Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

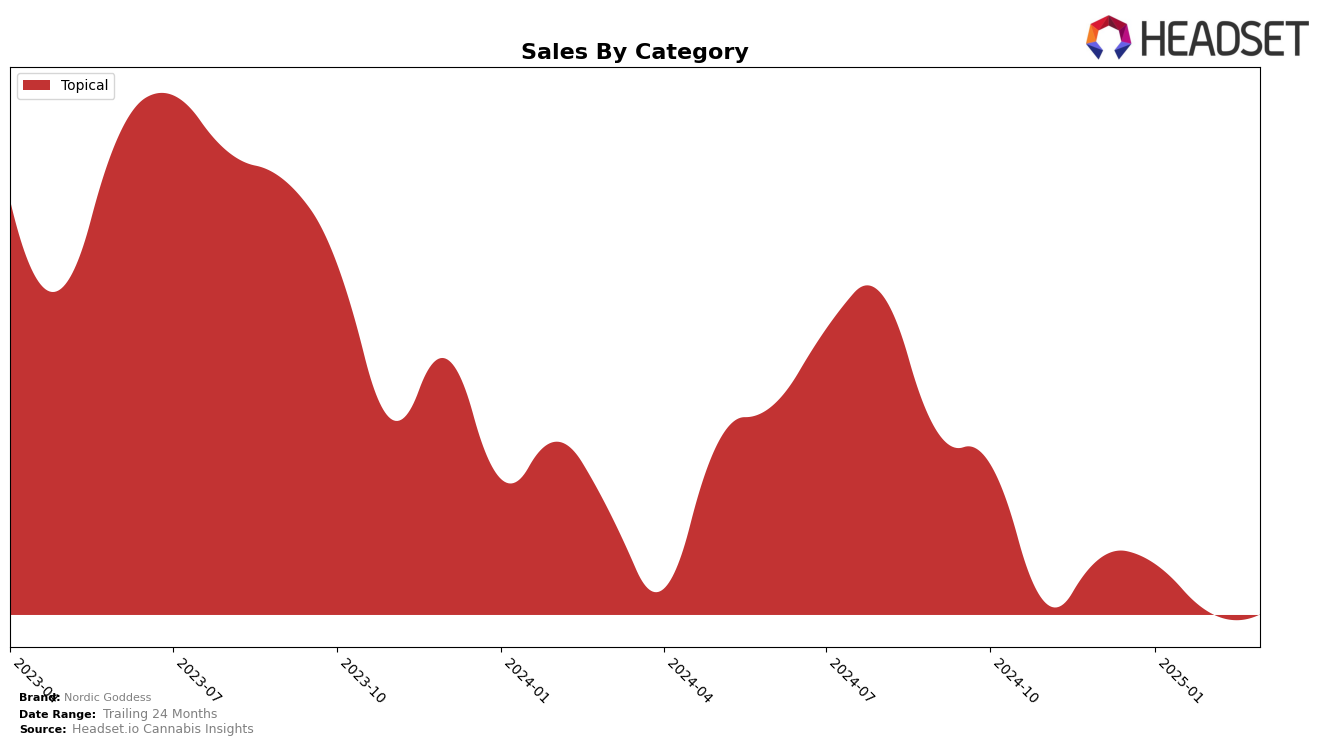

Nordic Goddess has shown varied performance across different states in the Topical category. In Colorado, the brand maintained a consistent position, ranking 4th in December 2024 and January 2025, followed by a slight drop to 5th place in February and March 2025. Despite the drop, the brand remained within the top five, suggesting a stable presence in the market. In Massachusetts, Nordic Goddess experienced more fluctuation, starting at 3rd place in December 2024, slipping to 5th in January 2025, recovering to 4th in February, and then falling back to 5th in March 2025. This indicates a competitive landscape in Massachusetts, where the brand is consistently battling to stay among the top five.

In Nevada, Nordic Goddess demonstrated a strong presence, starting in 2nd place in December 2024 and moving up to claim the top spot in January and February 2025. However, by March 2025, the brand slipped to 3rd place, indicating some competitive pressure or market dynamics at play. The ability to reach and maintain the top rank for two consecutive months highlights the brand's strong market penetration and consumer preference in Nevada. Across these states, Nordic Goddess's performance reveals a mix of stability and competitive challenges, emphasizing the importance of market-specific strategies to maintain and improve their standings.

Competitive Landscape

In the competitive landscape of the Colorado topical cannabis market, Nordic Goddess has experienced some fluctuations in its ranking, which may impact its sales trajectory. As of March 2025, Nordic Goddess holds the 5th position, a slight decline from its 4th place standing in December 2024 and January 2025. This change in rank is primarily due to the consistent performance of competitors like Mary Jane's Medicinals, which has maintained a steady 3rd place ranking throughout the observed period. Meanwhile, Care Division has shown resilience by climbing to 4th place in February 2025, overtaking Nordic Goddess. Despite these shifts, Nordic Goddess remains a strong contender in the market, although its sales have shown a downward trend from December 2024 to February 2025, before a slight recovery in March 2025. This indicates a need for strategic adjustments to regain and potentially improve its market position against competitors such as Highly Edible, which has shown significant sales growth, particularly in March 2025.

Notable Products

In March 2025, the top-performing product for Nordic Goddess was the CBD/THC 1:1 Cooling Therapeutic Body Balm (250mg CBD, 250mg THC, 2oz), maintaining its consistent first-place ranking from previous months, with sales of 1163 units. The CBG/CBD/THC Vibe 10X Body Balm (250mg CBG, 2500mg CBD, 2500mg THC, 2oz) also held steady in the second position. The CBD/THC 1:1 Therapeutic Body Balm (500mg CBD, 500mg THC) remained in third place, showing a slight increase in sales from February. THC Cooling Balm (500mg) rose to fourth place, marking its first appearance in the rankings since December 2024. Finally, the CBD/THC 1:1 Vibe 10x Body Balm (2500mg CBD, 2500mg THC, 2oz) stayed in fifth place, despite a drop in sales compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.