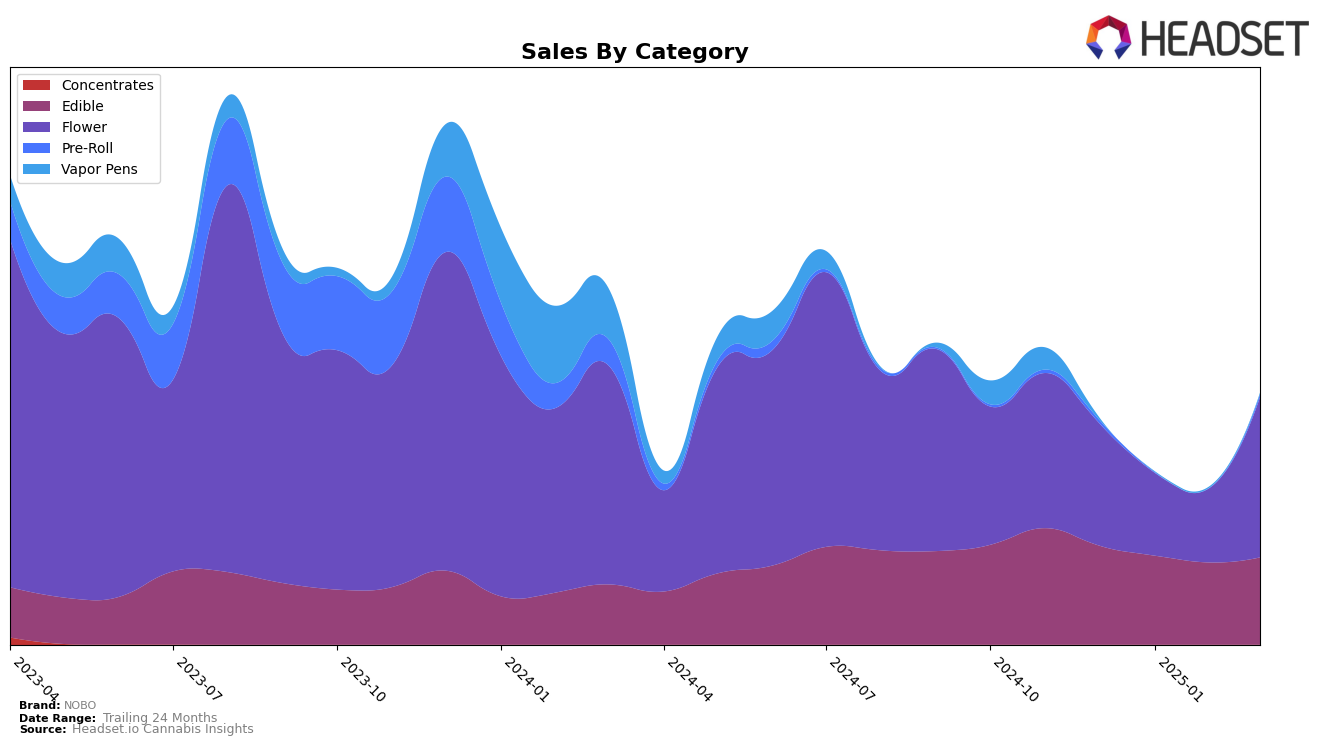

In the state of Colorado, NOBO has shown a notable improvement in the Flower category. Starting from a rank of 69 in December 2024, they were absent from the top 30 in January 2025, but made a significant comeback in February 2025, climbing to the 50th position and further advancing to 45th place by March 2025. This upward trajectory indicates a strategic push or market reception that is favorably impacting their sales, which saw a substantial increase from February to March. The absence from the top 30 in January, however, suggests that the brand may have experienced challenges that month, but their recovery in the following months highlights resilience and potential market adaptation strategies.

In Michigan, NOBO's performance in the Edible category has been relatively stable, maintaining a position within the top 15, though with a slight dip from 10th in December 2024 to 13th in March 2025. This consistency suggests a steady consumer base or effective product offerings in this category. Meanwhile, in the Flower category, NOBO experienced more volatility, dropping from 32nd in December 2024 to 69th in February 2025, only to rebound impressively to 29th by March 2025. This fluctuation might indicate a competitive market or internal adjustments within NOBO's product lineup or marketing efforts. The drastic improvement in March could point to successful interventions or shifts in consumer preferences that favored NOBO's offerings.

Competitive Landscape

In the competitive landscape of the Michigan flower category, NOBO has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 32nd in December 2024, NOBO saw a decline to 43rd in January 2025 and further dropped out of the top 50 in February 2025, indicating a challenging period. However, by March 2025, NOBO rebounded significantly to 29th place, suggesting a recovery in sales performance. This resurgence contrasts with competitors like Carbon, which maintained a more stable presence, ranking as high as 24th in January 2025. Meanwhile, High Profile showed a consistent upward trend, climbing from 57th in December 2024 to 27th by March 2025. Despite these challenges, NOBO's March sales figures surpassed those of Peninsula Cannabis, which ranked 31st, highlighting NOBO's potential for regaining market share. This dynamic environment underscores the importance of strategic adjustments to maintain competitiveness in Michigan's flower market.

Notable Products

In March 2025, the top-performing product for NOBO was THC/CBN 2:1 Purple Pear Sleep Gummies 10-Pack, maintaining its first-place ranking for four consecutive months with sales of 23,359 units. Cherry Gummies followed closely in second place, consistently holding this position since December 2024. Green Apple Gummies 10-Pack secured the third spot, showing stability in its ranking since January 2025. Watermelon Gummies 10-Pack improved its ranking to fourth place after dropping to fifth in February 2025. Notably, Balance Vanilla Mint Gummies 10-Pack entered the rankings for the first time in March 2025, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.