Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

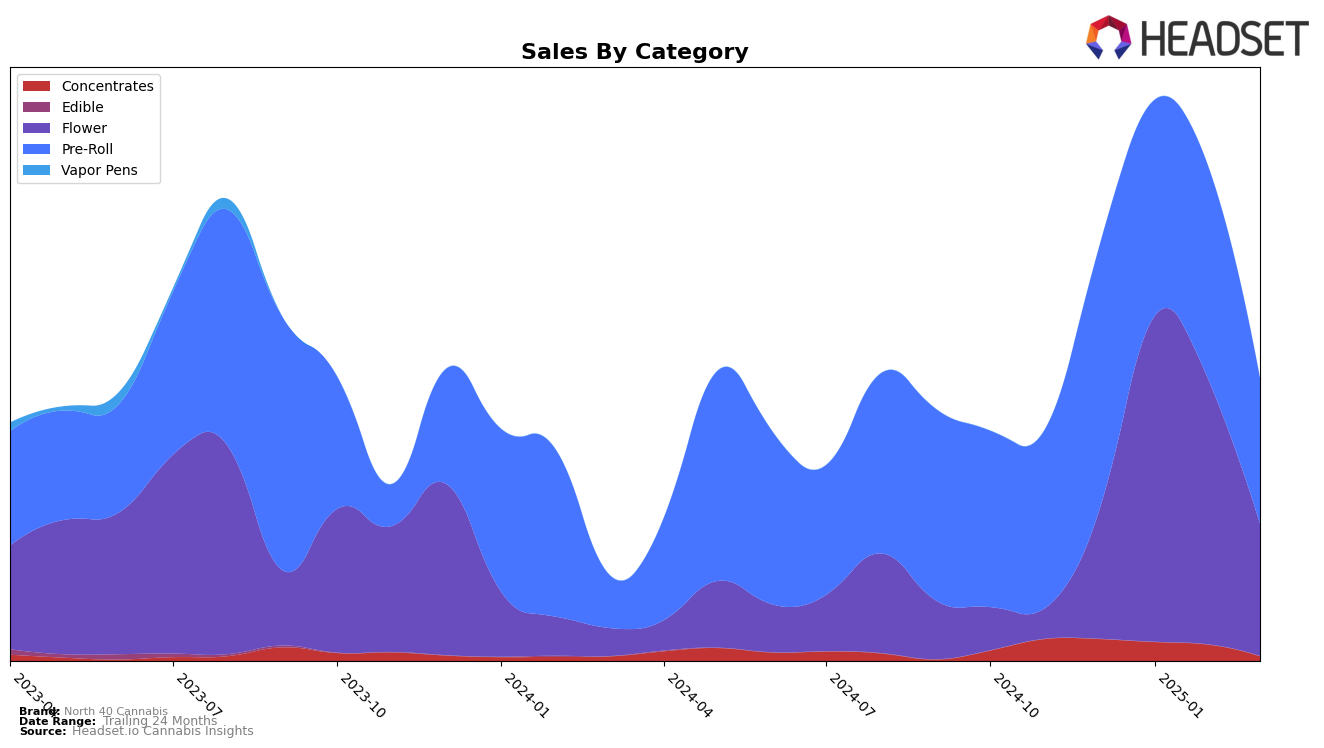

North 40 Cannabis has shown a dynamic performance in the Saskatchewan market, particularly in the Flower category. Starting from a December 2024 ranking of 37th, the brand made a significant leap to 19th in January 2025, maintaining a steady position at 18th in February before sliding to 30th in March. This fluctuation suggests a competitive market environment where North 40 Cannabis is striving to solidify its presence. The brand's sales in this category saw a notable increase in January, reaching a peak before experiencing a decline by March, indicating potential challenges in sustaining growth amidst market pressures.

In the Pre-Roll category, North 40 Cannabis demonstrated a strong upward trajectory initially, improving from 21st in December 2024 to 13th by February 2025. This upward movement highlights the brand's growing appeal in this segment, although the drop to 29th in March could be a cause for concern, suggesting a need to reassess strategies to maintain momentum. Despite these fluctuations, the brand's performance in Saskatchewan remains noteworthy, as it continues to compete within the top 30 brands, a position not all brands can claim consistently in such a competitive landscape. The variations in rankings across months hint at both opportunities and challenges that North 40 Cannabis faces in its pursuit of market dominance.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, North 40 Cannabis has experienced notable fluctuations in its market rank and sales performance over the past few months. Starting from a rank of 21 in December 2024, North 40 Cannabis improved its position to 17 in January 2025 and further to 13 in February 2025, demonstrating a positive momentum. However, by March 2025, the brand saw a decline, dropping to rank 29, which indicates a potential challenge in maintaining its upward trajectory. In comparison, Herba Farms started strong at rank 16 in December 2024 but experienced a similar downward trend, falling to rank 30 by March 2025. Meanwhile, OHJA and JC Green Cannabis Company have maintained relatively stable positions, with OHJA fluctuating between ranks 20 and 28, and JC Green Cannabis Company improving from rank 49 to 37 over the same period. The entry of Tasty's (CAN) in February 2025 at rank 20, and its subsequent slight decline to rank 25 in March 2025, adds another layer of competition. These dynamics suggest that while North 40 Cannabis has shown potential for growth, sustaining its market position amidst fluctuating sales and emerging competitors will be crucial for its future success.

Notable Products

In March 2025, Rocket Fuel Pre-Roll 3-Pack (1.5g) maintained its top position as the best-selling product for North 40 Cannabis, despite a decrease in sales to 585 units. Sage Mints Pre-Roll 3-Pack (1.5g) made a notable entrance to the rankings, securing the second spot with an impressive sales figure of 461 units. Pomelo Skunk Pre-Roll 3-Pack (1.5g) climbed from the fifth position in February to third place in March, showing a steady increase in popularity. Strawberry Miracle Pre-Roll 3-Pack (1.5g) dropped to fourth place, reflecting a decrease in sales from previous months. Tropical Blast Pre-Roll 3-Pack (1.5g) entered the rankings for the first time in March, taking the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.