Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

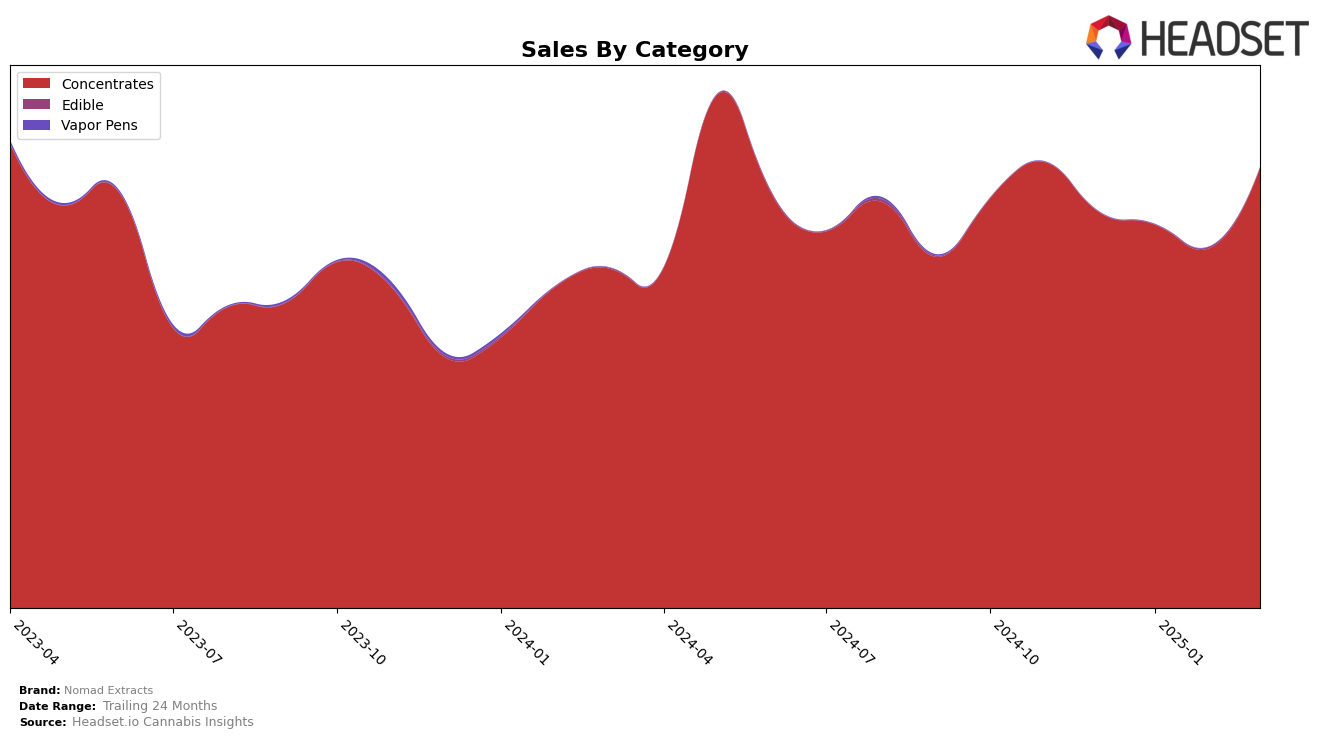

Nomad Extracts has demonstrated consistent performance in the Colorado concentrates market. Over the span from December 2024 to March 2025, the brand has maintained a stable presence, consistently ranking within the top ten. Notably, they achieved a slight improvement in their ranking from 7th to 6th place in February 2025, and maintained this position into March. This upward movement, amidst a competitive market, signifies a positive trend for the brand, particularly as their sales in March 2025 saw a significant increase compared to the previous months.

While Nomad Extracts has shown stability in Colorado, it is important to note that the brand did not appear in the top 30 for any other state or province during this period. This absence in other markets could indicate a focused strategy within Colorado or potential challenges in expanding their reach beyond this state. The lack of presence elsewhere could be seen as a limitation to their growth potential, or it could reflect a strategic decision to concentrate resources where they have established a strong foothold.

Competitive Landscape

In the competitive landscape of concentrates in Colorado, Nomad Extracts has shown a steady performance with a slight upward trend in recent months. From December 2024 to March 2025, Nomad Extracts improved its rank from 7th to 6th, indicating a positive shift in market positioning. This improvement is notable given the competitive pressure from brands like Denver Dab Co, which maintained a consistent rank around 7th, and Dabble Extracts, which held a stable 5th position. Meanwhile, 710 Labs consistently secured the 4th rank, showcasing a strong foothold in the market. Despite these challenges, Nomad Extracts' sales trajectory has been on an upward trend, particularly in March 2025, where they saw a significant increase in sales, closing the gap with higher-ranked competitors. This suggests that Nomad Extracts is effectively capturing market share and could potentially climb further in the rankings if this momentum continues.

Notable Products

In March 2025, Hawaiian Plushers Sugar Wax (1g) maintained its top position in the Concentrates category for Nomad Extracts, with sales reaching $637. Love Affair Wax (1g) secured the second spot, marking its debut in the rankings this month. Do-Si-Dos Sugar Wax (1g) followed closely in third place, indicating a strong entry as well. Punch Breath Sugar Wax (1g) and Banana Power OG Platinum Wax (1g) rounded out the top five, both also appearing for the first time in the rankings. Notably, Hawaiian Plushers Sugar Wax (1g) sustained its number one rank from February 2025, showcasing consistent performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.